Personal Wealth Management / Market Analysis

An End-of-Summer Sentiment Check-In

We find sentiment globally is hitting pessimistic extremes.

Unquestionably, 2022 has been a trying year, with headlines in financial publications we follow touting everything from inflation to energy prices, potentially looming rate hikes, the Ukraine war and more. Worldwide, stocks have been weak.[i] In US dollars, global stocks are in a bear market—a typically long decline exceeding -20% from a high.[ii] Given that backdrop, we think a fair amount of investor disappointment and frustration is understandable. But, although it can be hard to appreciate in the moment, our historical research shows bull markets (broadly rising stocks) are born on pessimism—and, as we will show, recent surveys suggest bearishness is at an extreme. This doesn’t pinpoint when an upturn will begin or whether it is already underway—nothing does—but we see widespread pessimism as a reason for optimism.

Bank of America’s (BofA) global fund manager survey, widely watched amongst commentators we follow, showed broad bearishness in September.[iii] The latest reading indicated a record share of respondents have cut equity holdings.[iv] Now, records start in 2002, so it isn’t an especially long history, in our view, but it does include 2007 – 2009’s bear market and early-2020’s brief downturn for comparison. Similarly, 62% of managers have raised cash holdings—a reading that has never been above 60% in two decades.[v] Also notable: 72% expect the global economy to weaken in the next year, with 68% seeing recession—broadly weak economic conditions—likely.[vi] Both rates are near all-time highs, exceeded by only March 2009 and April 2020.[vii] The earnings outlook is even glummer with 92% expecting declining profits.[viii]

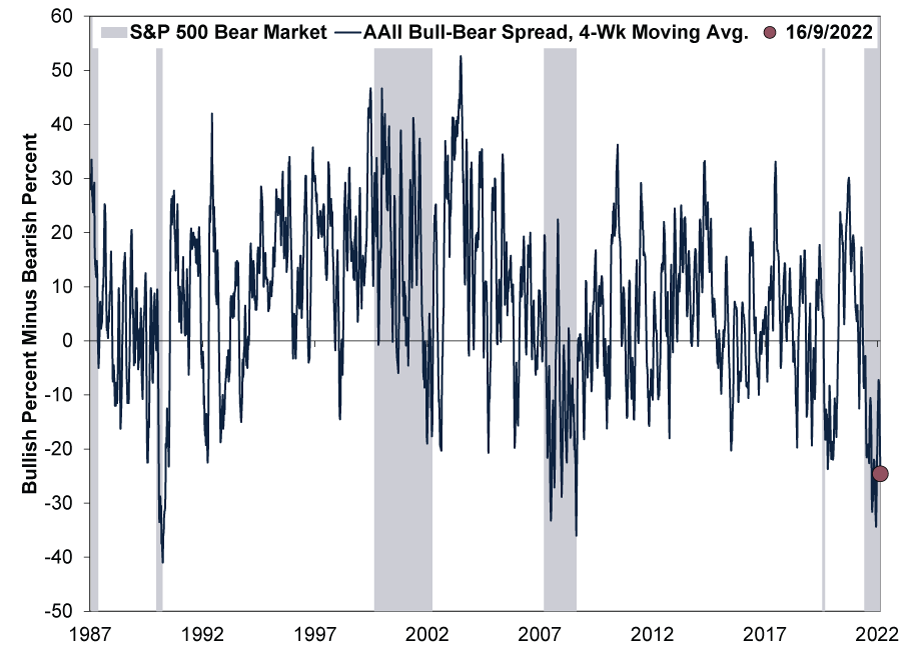

BofA’s survey reflects professional investors’ attitudes—what large money managers are thinking and (presumably) doing. But the American Association of Individual Investors’ (AAII) polling suggests to us individual investor sentiment is similar, at least in the US.[ix] AAII surveys its members weekly about their outlook: positive (bullish), negative (bearish) or neutral. Combining them, AAII subtracts the bearish from the bullish, resulting in its net bull-bear percentage. This can be very noisy week to week, so to smooth it out a bit, Exhibit 1 shows the rolling four-week average. Although off its summer trough that coincided with the S&P 500’s 16 June year-to-date low in US dollars, it remains below nearly all points in its 35-year history.[x] Whilst it isn’t so surprising individual investors are feeling dour, we think the extent is rather remarkable.

Exhibit 1: American Individual Investors Remain Remarkably Bearish

Source: FactSet, as of 19/9/2022. AAII Bull-Bear Market Spread, 31/7/1987 – 16/9/2022. Bear market dating based on the S&P 500 price index in US dollars. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.

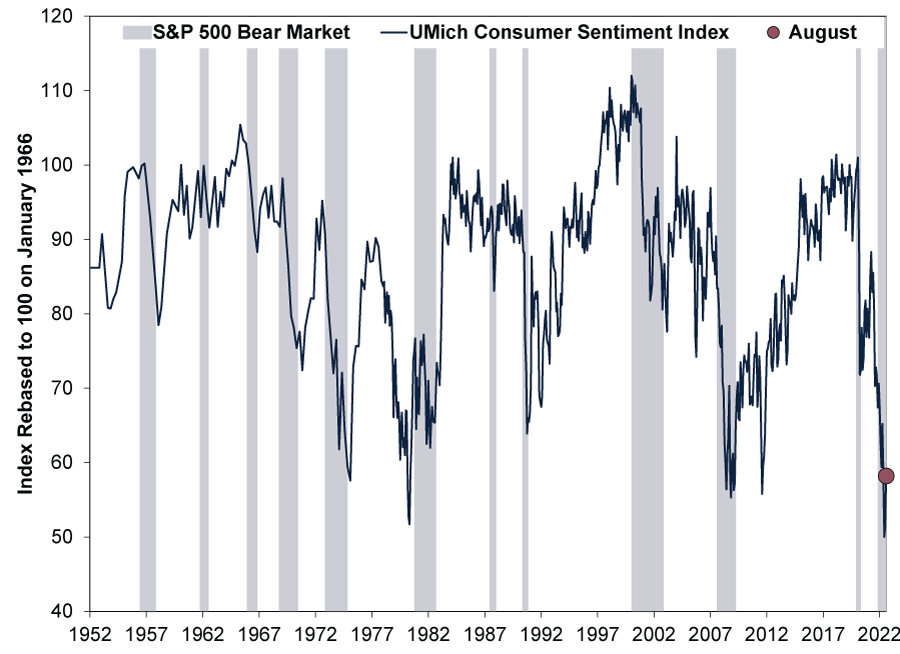

For a longer-term look at how pessimistic people are, we can also check in on American consumers’ feelings, broadening sentiment perspectives beyond investors. As Exhibit 2 shows, through its seven-decade history, the University of Michigan’s (UMich) Consumer Sentiment Index hit an all-time low in June, around the time national average US petrol prices hit a record high $5.02 per gallon (£1.17 per litre).[xi] With US dollar prices at $3.68 per gallon (£0.85 per litre) currently, it appears pump prices’ drop has provided some relief. But American consumer sentiment under 60 is still extremely low historically. From stocks to the economy, long-running surveys—through myriad market cycles—suggest folks feel about the worst they have ever been, according to these data.

Exhibit 2: US Consumer Sentiment About as Pessimistic as It Gets

Source: FactSet, as of 19/9/2022. UMich Consumer Sentiment Index, January 1952 – August 2022. Bear market dating based on the S&P 500 price index in US dollars. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.

It isn’t just true in America, either. Take Germany’s ZEW Economic Expectations Index as an example.[xii] Over the past 30 years, the outlook for the German economy has rarely been as bad as economists saw this past August. The only times worse: 2008’s global financial crisis and in 1992, when hot inflation led the Bundesbank to jack up rates. And, of course, inflation pressure and other factors have weighed on UK consumer confidence too. Last week, YouGov’s UK consumer confidence index fell into negative territory for the first time since the COVID lockdowns in June 2020.[xiii]

Yet when investors, consumers and economists’ moods alike are plumbing depths not seen in decades—if ever—we find it helps set the stage for a market recovery. It isn’t a precise timing tool, of course. Nothing is—short-term moves are unpredictable, in our experience. But we think seemingly near-universal bearishness does set the stage for expectations undershooting reality to a great degree. When it appears most everyone expects the worst, it is probably priced in to a large extent, in our view. Based on our analysis, if the worst happens, stocks can move on. And if expected worst-case scenarios don’t occur? Typically, we have found the positive surprise is likely to drive stocks higher.

[i] Source: FactSet, as of 20/9/2022. Statement based on MSCI World Index returns with net dividends, 31/12/2021 – 19/9/2022.

[ii] Ibid. Statement based on MSCI World Index returns with net dividends, 4/1/2022 – 19/9/2022. Presented in US dollars. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.

[iii] “BofA Survey Shows Investors Fleeing Equities En Masse on Fear of Recession,” Sagarika Jaisinghani, Bloomberg, 13/9/2022. Accessed via Yahoo!

[iv] Ibid.

[v] Ibid.

[vi] “Portfolio Managers Are ‘Super Bearish’ With Cash Holdings Highest Since 9/11, Bank of America Says,” Barbara Kollmeyer, MarketWatch, 13/9/2022. Accessed via MSN.

[vii] Ibid.

[viii] Ibid.

[ix] “AAII Sentiment Survey: Pessimism Pulls Back While Optimism Rebounds,” Staff, AAII, 15/9/2022.

[x] Source: FactSet, as of 19/9/2022. Statement based on S&P 500 total returns in US dollars. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.

[xi] Source: American Automobile Association, as of 19/9/2022.

[xii] ZEW stands for Zentrum für Europäische Wirtschaftsforschung, which if you are wondering means Centre for European Economic Research.

[xiii] “Overall Consumer Confidence Is Negative for the First Time Since May 2020,” Christien Pheby, YouGov, 16/9/2022.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.