Personal Wealth Management / Market Analysis

The Weak Pound Isn’t Likely to Trigger an Inflationary Spiral

In our view, currency markets aren’t signalling economic disaster in the UK.

In recent days, a new narrative has risen amongst financial commentators we follow: Allegedly, the pound’s decline from $1.37 in mid-January to $1.23 at Monday’s close means global markets have lost confidence in the Bank of England and the UK economy in general, dooming the country to a vicious circle of a weakening currency and worsening inflation, not to mention sagging economic growth.[i] Now, as we will discuss shortly, we do think the weak pound likely contributes to inflationary pressures, but we think the broader warnings probably go too far. We think taking a look at currency markets globally can help put things in perspective and show why we don’t think the pound’s slide is automatically a bad sign for UK stocks.

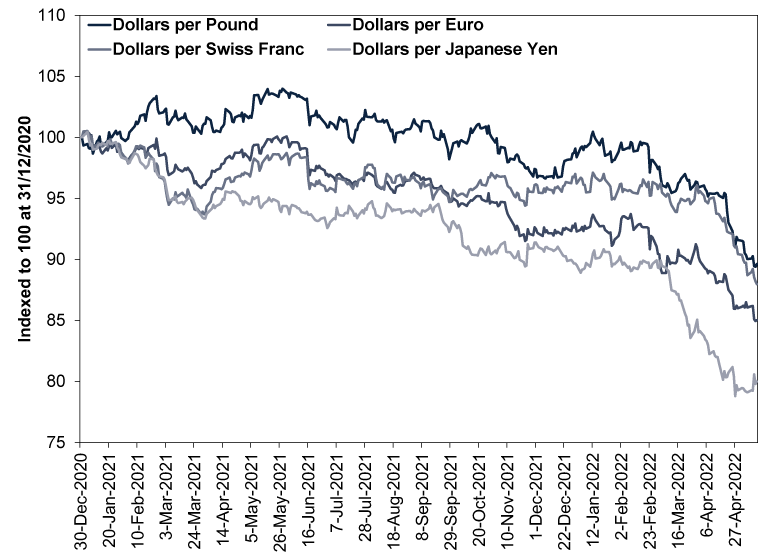

If the pound were the only major currency sliding right now, we would be open to the argument that it is saying something unique about the UK economy. But as Exhibit 1 shows, it isn’t so much that the pound is weak, but rather that the US dollar is strong. The euro, Swiss franc and Japanese yen have all weakened relative to the dollar since 2021 began, and all have endured an escalating slide this year. Over the entire period, the pound has actually weakened less than these other currencies.

Exhibit 1: A Look at Major Global Currencies Versus the Dollar

Source: FactSet, as of 17/5/2022. British pounds, euros, Swiss francs and Japanese yen per dollar, spot rates, 31/12/2020 – 16/5/2022. Indexed to 100 at 31/12/2020. Please see the Annex at the end of this article for a longer look at these data.

In our view, it isn’t surprising that the dollar has strengthened. Throughout modern market history, we have observed that the dollar tends to strengthen when investors perceive economic and market trouble. We think this period qualifies, and not just because global stocks have had a rough year.[ii] Rising long-term interest rates, monetary policy institutions’ interest rate hikes, high inflation in North America and Europe, the war in Ukraine and China’s latest COVID restrictions have all spurred commentators we follow to warn of big economic trouble. Investor sentiment surveys on both sides of the Atlantic show fear and pessimism are dominant.[iii] When fear reigns, we have found it tends to spark what financial professionals call a flight to quality—a mass flight to assets perceived as stable stores of value. The US has the world’s deepest, most liquid capital markets, making it the only currency capable of sopping up high global demand when a crisis threatens.[iv] Hence, our research shows money flocks there, driving the dollar higher. It is usually temporary, with other currencies recovering as the crisis-like mentality eases. That suggests to us the pound likely isn’t trapped in a vicious circle.

With that said, and as we mentioned at the outset, we do agree the weaker pound likely adds to inflationary pressures. The UK imports a range of consumer goods as well as resources and intermediate parts. When the pound is weak, if exporting nations with stronger currencies don’t cut their prices, then imports cost more—it takes more sterling to buy goods denominated in those currencies. Economists often call this importing inflation. Yet we caution against overstating the effect. For one, imports of goods represented less than one-fourth of total national expenditure last year, which limits the pound’s influence on prices. Two, currencies trade in pairs, and the UK has dozens of trading partners. The pound may have weakened almost 10% against the dollar this year, but it is basically flat relative to the euro, up relative to the yen and down just a bit versus the Chinese yuan.[v] Note, too, that the last time the pound weakened near present levels versus the dollar—in 2016, in the run up to and aftermath of the Brexit vote—inflation didn’t soar.[vi] The Consumer Price Index (CPI) inflation rate rose 0.7% in 2016 and 2.7% in 2017—even as the pound strengthened significantly—with both figures below the Bank of England’s 3.0% annual limit.[vii] Gross domestic product growth exceeded 2.0% in both years.[viii] As for today, whilst the CPI inflation rate just hit 9.0% y/y in April, based on our interpretation of the report, that stemmed primarily from the energy price cap increasing—not the weak pound.[ix]

As for UK stocks, our research shows currencies and stock markets have no set relationship. UK stocks have historically done fine alongside both a weak and strong pound—and the pound has been strong during some rough patches for UK stocks and weak during others.[x] For Brits investing internationally, the pound’s weakening relative to the dollar has actually helped cushion global markets’ decline this year. US stocks, which are nearly 70% of the MSCI World Index’s market value, are down more than the MSCI World when measured in dollars this year. But because the dollar has strengthened, Brits get to add the dollar’s appreciation to their return on US stocks. Hence, whilst the MSCI World Index is currently down -16.1% in dollars year to date, it is down just -7.2% in sterling. Still down, but by less than half the amount in dollars—a silver lining, in our view. Granted, this effect reverses when the pound strengthens, and our research has found the long-term impact is roughly zero sum, but we doubt that negates the emotional benefits of milder declines in the here and now.

In our view, the chatter about the pound is primarily indicative of sentiment—if commentators are touting dismal domestic reasons for the pound to be lower and ignoring that other currencies have fallen similarly, we think it speaks to their pessimistic view of the UK economy. That suggests to us that expectations are very low, and our research shows stocks move on the gap between reality and expectations over the next 3 – 30 months or so. Today’s pessimism sets the bar quite low, which likely makes positive surprise much easier to achieve. Even mediocre results would likely qualify as a relief, at this point, given the volume of recession forecasts we have seen. We can’t predict when this year’s negativity will end, but whenever it does, we think there is likely plenty of fuel to drive UK and global stocks higher.

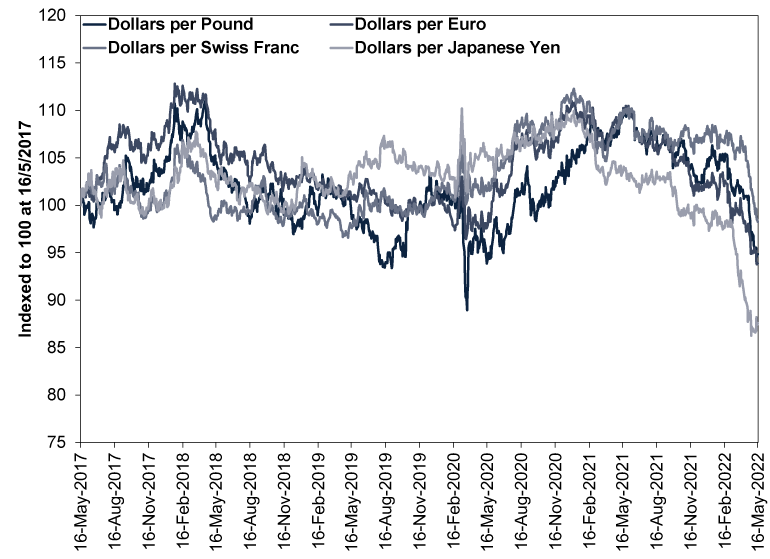

Annex: A Longer Look at Major Global Currencies Versus the Dollar

Source: FactSet, as of 17/5/2022. British pounds, euros, Swiss francs and Japanese yen per dollar, spot rates, 16/5/2017 – 16/5/2022. Indexed to 100 at 16/5/2017.

[i] Source: FactSet, as of 17/5/2022. US dollars per British pound, 13/1/2022 – 16/5/2022.

[ii] Ibid. Statement based on MSCI World Index return in GBP with net dividends, 31/12/2021 – 16/5/2022.

[iii] Source: FactSet, American Association of Individual Investors and GfK, as of 17/5/2022.

[iv] Source: IMF, as of 17/5/2022. Statement based on the size of developed nations’ sovereign debt markets.

[v] Source: FactSet, as of 17/5/2022.

[vi] Ibid.

[vii] Ibid. The Consumer Price Index is a government-produced measure of goods and services prices across the broad economy.

[viii] Ibid. Gross domestic product is a government-produced measure of economic output.

[ix] Source: Office for National Statistics, as of 18/5/2022.

[x] Source: FactSet, as of 17/5/2022. Statement based on the Bank of England’s effective exchange rate index and MSCI UK IMI returns with net dividends in GBP.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.