Personal Wealth Management / Economics

A May Retail Sales Roundup

Australian, Canadian and UK retail sales figures indicate consumers are visiting newly reopened stores.

A trio of retail sales reports from Britain and two big Commonwealth countries—Australia and Canada—all show a lockdown-driven plunge in April followed by a sharp May rebound as virus-related restrictions started to lift. In our view, their experience contradicts worries we have encountered in financial media of a prolonged spending slump delaying an economic recovery and illustrates the big difference economic reopenings can make.

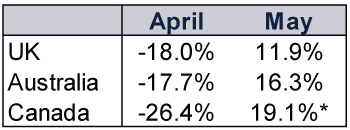

First, the numbers:

Exhibit 1: Month-Over-Month % Change in UK, Australia and Canada Retail Sales

Sources: Office for National Statistics (ONS), Statistics Canada and the Australian Bureau of Statistics, as of 22/6/2020. *Statistics Canada provided May’s figure in a special “advance estimate … given the rapidly evolving economic situation.”

In our view, divergent sales amongst various retail categories underscores COVID-related restrictions’ central role in determining where—and how much—consumers shopped. Lockdowns typically carve out exceptions for so-called essential businesses like grocery stores, gas stations and pharmacies, whilst shuttering nonessential businesses like clothing, sporting and household goods stores. Consequently, the nonessential variety tended to plunge deeper in April and rebound more in May.

For example, in the UK, the ONS noted that “non-food stores provided the largest positive contribution to the monthly growth in May 2020, aided by a strong increase of 42.0% in household goods stores, with the opening of hardware, paints and glass stores reflected in this sector.”[i] Compare this to April, when UK household goods sales fell -45.6%.[ii] Conversely, sales at “predominantly food stores,” which include grocery stores, fell just -4.1% m/m in April, likely buoyed by consumers stocking their pantries as restaurants closed en masse, in our view.[iii] No surprise to us, then, that they remained negative (-0.2% m/m) in May.[iv]

Similarly, Australia’s Bureau of Statistics reported, “there were large increases in turnover [meaning sales] in Clothing, footwear and personal accessory retailing and Cafes, restaurants and takeaway food services, as restrictions eased throughout [May]… Turnover increased across all subgroups in the Household goods retailing industry.”[v] Whilst Canada hasn’t released detailed May data yet, it noted “clothing and clothing accessories (-84.8%), sporting goods, hobby, book and music (-66.7%) and motor vehicle and parts dealers (-64.2%) stores reported the largest percentage declines from February to April.”[vi]

Whilst May’s upturn is encouraging, retail sales haven’t returned to pre-lockdown levels in any of these countries—largely, in our view, because they haven’t fully reopened. In the UK, for example, only England and Northern Ireland have reopened thus far, and not all at once. In England, many nonessential retailers couldn’t open until 15 June, and social distancing rules still limit foot traffic. Scotland and Wales still mandate closures of nonessential stores. Australia and Canada haven’t removed all restrictions, either.

Another caveat for retail sales’ strong May, in our view, is the likely role of substitution. Governments allowed many goods retailers to reopen sooner than services selling access to similar products. For example, since fitness centres typically face tighter restrictions, consumers may choose to purchase exercise equipment instead of a gym membership. Whilst complete data are scarce, we have seen anecdotal reports throughout financial news sites of surging sales at fitness equipment stores, kettlebell shortages and bidding wars on used exercise equipment. Likewise, judging by the huge volume of personal care at home how-to guides we have seen in major newspapers’ lifestyle sections, many people are likely compensating for salon closures by buying home hair colouring and trimming kits, nail polish, clippers and cuticle gel for at-home manicures, and the like. So, although consumers appear eager to shop where they can, as more competing services reopen, the pace of the spending rebound could slow somewhat—even as the economy returns to some form of normalcy.

That said, we think these data comport with other hints of pent-up demand and undercut fears that spending will automatically remain tepid even after shops reopen. Whilst consumers may be reducing shopping trips out of caution, May’s reports are an encouraging sign that as businesses reopen, customers seem able and willing to open their pocketbooks. This makes sense to us, as the ONS and US Bureau of Economic Analysis’s vast historical economic data troves show consumer spending generally tends to be pretty stable, even in recessions. Plus, like the US government, the UK, Canada and Australia swiftly subsidised furloughed and laid off employees’ wages at least partially, giving them space to spend.

In our view, retail sales data are backward-looking (since they report activity during some past period, which doesn’t inherently predict the future) and may not continue rising, particularly if broad shutdowns return—a political decision that we think defies forecasting. In our view, though, widespread fears of stagnant consumer spending suggest more positive surprise may be in store if continued reopenings let consumers return to their usual shopping habits.

[i] Source: Office for National Statistics, as of 22/6/2020.

[ii] Ibid.

[iii] Ibid.

[iv] Ibid.

[v] Source: Australian Bureau of Statistics, as of 22/6/2020.

[vi] Source: Statistics Canada, as of 22/6/2020.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments UK has developed several informational and educational guides tackling a variety of investing topics.