Personal Wealth Management / Interesting Market History

Inflation Is Up, Gold Seems Dull

Gold’s alleged inflation-hedging prowess is substandard, in our view.

A long-held investment tenet amongst commentators we follow claims gold is a great way to insulate or hedge an investment portfolio against inflation, which is a broad rise in prices across the economy. But consider: Despite the UK Consumer Price Index (CPI) hitting 3.2% y/y—a rate last seen in 2012 and an upturn echoed across the developed world—gold is down -5.4% on the year.[i] In our view, this is a clue to a broader truth: History shows gold’s inflation-hedging reputation rings hollow.

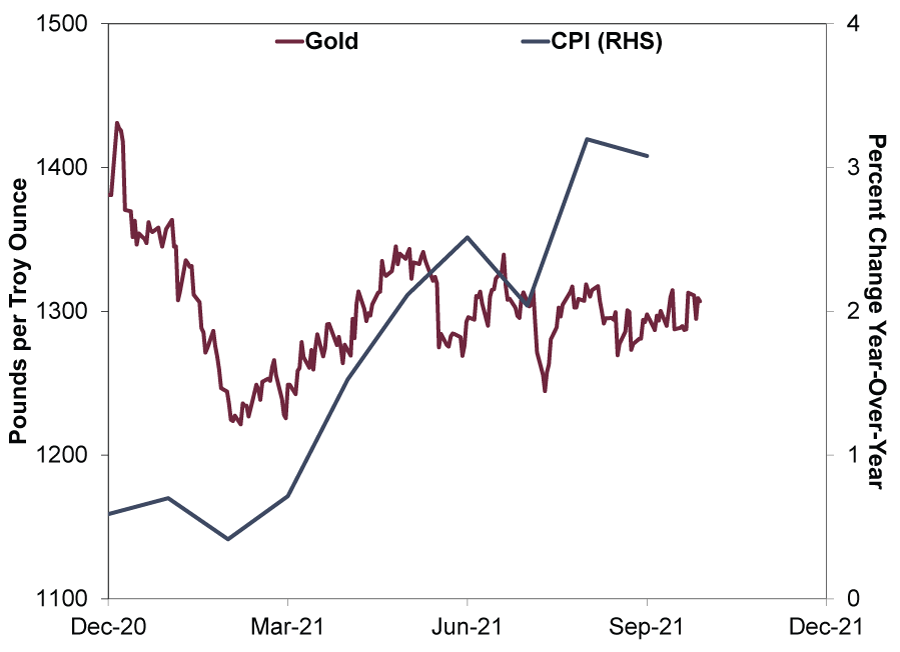

Exhibit 1 illustrates this year’s sharp divergence. Despite UK CPI’s accelerating from 0.6% y/y in December and a similar acceleration of American inflation, gold has floundered.

Exhibit 1: No Hedge Year to Date

Source: FactSet, as of 29/10/2021. Gold price per troy ounce, 31/12/2020 – 28/10/2021, and UK CPI, December 2021 – September 2021. As the Royal Mint explains: “A troy ounce is a system of weights used for precious metals and gems, based on a pound of 12 ounces as opposed to the traditional 16.” The Consumer Price Index is a national measure of prices across a broad range of goods and services.

Now, gold’s spring run did coincide with the inflation rate’s quintupling from February to May, but even then, it didn’t break even for the year.[ii] Plus, whilst CPI inflation rose another percentage point, gold fell back—not what you would expect from a true inflation hedge.[iii] It is also down -16.9% from 6 August 2020’s record high of £1573 per troy ounce, when CPI inflation was a paltry 0.2% y/y.[iv]

This is just one time period. Perhaps gold investors simply think, as we do, that heightened inflation rates are likely to subside before long. But our historical research shows even in other inflationary periods, gold’s performance has been spotty at best—an unreliable hedge. Many commentators we follow note that gold performed well from the time the US abandoned its de facto gold standard in 1974 until January 1980 as US CPI soared, arguing this illustrates the benefits available globally today.[v] (UK restrictions on gold ownership lingered until 1979.) But was this about inflation or the removal of fixed, government-set prices and ownership restrictions? With no counterfactual, you can’t know.

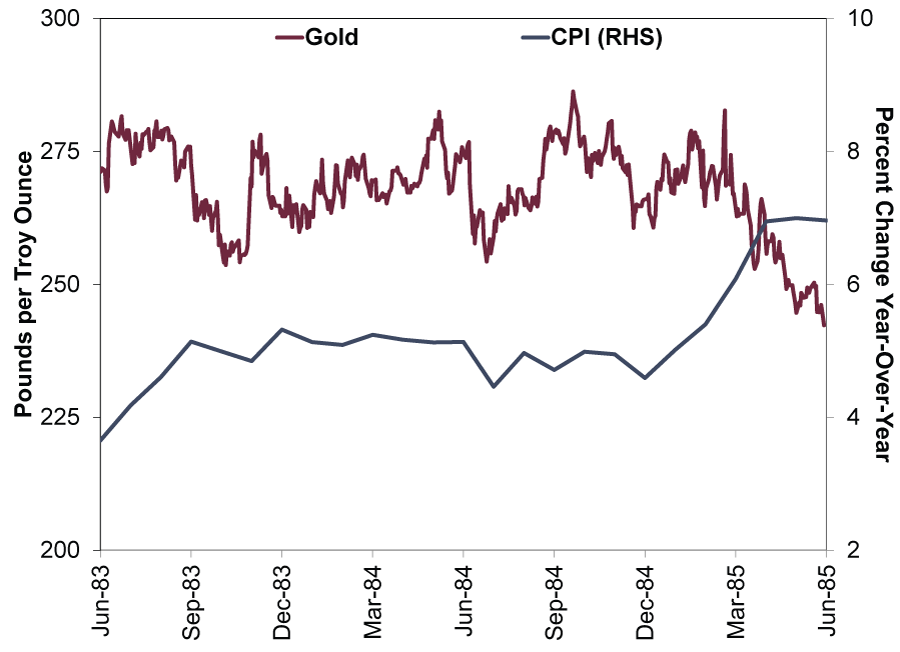

In any event, since then, owning gold to guard against inflation wouldn’t always have worked out so well. From June 1983 to June 1985, when CPI accelerated from 3.6% y/y to 7.0%, gold fell -10.7%.[vi] (Exhibit 2) Whilst gold held up ok as the inflation rate hovered around 5% y/y from September 1983 to December 1984, it fell as CPI topped 6%, precisely when the desire for a hedge likely would have been most acute.[vii]

Exhibit 2: Not Really One Much Historically, Either

Source: FactSet, as of 29/10/2021. Gold price per troy ounce, 30/6/1983 – 30/6/1985, and CPI, June 1983 – June 1985.

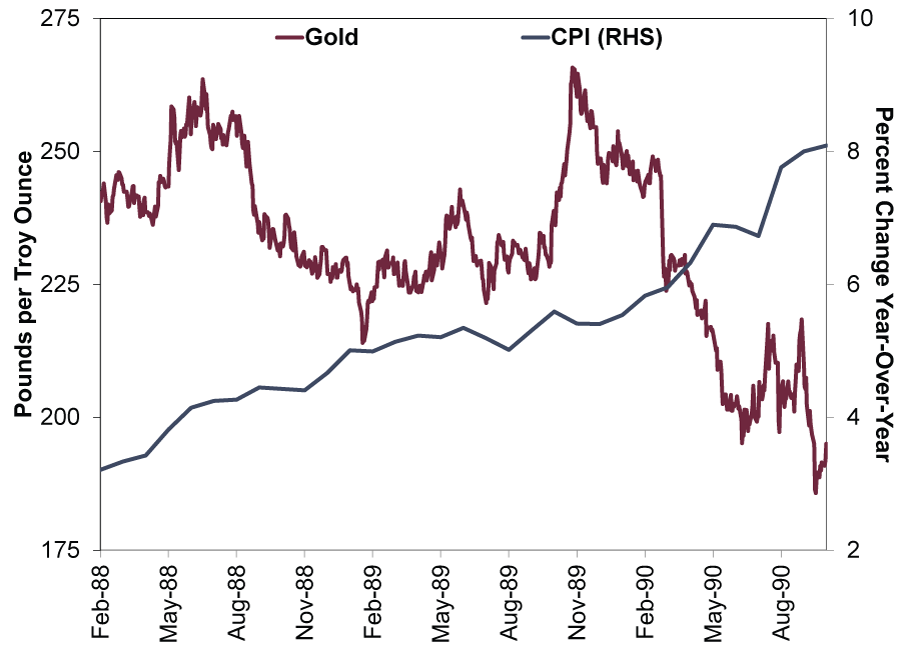

Or take February 1988 to October 1990, when CPI accelerated from 3.2% y/y to 8.1%.[viii] Gold? It fell -19.0%.[ix] (Exhibit 3) Again like this year, there were short periods where gold seemed to hedge well. From February through October 1989, CPI accelerated by 0.6 percentage points, whilst gold rose from £214 per troy ounce to £266 on 24 November 1989.[x] Over the next year though, CPI accelerated further, topping 8% in 1990.[xi] But from its November 1989 peak, gold fell -26.6% through Halloween 1990.[xii] During CPI’s run higher, gold worked as an inflation hedge for only about a third of the time—fleeting.

Exhibit 3: Another Questionable Inflation-Hedging Period

Source: FactSet, as of 29/10/2021. Gold price per troy ounce, 29/2/1988 – 31/10/1990, and CPI, February 1988 – October 1990.

We don’t think inflation is likely to prove lasting today, as the currently elevated rates seem like a function of supply and demand mismatches driven by economic lockdowns and subsequent reopenings. As these even out, we think CPI rates are likely to revert to the slow pre-pandemic norm.[xiii] But even if inflation were likely to stay high, the case for gold would be weak to us. It may make a good crown,[xiv] but as an investment—or an investment tool—it doesn’t have much utility today, in our view.

[i] Source: FactSet, as of 29/10/2021. Gold price per troy ounce, 31/12/2020 – 29/10/2021, and CPI, August 2021.

[ii] Ibid. Gold price per troy ounce, 8/3/2021 – 26/5/2021, and CPI, February 2021 – May 2021.

[iii] Ibid. Gold price per troy ounce, 31/5/2021 – 29/10/2021, and CPI, May 2021 – September 2021.

[iv] Ibid. Gold price per troy ounce, 6/8/2020, and CPI, August 2020.

[v] Ibid. Gold price per troy ounce, 31/12/1974 – 21/1/1980.

[vi] Ibid. Gold price per troy ounce, 30/6/1983 – 30/6/1985, and CPI, June 1983 – June 1985.

[vii] Ibid. CPI, December 1984 – June 1985.

[viii] Ibid. CPI, December 1986 – October 1990.

[ix] Ibid. Gold price per troy ounce, 31/12/1986 – 31/10/1990.

[x] Ibid. Gold price per troy ounce, 15/2/1989 – 24/11/1989, and CPI, February 1989 – October 1990.

[xi] Ibid. October 1990.

[xii] Ibid. Gold price per troy ounce, 24/11/1989 – 31/10/1990.

[xiii] Ibid. CPI, January 2019 – January 2020.

[xiv] Dental or otherwise.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments UK has developed several informational and educational guides tackling a variety of investing topics.