Personal Wealth Management / Economics

The First Q2 GDP Reports Were Historically Awful, but Likely Not a Surprise

Q2 results didn’t catch markets off guard, in our view.

Q2 gross domestic product (GDP, a government-produced measure of economic output) results for the first major economies to report emerged last week, and we think it is fair to say they are rather ugly. The US, eurozone and the latter’s four largest economies notched brutal GDP declines, and we don’t think they will be the last nations to do so.[i] As these Q2 numbers hit the wires, we think it is worth remembering equities likely spent February and March reckoning with the lost economic activity that is now registering in GDP—and in our view, markets are now looking far, far beyond what happened between April and June.

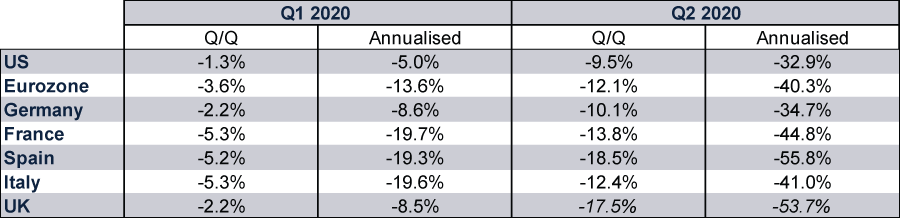

Exhibit 1 shows Q1 and Q2 results for the nations reporting thus far. We included quarter-over-quarter figures (the percentage change between the reported quarter and previous quarter) as well as annualised figures (the rate at which GDP would grow or contract over a full year if the reported quarter’s growth rate persisted for four quarters) in order to make comparison between the US and eurozone nations easier. This is because America reports annualised growth, whilst European nations use the quarter-over-quarter numbers.

Exhibit 1: US and Eurozone GDP Results

Source: FactSet, as of 31/7/2020. German GDP growth rate converted from quarter-over-quarter to annualised.

We think perhaps the most surprising development is that US GDP didn’t fall quite as much as German GDP. Considering Germany began reopening from the COVID lockdowns before most of the US, we think it would be reasonable to expect German GDP to fall less than the US’s. Analysts certainly seemed to think so. According to FactSet’s most recent surveys, consensus estimates were for German GDP to drop -9.0% q/q, beating the US, which analysts estimated at -10.1% q/q (based on consensus estimates of a -34.6% annualised drop).[ii] Germany’s initial release doesn’t include a detailed breakdown, though the accompanying press release from the country’s official statistics agency noted a “massive slump” in trade and private demand, with only government spending increasing.[iii] The US breakdown showed much the same. But we won’t know for a few weeks whether the US’s edge over Germany may have stemmed primarily from a slightly less sharp decline in private sector activity or relatively higher government spending—presuming that edge isn’t revised away in future releases.

In our view, it doesn’t much matter either way. For one, Fisher Investments’ research shows equities don’t move in lockstep with GDP. Two, tempting as it may be to dig into the details to see which country’s COVID response might have had less of an economic impact, we think doing so is useful only for academic purposes—not portfolio positioning or equity market forecasting. Based on how our research indicates markets normally behave, we think the bear market that ran from 12 February to 23 March was shares’ way of pre-pricing (meaning, pre-emptively incorporating into share prices) the recession that GDP data are now registering.[iv] Our research also shows equity markets typically lead the economy, with bear markets starting months before recessions do.[v] During a bear market’s panicky throes, we think shares generally look to the short end of their typical 3 – 30 month horizon, seemingly focused exclusively on the near-term damage. In our view, a bear market is shares’ way of reckoning with an economic contraction and its effect on corporate earnings. Once markets have a reasonable idea of how deep the recession will be and how long it will last, we think they are able to start looking further out and weighing how the recovery will help corporate earnings recover over the next couple of years. In our view, that is what they have been doing since late March and continue doing today.

We also think that long-term view is rational. We find GDP to be a useful, comprehensive look at all economic activity. But because it is quarterly (outside the UK and Canada, which report monthly GDP), it can gloss over month-to-month changes. In this case, we think it glosses over the stark improvement most monthly metrics we monitor showed in May and June, as more businesses began reopening. Retail sales and industrial production surged in the US in June.[vi] In Germany, both measures rose sharply in May, though retail sales then contracted slightly in June.[vii] Flash purchasing managers’ indexes—business surveys measuring the breadth of growth—suggest the recovery continued in July.[viii] Analysts now expect US GDP to start recovering in Q3, with an 18.4% annualised rise.[ix] That isn’t a complete recovery, but we think it is a fine start. In our view, past bull markets have proven equities don’t need GDP to recover its prior peak as quickly as it fell. A recovery that puts corporate earnings on a path higher over the next year, two, three or more is probably enough, in our view.

All the evidence we see today suggests this outcome is likely. Even with COVID lingering, it appears countries have avoided new, sweeping national lockdowns. For the global economy, we think that is really what counts and, barring a reversal, should allow a recovery to unevenly continue from here.

[i] Source: FactSet, as of 30/7/2020. Statement based on historical US and German annualised GDP growth.

[ii] Source: FactSet, as of 30/7/2020.

[iii] Source: Destatis, as of 30/7/2020.

[iv] Source: FactSet, as of 30/7/2020. Statement based on MSCI United Kingdom Index with net dividends, 12/2/2020 – 23/3/2020.

[v] Source: FactSet, as of 31/7/2020. Statement based on S&P 500 Index and MSCI UK Investible Market Index and MSCI World Index price levels.

[vi] Ibid., as of 4/8/2020.

[vii] Ibid.

[viii] Source: FactSet, as of 30/7/2020.

[ix] Ibid.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments UK has developed several informational and educational guides tackling a variety of investing topics.