Fisher Investments UK is part of the global Fisher group of companies. Our US parent company, Fisher Investments, first began managing discretionary assets in 1979. Below is a convenient summary of the Fisher Investments Research Group and its work.

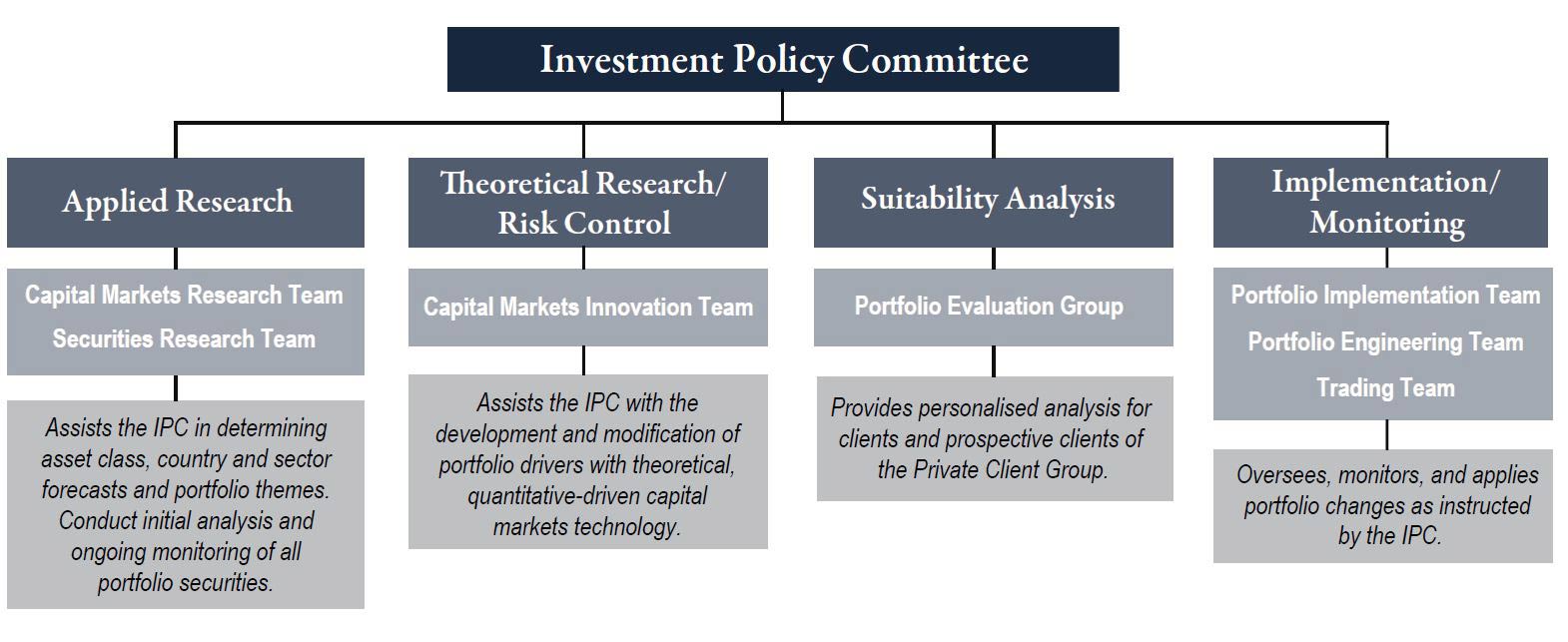

Responsibilities of The Fisher Investments Research Group

Each team has unique responsibilities, including analysing economic trends, updating sector and industry analyses, evaluating securities, calculating performance and implementing the IPC's portfolio decisions.

Infographic Long Description

The graphic details the various investment-research teams and shows how they relate to the firm’s main investment decision-making body, the Investment Policy Committee (IPC).

At the top of the graphic is a single box that reads “Investment Policy Committee.” Emerging from the bottom of the IPC box are four categories, or “branches.” Each vertically arranged branch comprises three boxes. The first box represents the “Research Area.” The second box in the branch represents the teams that serve that research area. The third box provides details on the tasks and duties of those particular teams.

The left-most branch begins with a box reading, “Applied Research.” The second box of this branch reads, “Capital Markets Research Team” and “Securities Research Team.” The third box explains, “Assists the IPC in determining asset class, country and sector forecasts, and portfolio themes. Conduct initial analysis and ongoing monitoring of all portfolio securities.”

The top box of the middle-left branch reads, “Theoretical Research / Risk Control.” The second box says, “Capital Markets Innovation Team.” The third box details, “Assists the IPC with the development and modification of portfolio drivers with theoretical, quantitative-driven capital markets technology.”

The first box of the middle-right branch reads, “Suitability Analysis.” The label of the second box says, “Portfolio Evaluation Group.” The third box explains, “Provides personalized analysis for clients and prospective clients of the Private Client Group.”

The final branch’s first box says, “Implementation / Monitoring.” The second box has three teams listed: Portfolio Implementation Team, Portfolio Engineering Team, and Trading Team. The third box reads, “Oversees, monitors, and applies portfolio changes as instructed by the IPC.”

Applied Research

Two Applied Research teams, the Capital Markets Research Team and the Securities Research Team, provide information and analysis upon which the IPC makes portfolio decisions. Both teams have dedicated analysts specialising in fixed income research.

Capital Markets Research Team

The Capital Markets Research Team gathers information about regions, countries, sectors and industries and analyses that info from a top-down perspective using economic-, political- and sentiment-based factors. This information assists the IPC in determining asset class, country and sector forecasts and portfolio themes.

Securities Research Team

The Securities Research Team conducts the initial analysis and ongoing monitoring of all individual portfolio securities from a fundamental, bottom-up perspective.

Portfolio Implementation & Monitoring

Implementation Team

The Implementation Team oversees and applies portfolio changes—generating trade orders—as instructed by the IPC, portfolio strategy and client restrictions.

Portfolio Engineering Team

The Portfolio Engineering Team monitors strategies to ensure the intended portfolio themes are represented.

Trading Team

The Trading Team works together with the Portfolio Implementation Team to generate and execute trade orders as directed by the IPC.