Personal Wealth Management / Market Volatility

Bear Markets

Fisher Investments describes the characteristics of Bear Markets, and how to differentiate one from a stock market correction.

Fisher Investments has been helping clients through bear markets for over 40 years. We can help you, too.

Read on to learn what you need to know about bear markets and how you can limit lasting damage to your portfolio and be poised to benefit when the next bull market starts.

Key Takeaways:

- Bear markets are fundamentally driven downturns of about 20% or more.

- Bear markets are often caused either by euphoric investor sentiment or some negative economic surprise of great scale.

- Each bear market has been followed by a subsequent bull market, so preparing for the recovery is key.

Analyze Stock Market History for Perspective

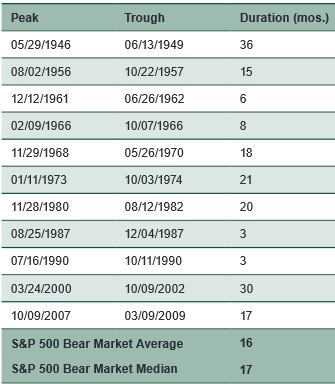

We define a bear market as a fundamentally driven stock downturn of about 20% or more over an extended period of time. Given this definition, the S&P 500 saw 11 bear markets between 1946 and 2018, lasting 16 months on average.[i]

Exhibit 1: S&P 500 Bear Markets 1929 – 2009

Source: FactSet, Global Financial Data, as of 12/24/2018. S&P 500 Price Index Level from 05/29/1946 – 12/21/2015. Returns are presented exclusive of dividends. For “Duration,” a month equals 30.5 days.

Bear markets are commonly remembered for the widespread fear they cause as investors watch their account values drop. This fear sometimes leads investors to panic and abandon their investment strategy, which may ultimately be costly if they sell their investments at a loss and potentially miss out on the rebound.

Identifying a Bear Market

Bear markets often begin with an inconspicuous slowing of economic momentum at a time when investors are feeling overly confident and keep bidding stocks up despite deteriorating earnings. As market fundamentals show weakness or warning signs, euphoric investors ignore them and instead look for reasons their stocks should continue their rise. Less commonly, bears can also start when a big, unforeseen negative economic event suddenly sends the economy into a recession.

Generally bear markets are extremely difficult to identify early on, but with thorough analysis and practice, we believe a fundamental bear market can be identified and potentially even side-stepped, if recognized before some or all of the portfolio decline occurs. If you identify a bear market late and significant decline in portfolio value has already happened, we believe you are likely better off staying invested. As difficult as it may seem, doing so can prevent you from realizing losses in your portfolio. Also, if you have a reasonably long investment time horizon, remaining invested is a good way to be sure you’ll be in the market to benefit when the next bull inevitably begins.

Four Bear Market Rules

We have four basic guidelines for bear markets. It’s important to keep in mind that no two bear markets are the same, therefore no one metric is perfect for identifying every bear market.

- The Two-Percent Rule. In a bear market, stock prices often decline about 2% per month. Contrary to popular belief, bear markets don’t often begin with sharp, sudden drops. If there is a steep drop of much more than 2% per month, what you’re experiencing may just be a short-term correction and not a bear market.

- The Three-Month Rule. One of the greatest dangers to investors is the risk of getting out of stocks at the wrong time and missing bull market returns. This rule recommends waiting three months after you believe the market has peaked before going defensive. This provides a window of time to assess fundamental data, market action and possible drivers for the bear.

- The Two-Thirds/One-Third Rule. Analyzing historical bear markets, we’ve observed about one-third of bear markets’ decline tends to occur during the first two-thirds of a bear market, and about two-thirds of the decline occurs during the bear’s final third. So it may not be as important to miss the initial drop, as the sharper drops often occur later on in the bear market.

- The 18-Month Rule. Bear markets rarely last longer than two years. Waiting too long to reinvest in stocks may increase your risk of missing out on the sharp rebound and beginning of the next bull market.

Not a Rule: Recessions. Don’t confuse economic recessions and bear markets. An economic recession is commonly defined as two consecutive quarters of negative gross domestic product (GDP) growth. While the two may coincide, bear markets can occur without a corresponding recession and vice versa. Importantly, because stocks typically lead the economy, you shouldn’t use a recession to identify a bear market—by then, the bear market has likely started already.

More Bear Market Indicators

Although no single indicator can accurately identify every bear, we believe a combination of leading indicators coupled with research and analysis can help you identify a bear market in its early stages and potentially avoid some of the ensuing decline.

We believe fundamentals play a key role in determining the current state of the market. A few examples of negative fundamentals include:

- Weak corporate earnings

- Inverted yield curves

- Faltering revenue growth

Just as important as fundamentals, history has shown that investor euphoria can precede a bear market. Indicators of euphoria may include:

- High leveraged-buyout activity

- Rising corporate debt

- Overpriced initial public offerings.

When euphoric investors start searching for reasons that stocks will keep rising and begin to dismiss negative fundamentals, a bear market could be on the horizon.

What Signs Suggest a Bear Market May Be Forming?

Every bull market climbs the proverbial “Wall of Worry”—short-term worries that can boost investor fear and volatility during a broader bull market. These worries sometimes even lead to corrections—sharp sentiment-based downturns of about -10% to -20%. But these short corrections typically lack the size and scale of a true bear market, and since they are often based on fear, trying to trade around corrections can be a futile exercise.

Sometimes a bull market runs into an unexpected negative big enough to knock several trillion dollars off global GDP. Think of it as a big, bad, unexpected negative that “wallops” an otherwise strong economy and bull market. However, while wallops have happened, they are rare. More often investors misunderstand an event’s impact and how it fits into the bigger picture. Overestimating the potential impact of any event could cause investors to falsely spot wallops or mistake bull-market corrections for bear markets.

That’s No Bear!

It can be difficult to determine what will lead to the next bear market or correction. Timing corrections is nearly impossible, as they start with a bang and end just as quickly. And going defensive for a correction could mean reducing equity exposure, which can also set you back. We believe most investors are often better off staying disciplined and riding through corrections and other bull market volatility.

Anticipate a Stock Market Recovery

Finally, we debunk one of the most prevalent yet dangerous investing myths: One big bear market and you’re done. Chances are, even if you weathered every bear market without making one defensive move, your equity portfolio would still have generated a cumulative profit over the longer term. We’ve observed that bull markets are often longer and stronger than their preceding bear markets. Keep in mind that every bear market is followed by a bull market. If you wait too long to re-enter the stock market after a crash you may miss out on the next bull market’s initial bounce.

If you’re worried about volatility, we can help. We stand by our clients when markets are rising and when they are falling—even in challenging, frightening times. We can be your partner and keep you on track. Contact us to see how.

Worried about what you will do in the next bear market? Fisher Investments may be able to help you manage your portfolio through bear markets and other stages of the market cycle. Contact us directly to set an appointment.

[i] Source: FactSet, Global Financial Data, as of 12/14/2018. S&P 500 Price Index Level from 05/29/1946 - 12/21/2015. Returns are presented exclusive of dividends. For “Duration,” a month equals 30.5 days.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.