Personal Wealth Management / Market Analysis

The European Energy Improvements We Think Stocks Anticipated

Energy prices have returned to pre-crisis levels—a development markets anticipated first, in our view.

Economic reality exceeding fears is the primary force underlying global stocks’ rally since last summer, in our view.[i] One prominent example: Europe’s energy situation. Since mid-2021, the Continent has faced a sequence of energy issues, ranging from a dearth of wind early—which drove utilities to shift to natural gas—and then, of course, its dependence on Russian energy contributing to ginormous price spikes and worries of rationing and blackouts.[ii] Energy costs hit eye-watering levels: European natural gas prices registered an all-time high in October 2021—and would triple in under a year—whilst global oil prices rose to their highest levels in more than a decade.[iii]

These developments convinced many experts we follow that Continental energy shortages would drive a deep recession.[iv] Yet as we approach summer 2023—and with European gas prices down to their lowest level in two years—the energy situation is looking decidedly less dire, in our view.[v] To us, this is a shining example of reality turning out better than feared, which has propelled a strong eurozone stock market rally since last fall.[vi] Conditions still aren’t pristine—but our research shows they needn’t be for stocks, a key lesson to keep in mind.

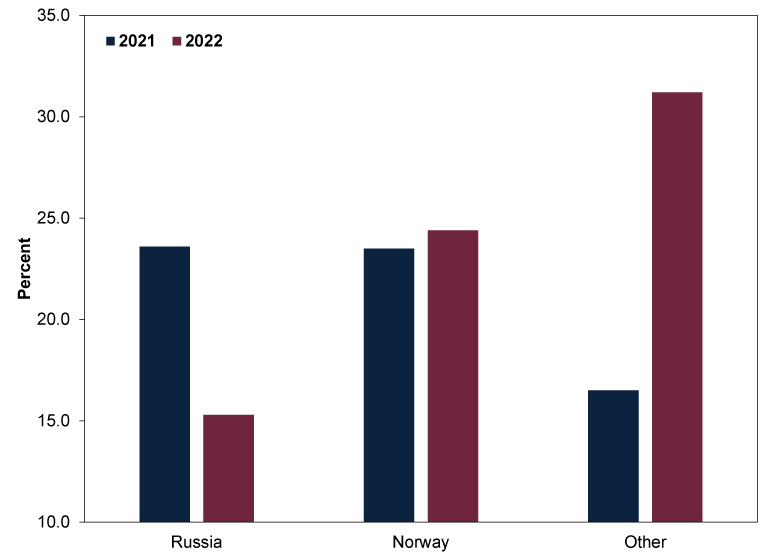

A big reason reality has turned out better than many financial commentators we follow projected: Russia lost its energy leverage over Europe, as the Continent found other sources of natural gas. As Exhibit 1 shows, the European Union (EU) has been shifting away from Russian gas, finding supply from other nations, including Norway, America, Algeria and Qatar. (Exhibit 1)

Exhibit 1: Extra-EU Imports of Natural Gas, 2021 - 2022

Source: Eurostat, as of 3/5/2023. Origin of EU natural gas imports, 2021 and 2022. Other refers to the United States, Algeria, Qatar and the United Kingdom.

EU nations have also been rapidly developing their liquefied natural gas (LNG) infrastructure to reduce their reliance on Russian gas imports. In under a year, Germany permitted, built and is now operating three floating LNG terminals.[vii] The German government now expects to slow development of more terminals since gas supply is no longer a pressing problem.[viii]

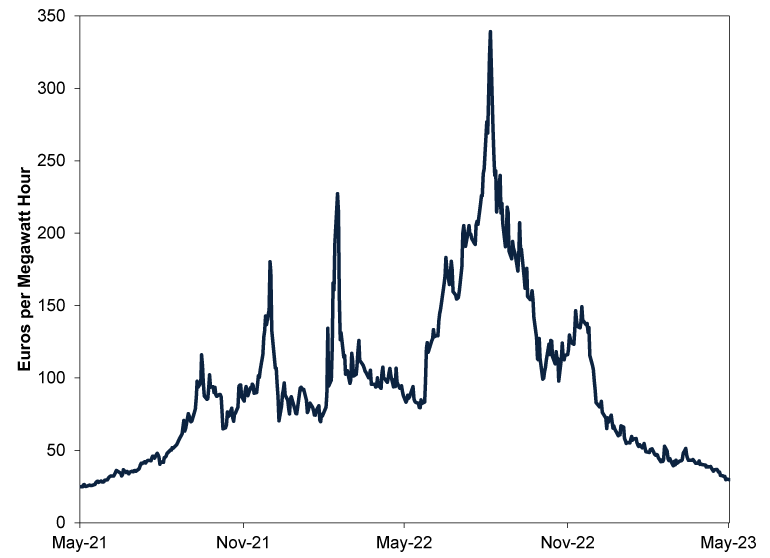

Granted, this transition hasn’t been easy or painless. We have read myriad examples of businesses and households struggling with higher energy prices even with government aid. Some factories have reduced output, temporarily closed and/or resorted to layoffs.[ix] But from an investing perspective, forecasts of a deep, energy-driven European recession have yet to manifest based on our analysis of macroeconomic data—and now energy prices have round-tripped to pre-crisis levels. (Exhibit 2)

Exhibit 2: European Natural Gas Prices Are Back to 2021 Levels

Source: FactSet, as of 22/5/2023. Dutch TTF natural gas price in euros, 21/5/2021 – 22/5/2023.

We don’t think this improvement is news to forward-looking stocks, though. From their November 2021 high in euros (used here to avoid currency skew) to their September 2022 low, eurozone stocks fell -24.8% whilst German stocks slipped -30.6%—both worse than global stocks’ -12.4% over the same period.[x] To us, Europe’s outsized drop reflected stocks’ pricing in the energy crisis and its related fallout—particularly on the German economy, whose large chemicals industry is dependent on natural gas.[xi] According to our research, stocks’ behaviour is consistent with the pre-pricing of an economic downturn—which they started doing in late 2021.[xii] Likewise, we observed that markets began recovering before official economic data confirmed improvement. Fittingly, Germany’s DAX index hit a record high last week, just as natural gas prices returned to pre-crisis levels.[xiii] Whilst this is a coincidence, we think it is also a timely reminder stocks don’t wait for things to fully improve.

Now it appears people are catching up to what markets already moved on, as evidenced by the European Commission’s (EC) latest projections for the EU economy and member nations. In its Autumn 2022 Forecast, the EC predicted EU gross domestic product (GDP, a government-produced measure of economic output) would contract in Q4 2022 and Q1 2023—with a full-year 2023 GDP projection of 0.3% growth—and anticipated a -0.6% annual contraction for Germany.[xiv] But in its Spring 2023 forecast released last week, the EC acknowledged the latest data were better than they thought.[xv] Now the outfit projects an EU GDP annual expansion of 1.0% and thinks German GDP will grow 0.7% rather than contract this year.[xvi] Interestingly, the EC’s revision echoed the Bank of England’s upgrade to UK growth expectations, as better-than-anticipated data also forced policymakers there to update their estimates.

Now, this doesn’t mean economic conditions are great. Inflation, although slowing, is still well above pre-2021 rates.[xvii] Heavy industry remains in a soft patch: Eurozone March industrial production contracted -4.1% m/m whilst the region’s manufacturing purchasing managers’ indexes (PMIs) have registered sub-50 readings since July last year—a sign more businesses are contracting than expanding.[xviii] That is an economic headwind, though the services sector is generally holding up better, and it is the majority of eurozone output.[xix]

Looking ahead, we don’t dismiss the possibility of a eurozone recession later this year, and we are keeping a close eye on global lending trends, as less capital moving throughout the economy can weigh on growth. But for investors, we think it is beneficial to remember stocks move most on the gap between expectations and reality—and the former remain quite low. Consider: Energy fears haven’t gone away even after recent improvement, and some economists think challenges loom next winter, as competition with other regions for natural gas could lead to European shortages.[xx] To us, that suggests pessimism remains prevalent—and that the wall of worry bull markets (prolonged periods of rising equity prices) climb remains high.

[i] Source: FactSet, as of 24/5/2023. Statement based on MSCI World Index returns with net dividends, in GBP, 16/6/2022 – 23/5/2023.

[ii] “Europe’s Energy Crunch Will Trigger Years of Shortages and Blackouts,” Stephen Stapczynski, Anna Shiryaevskaya and Faseeh Mangi, Bloomberg, 8/11/2022. Accessed via Financial Post.

[iii] Source: FactSet, as of 22/5/2023. Statement based on Dutch TTF spot prices, 5/10/2021 – 26/8/2022 and Brent Crude Oil spot price, 3/7/2008 – 8/3/2022.

[iv] “Euro Zone Predicted to Have a Deep Recession and a Difficult, Slow Recovery,” Silvia Amaro, CNBC, 16/11/2022. Recession is a protracted, economy-wide decline in economic activity.

[v] See note ii. Statement based on Dutch TTF spot prices, as of 23/5/2023.

[vi] Ibid. Statement based on MSCI European Monetary Union Index returns with net dividends, in GBP, 13/10/2022 – 23/5/2023.

[vii] “Germany Scales Down LNG Terminal Plans as Supply Crisis Eases,” Markus Wacket and Riham Alkousaa, Reuters, 15/5/2023. Accessed via MSN.

[viii] Ibid.

[ix] “Rocketing Energy Costs Are Savaging German Industry,” Anna Cooban, CNN, 7/10/2022.

[x] Source: FactSet, as of 22/5/2023. MSCI EMU Index, MSCI Germany Index and MSCI World Index returns with net dividends, 17/11/2021 – 29/9/2022. Presented in euros. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

[xi] “Russia Is Giving German Industry a Slow Puncture,” George Hay, Reuters, 27/7/2022. Accessed via Nasdaq.com.

[xii] See note x.

[xiii] “Germany's DAX Stock Index Hits Record High,” Staff, Deutsche Welle, 19/5/2023.

[xiv] “Autumn 2022 Economic Forecast: The EU Economy at a Turning Point,” European Commission, 11/11/2022.

[xv] “Spring 2023 Economic Forecast: An Improved Outlook Amid Persistent Challenges,” European Commission, 15/5/2023.

[xvi] Ibid.

[xvii] Source: FactSet, as of 24/5/2023. Statement based on eurozone Harmonised Index of Consumer Prices (HICP), year-over-year change, January 2021 – April 2023. HICP is a government-produced measure of goods and services prices across the broad economy.

[xviii] Source: S&P Global, as of 23/5/2023. Statement based on May preliminary eurozone PMIs. PMIs are monthly business surveys that track the breadth of economic activity amongst respondents.

[xix] Source: S&P Global and the World Bank, as of 23/5/2023. Statement based on May preliminary eurozone PMIs and services sector’s value add as a percentage of GDP in 2021.

[xx] “Europe’s Energy Market Faces 3 Key Challenges This Year, the IEA’s Chief Says,” Charmaine Jacob, CNBC, 21/5/2023.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.