Personal Wealth Management / Market Analysis

A German Lesson on How Markets Work

Stocks move ahead of the economy.

Europe’s energy crisis has dominated the headlines of financial publications we follow, with many commentators arguing the fallout would disproportionately roil Germany’s mighty industrial sector—hamstringing a big driver of the Continent’s largest economy.[i] But against this mixed backdrop, German stocks have been rallying since late September—despite data that largely show the industry struggling.[ii] In our view, this is a reminder stocks look forward. In this case, we think they seemingly pre-priced heavy industry’s weakness—and moved on—before any improvement was clear.

We wrote earlier this month about German GDP’s Q4 contraction, and whilst that initial estimate doesn’t provide a component breakdown, statistics agency Destatis noted private consumption expenditure fell on a quarterly basis.[iii] Detailed results will come out on 24 February, but some recently released, narrower gauges provide colour in the meantime. On the factory front, December industrial production fell -3.1% m/m on a price-adjusted basis, and weakness was widespread.[iv] Manufacturing (-2.1%) and energy production (-2.3%) both slipped whilst energy-intensive industries’ production—which fell for most of the year—contracted sharply (-6.1%).[v] December factory orders rose 3.2% m/m on a price-adjusted basis, but the positive headline number comes with a caveat: Volatile large-scale orders (e.g., for engines and turbines or spacecraft) skewed the result.[vi] Removing this bouncier category, orders contracted -0.6%, signalling flagging demand.[vii]

Rounding out the data, the January Consumer Price Index (CPI) rose 8.7% y/y, a tick higher than December’s 8.6%.[viii] On a harmonised basis (which EU nations produce in addition to national CPI measures to facilitate comparison across the bloc’s member nations) prices rose 9.2% y/y, slowing from the prior month’s 9.6% rate.[ix] Now, there were some complicating factors likely affecting recent prices, as the government provided relief on households’ natural gas bills in December and an electricity price cap took effect in January—though we won’t have those details until the next estimate.[x] Destatis didn’t provide January preliminary results for individual product groups, as the statistics agency shares only headline numbers when making changes to its methodology—as was the case this year.[xi]

In our view, these numbers confirm German factories have taken a hit, demand is mixed and, despite some improvement, elevated prices remain a headwind. Whether or not Germany enters recession (a broad decline in economic activity), the country’s industrial sector had a tough 2022—in line with stories of factories slowing production and some occasionally going offline due to high energy costs.[xii]

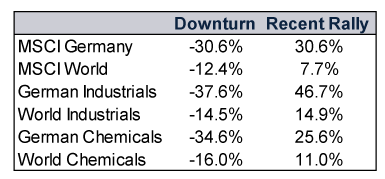

Whilst the output data indicate the magnitude of the economic damage, we think they are old news to stocks. Based on our study of market history, German stocks’ behaviour over the past 15 months was consistent with pre-pricing an economic downturn. From their high in euros (used here to avoid currency skew) on 17 November 2021, German stocks fell -30.6% to their most recent low on 29 September 2022—a much steeper decline than global stocks’ -12.4% in euros over the same period.[xiii] The sectors and industries that an energy crunch would likely hit hardest due to their power needs performed as one would presume, too. German Industrials—the country’s largest sector—plunged -37.3% in euros, far worse than the MSCI World Industrials’ -14.5%.[xiv] Same for the German Chemicals industry, which dropped -34.6% in euros to the MSCI World Chemicals’ -16.0%.[xv]

Since that September low, hard-hit German stocks have also rebounded stronger than their global counterparts. That rally began right at Q3’s close—before all the developments the latest economic data just confirmed. (Exhibit 1)

Exhibit 1: German Stocks’ Downturn and Rebound

Source: FactSet, as of 16/2/2023. Returns are all in euros to avoid currency skew. Currency fluctuations between the euro and pound may result in higher or lower investment returns. MSCI Germany Index, MSCI World Index, MSCI Germany Industrials sector, MSCI World Industrials sector, MSCI Germany Chemicals industry, and MSCI World Chemicals industry returns with net dividends, 17/12/2021 – 29/9/2022 and 29/9/2022 – 15/2/2023.

We don’t think there is a disconnect here, based on our view that stocks are leading economic indicators. We think they are mostly efficient discounters of widely known information, digesting broadly held opinions, forecasts and data. In our view, stocks have been pre-pricing the prospect of a German recession since late 2021, when warnings about high energy prices, elevated inflation and supply bottlenecks contributing to a downturn first arose.[xvi] Russia’s invasion of Ukraine early last year amplified those projections, based on financial publications we follow. Rather than wait for recession to become official—or for the data to even weaken—we think stocks moved first and pre-priced the probable negative economic impact in real time. In our view, markets have since moved on, weighing emerging reality against those fearful forecasts. That reality doesn’t seem as bleak as what markets anticipated—e.g., feared energy shortages have yet to materialise.[xvii] Now markets seem to be looking ahead to the economic and political factors impacting corporate profits over the next 3 – 30 months—and the likely recovery. Hence, the rally, in our view.

We don’t know definitively whether a new bull market has started yet, as cyclical turning points are clear only with ample hindsight. But we think there is a critical lesson here for investors: Stocks don’t sound an all-clear signal announcing a rebound is coming. Waiting for official confirmation that a recovery has begun may mean missing out on what in our experience are typically sharp early stages—which can be costly for investors seeking market-like returns to help reach their specific investment goals.

[i] Source: The World Bank, as of 17/2/2023. Statement based on 2021 German GDP (in constant 2015 USD).

[ii] Source: FactSet, as of 17/2/2023. MSCI Germany Index returns with net dividends in euros, 29/9/2022 – 17/2/2023. Currency fluctuations between the euro and pound may result in higher or lower investment returns.

[iii] Source: Destatis, as of 14/2/2023. GDP refers to gross domestic product, a government-produced estimate of economic output.

[iv] Ibid.

[v] Ibid.

[vi] Ibid.

[vii] Ibid.

[viii] Ibid. CPI is a government-produced measure of the change in prices economy-wide.

[ix] Ibid.

[x] “German Inflation Slows to Five-Month Low on Energy Aid,” Jana Randow, Bloomberg, 9/2/2023. Accessed via Yahoo! Finance.

[xi] See note iii.

[xii] “Idled Plants Fuel German Angst About De-Industrialisation,” Staff, France 24, 12/10/2022.

[xiii] Source: FactSet, as of 14/2/2023. MSCI Germany Index and MSCI World Index returns in euros with net dividends, 17/11/2021 – 29/9/2022. Currency fluctuations between the euro and pound may result in higher or lower investment returns.

[xiv] Ibid. MSCI Germany Industrials sector and MSCI World Industrials sector returns in euros with net dividends, 17/11/2021 – 29/2/2022. Currency fluctuations between the euro and pound may result in higher or lower investment returns.

[xv] Ibid. MSCI Germany Chemicals industry and MSCI World Chemicals industry returns in euros with net dividends, 17/11/2021 – 29/9/2022. Currency fluctuations between the euro and pound may result in higher or lower investment returns.

[xvi] “Europe’s Biggest Economy Is on the Brink of a Winter Recession,” Charles Riley, CNN Business, 14/12/2021.

[xvii] “Europe’s Natural Gas Prices Fall to 18-Month Low,” Anna Cooban, CNN, 17/2/2023.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.