Personal Wealth Management / Market Analysis

No Surprises in China’s Slowdown

Q3 economic growth was largely in line with long-running trends, according to our analysis.

Chinese gross domestic product growth slowed to 4.9% y/y in Q3, with most financial commentators we follow surmising that the problems at property developer China Evergrande and associated real estate woes, combined with September’s electricity shortage, took a big bite out of the economy. (Gross domestic product, or GDP, is a government-produced measure of economic output.) Whilst we agree those issues likely did have some negative effects, we think most of today’s coverage overstated them and ignored a simple but important point: Q3’s growth rate is right in line with the long-running trend, as we will show. In our view, that makes these results a return to pre-pandemic normal, not a sign of sudden big problems in the world’s second-largest economy—a fine backdrop for equity markets.[i]

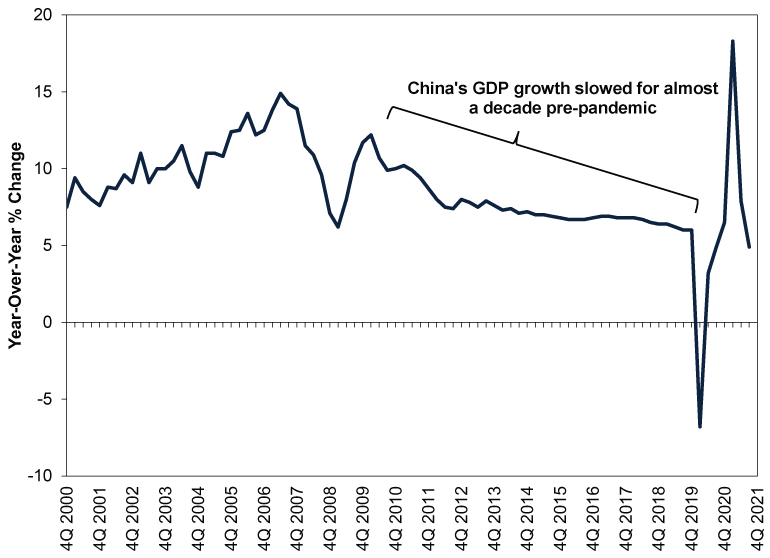

Also lost in most coverage we encountered: Chinese GDP thus far appears to be on track to meet the government’s full-year target of at least 6%, as it is up 9.8% year to date from 2020’s first three quarters.[ii] There is some COVID skew in this figure, stemming from last year’s lockdowns and the related contraction in economic activity. Yet according to a press release from China’s National Bureau of Statistics’ (NBS), the compound growth rate over the past two years is 5.2%.[iii] That is very much in line with pre-pandemic growth rates. So is Q3’s 4.9% growth, as Exhibit 1 shows—it largely extends the decade-long slowdown from the double-digit growth rates of old.

Exhibit 1: Slowing Growth Is the Norm in China

Source: FactSet, as of 18/10/2021.

Much of the sour sentiment we observed Monday stemmed not from the headline GDP figure, but from September data—specifically industrial production and real estate. The former slowed to 3.1% y/y, the lowest rate since last year’s lockdowns, which many commentators interpreted as a sign the electricity shortage and associated blackouts are taking a big toll on factories.[iv] Yet slow growth isn’t contraction. Take this with a grain of salt or two, as the accuracy of the seasonal adjustments statisticians use to arrive at this figure is an open question amongst analysts who cover China, but industrial production was about flat month-over-month (up 0.05%, according to the NBS).[v] Even if reality was a bit worse than that, we don’t think it points to electricity shortages sucker punching heavy industry. Rather, it suggests the sector overall did as best it could in the face of a stiff headwind.

Reading into any one month as a sign of things to come is generally an error, but we think that is especially true of September’s industrial production. The electricity crunch is a one-off negative, in our view, not a permanent state. Over the past several days, several reports indicate government has taken a number of steps to ease the electricity shortage, including easing price controls and beefing up coal production. That suggests to us the power shortage should ease sooner rather than later, giving factories a shot in the arm.

In our view, reading too much into September’s real estate data is similarly shortsighted. Yes, home sales fell -16.9% y/y in the month.[vi] But is that any wonder, what with uncertainty over Evergrande and other property developers weighing on sentiment? And with regulators reportedly directing banks to restrict credit for developers and home buyers? Those restrictions are already easing, according to recent statements from the People’s Bank of China (PBOC), which we think should help sales stabilise looking forward.[vii] Plus, even with the late-summer swoon, home sales are up a whopping 17.8% year to date through September versus 2020’s first 9 months.[viii] Meanwhile, residential real estate investment fell a much milder -1.6% y/y in the month and is up 10.9% year to date.[ix] Here too, we wouldn’t recommend reading into one month, but we think the sharp divide between September’s sales and investment activity shows Evergrande’s woes aren’t representative of the property sector as a whole. The PBOC’s recent measures easing liquidity for property developers should further support stability.[x]

At a philosophical level, we think the heightened focus on heavy industry and real estate shows that Western commentators broadly have an inaccurate view of China’s economy. Several outlets have claimed real estate is responsible for 29% of Chinese GDP, which they calculate by folding in furniture sales, construction and anything tangentially related to the sale of a home. In our view, all the assumptions folded into that figure are debatable, making it more accurate to look at pure real estate only. That figure—real estate, renting and leasing activities—was just north of 10% of GDP pre-pandemic, which is bigger than the US but not the driving economic force.[xi] Even if you fold construction into that—which includes a lot of things unrelated to residential and commercial real estate—you wind up at 17%, not nearly 30%.[xii]

Similarly, whilst manufacturing is more important economically in China than in more developed countries, it was still only about 39% of pre-pandemic GDP.[xiii] Services, which gets far less attention, now generates the majority of Chinese GDP—53.1% pre-pandemic and in 2020.[xiv] China now has an official Index of Services Production, which grew 5.2% y/y in September and even accelerated from August.[xv] The tech-heavy component of that index is up 19.3% year to date.[xvi] The legacy areas of China’s economy may have hit a speed bump, but those more orientated to China’s future are doing quite well, based on these figures. Incidentally, they are probably also more insulated against the temporary electricity issues, as factories are generally much, much more energy-intensive than offices.

China’s economy isn’t in perfect shape, but last we checked, no economy in the history of the world was ever perfect. All economies have pockets of strength and weakness at any given time. China’s weaker pockets are getting all the attention right now, but the stronger areas appear to be more than offsetting them and helping the world’s second-largest economy continue adding to global GDP. That is a just-fine economic environment for equities globally, in our view.

[i] Source: World Bank, as of 18/10/2021. Statement based on annual GDP by country.

[ii] Source: National Bureau of Statistics of China, as of 18/10/2021.

[iii] Ibid.

[iv] Ibid.

[v] Ibid.

[vi] Ibid.

[vii] “China Breaks Silence on Evergrande, Says Risks Controllable,” Staff, Bloomberg, 15/10/2021. Accessed via Yahoo! Finance.

[viii] Ibid.

[ix] Ibid.

[x] See Note vii.

[xi] Source: National Bureau of Statistics of China and US Bureau of Economic Analysis, as of 20/9/2021.

[xii] Source: National Bureau of Statistics of China, as of 20/9/2021.

[xiii] Source: FactSet, as of 18/10/2021.

[xiv] Ibid.

[xv] Ibid.

[xvi] Ibid.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.