Personal Wealth Management / Market Analysis

Explaining 2020’s UK Equity Market Underperformance

In our view, UK equity markets’ structure puts them at a relative disadvantage in this bull market.

Whilst global equity markets have reached pre-pandemic highs, UK markets have clawed only about halfway back from their low and are 24.1 percentage points behind global returns year to date.[i] Resurgent Brexit worries are probably contributing to the lag, but we think the main explanation is UK equity markets’ heavy tilt towards value shares—companies more sensitive to economic conditions that typically invest less in growth-orientated endeavours and whose shares generally trade at lower prices relative to expectations for the company’s future earnings. This year, value shares have underperformed their counterpart, growth shares—companies that tend to focus on growing their earnings and revenues over time and typically trade at relatively higher prices compared to expectations for the company’s future earnings.[ii] In our view, growth is likely to continue leading as this new bull market develops (a bull market is a prolonged period of generally rising equity markets). For UK investors, we think UK markets’ 2020 struggles underscore the importance of global diversification.

Value shares—like those in the Financials and Energy sectors, amongst others—have trailed growth during this new bull market.[iii] Our research indicates this is unusual. Value-orientated companies usually depend more on underlying economic growth to turn a profit. Hence, their shares typically get pummelled most in bear markets’ latter stages (a bear market is a fundamentally driven equity market decline of -20% or worse) as investors question whether they will survive the accompanying recession—and our research shows value shares typically bounce back fastest early in the ensuing bull market as those fears fade.

However, we think February – March’s bear market was so sudden and short that fear over value firms’ survival lacked time to build as it normally does. That means less of a relief bounce, in our view. Consistent with this, the previous bull market’s leadership trends didn’t reverse: Growth-orientated firms led going into the bear market, during, and since.

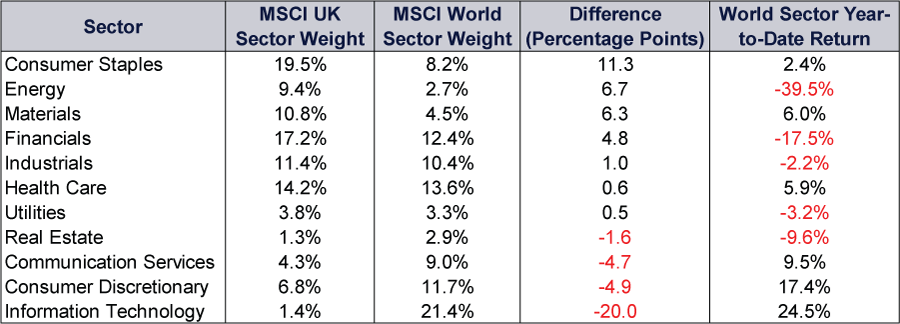

We think this is chiefly behind the UK’s lag. Exhibit 1 shows the UK’s equity market structure in comparison to global equities’. As the rightmost column shows, the two lowest-performing MSCI World sectors year to date—value-heavy Energy and Financials—are amongst the MSCI UK’s largest weights relative to global developed markets.

Exhibit 1: UK and Global Equity Market Sector Composition

Source: FactSet, as of 9/9/2020. MSCI UK Index and MSCI World Index sector composition weightings, and MSCI World Index returns with net dividends by sector, 31/12/2020 – 8/9/2020.

In our view, growth shares’ outperformance isn’t likely to flag over the foreseeable future. Value areas like Energy and Financials face stiff headwinds. Oil prices remain depressed tied to weak demand and ample supply, weighing on Energy firms’ profits. Financials face pressure from two issues facing banks: the need to set aside reserves for potentially souring loans and the interest rate environment hampering lending’s profitability. Banks borrow short-term to fund long-term loans, making the difference between long and short rates a proxy for new loans’ potential profitability. That gap is tiny today and looks unlikely to rise soon. Meanwhile, we think features common amongst growth-orientated companies—like fast-growing earnings and ample cash on hand—will remain in favour as the economy gradually recovers. Hence, we think growth will keep leading—and UK shares will keep lagging—until and unless market fundamentals shift markedly.

As for Brexit, our analysis of financial news headlines indicates many presently fear post-Brexit catastrophe—a highly unlikely result, in our view, as we think the UK will be able to trade on favourable terms with the rest of the world with or without a trade deal with the EU. These fears have added to uncertainty over the outcome, which we think has contributed to UK market lag somewhat. Now, that uncertainty is set to fall this year, which we would ordinarily see as bullish for British markets. But we think Britain’s value tilt likely outweighs this, making falling uncertainty over Brexit less of a tailwind for UK equities than it might otherwise be.

We see a key lesson for UK investors here: The importance of eschewing home country bias—the tendency to prefer your own country’s equity markets over other countries’. UK companies’ combined market value comprises just 4.2% of global developed markets.[iv] In our view, restricting yourself to domestic firms ignores a global opportunity set of potentially profitable companies and exposes you to country-specific risks and headwinds. We think global diversification can help remedy these deficiencies.

[i] Source: FactSet, as of 9/9/2020. Statement based on MSCI World Index returns with net dividends and MSCI United Kingdom Index total returns, 16/3/2020 – 9/9/2020.

[ii] Source: FactSet. Statement based on MSCI World Growth Index and MSCI World Value Index returns with net dividends, 31/12/2019 – 8/9/2020.

[iii] Ibid. Statement based on MSCI World Growth Index and MSCI World Value Index returns with net dividends, 23/3/2020 – 8/9/2020.

[iv] Ibid. MSCI World Index market capitalisation by country.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments UK has developed several informational and educational guides tackling a variety of investing topics.