Personal Wealth Management / Economics

Quick Hit: July UK and US Retail Sales

More evidence the global expansion remains in better shape than appreciated.

After recent market turbulence, UK and US consumers seemed to provide a reprieve. July retail sales for both countries rose, and some headlines heralded consumers as a bright spot in a stormy global economy—though pundits still fretted manufacturing weakness eventually spilling over. Whilst retail sales don’t capture all of consumer spending, we think the latest numbers add further evidence that the non-industrial parts of the UK and US economies, which happen to represent the majority of GDP, are faring fine.

In the UK, July retail sales rose 0.2% m/m (3.3% y/y).[i] Across the Atlantic, they grew 0.7% m/m (3.5% y/y).[ii] Both beat expectations (for -0.3% in the UK, 0.3% in the US).[iii] Whilst headlines cheered the growthy July, these summertime figures aren’t out of line with retail sales’ expansionary 2019.

Exhibit 1: UK Retail Sales

Source: FactSet, as of 16/8/2019. Percentage change in UK retail sales on a month-over-month and year-over-year basis, January 2018 – July 2019.

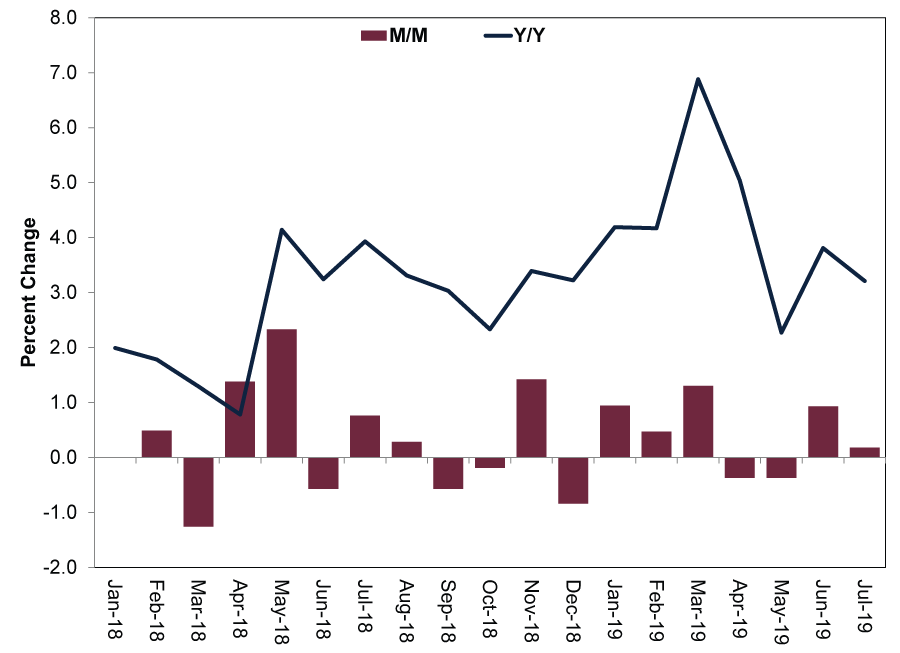

Exhibit 2: US Retail Sales

Source: FactSet, as of 16/8/2019. Percentage change in US retail sales on a month-over-month and year-over-year basis, January 2018 – July 2019.

Some financial pundits we read noted how one giant US Internet retailer’s arbitrary promotional day may have primed the pump for a strong July. Non-store retail sales rose 2.8% m/m in the US, accelerating from June’s 1.9%.[iv] The category fared even better in the UK, speeding from June’s 0.6% m/m to 6.9%.[v] Whilst we don’t dismiss the positives, non-store retailing comprises a small slice of total retail. In the UK, non-store retail makes up about 10% of total retail.[vi] The category accounted for about 13% of July’s total US retail sales.[vii]

Less appreciated, in our view: how broad based growth was. In the UK, whilst non-food stores took a hit—detracting 0.6 percentage point from growth—much-maligned department stores rose, snapping a six-month losing streak.[viii] In the US, only three categories contracted: motor vehicle & parts dealers, health & personal care stores and sporting goods, hobby, musical instrument & book stores.[ix]

July’s UK retail sales in particular provided a timely reminder to not blindly accept headlines’ doomsday warnings. Near August’s start, the British Retail Consortium announced retailers suffered “the worst month for sales in July since records began.” Besides the fact they reported total July sales rose 0.3% y/y, we think math explains why the gloomy assessment was off. The “worst read on record” wasn’t because July sales were weak—rather, they had to contend with a high base effect (meaning, the denominator in the year-over-year growth rate calculation). Warm weather and last year’s World Cup buoyed July 2018 sales, setting an inflated comparison point for this year. That sales were still positive on a year-over-year basis despite this illustrates retail sales’ continued strength, in our view.

We think recent trends provide better context, as year-old skew tells you little meaningful about today. The ONS’s official July estimate was 3.3% y/y, but on a monthly basis, UK retail sales rose in five of 2019’s seven completed months.[x] We think March’s surge and April and May’s pullbacks likely reflect the Brexit deadline’s shift from the end of March to Halloween, which pulled demand forward as consumers tried to front-run the original deadline—only to be left with unnecessary stockpiles when it moved. Whilst backward-looking data don’t tell the future, more recent retail sales suggest UK consumers have been faring fine despite the Brexit saga’s many twists and turns.

We aren’t saying retail sales tell you everything about personal consumption—especially since they exclude most services spending, which outweighs goods. But we think they do reinforce the notion things are better than many pundits seem to think.

[i] Source: Office for National Statistics, as of 19/8/2019. July UK retail sales, percentage change on a month-over-month and year-over-year basis.

[ii] Source: US Census Bureau, as of 19/8/2019. July US retail sales, percentage change on a month-over-month and year-over-year basis.

[iii] Source: FactSet, as of 16/8/2019. July expectations for percentage change in UK and US retail sales on a month-over-month basis.

[iv] Source: US Census Bureau, as of 19/8/2019. July non-store retail, percentage change on a month-over-month basis.

[v] Source: Office for National Statistics, as of 19/8/2019. July non-store retail, percentage change on a month-over-month basis.

[vi] Ibid. July non-store retail as a percentage of total UK retail sales.

[vii] Source: US Census Bureau, as of 19/8/2019. July non-store retail sales as a percentage of total US July retail sales.

[viii] Source: Office for National Statistics, as of 19/8/2019. Month-over-month contributions to growth by sector, Great Britain, July 2019 compared with June 2019, and July’s month-on-month growth rate for quantity bought in department stores.

[ix] Source: US Census Bureau, as of 19/8/2019. July change in monthly sales for retail and food services by kind of business.

[x] Source: FactSet, as of 19/8/2019. July UK retail sales percentage change year-over-year basis, and UK retail sales, percentage change on month-over-month basis, January 2019 – July 2019.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.