Personal Wealth Management / Economics

Supply Chains in the Spotlight

We find more and more signs that supply chain pressures are easing.

With all that is going on in the world this week, it might seem trivial to zero in on one cog in the global economy. Yet even little nuggets of falling uncertainty can matter, and there is one that we don’t think investors should overlook: Even as recession (broad extended economic contraction) chatter mounts, we find global supply chain pressures are easing. Whilst they aren’t fast inflation’s only cause, they have been a contributing factor, in our view, due primarily to dislocations from lockdowns and reopening. But in recent weeks, things appear to us to have started settling down a bit, albeit to little fanfare from financial outlets we follow, which we think likely helps gradually ease one of the key uncertainties in this year’s plethora of alleged risks.

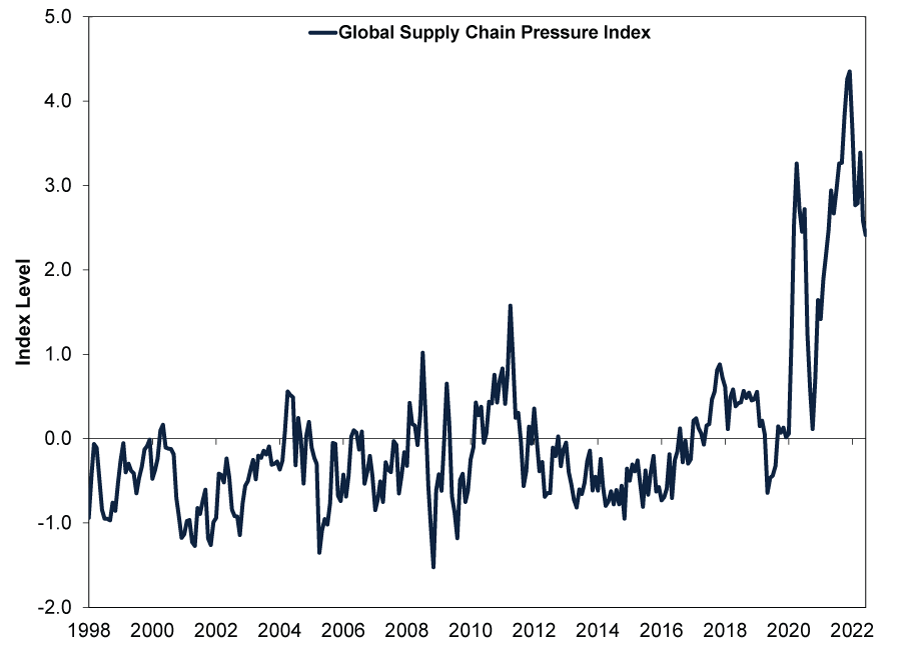

Consider Exhibit 1. Since we featured the New York Fed’s Global Supply Chain Pressure Index (GSCPI) last month, it has fallen further. The GSCPI mashes together various global shipping and transportation costs plus other supply chain indicators including delivery times, backlogs and inventory levels. June’s reading was still elevated relative to the index’s history, but it was noticeably down from December’s peak. This doesn’t mean disruptions won’t flare again—see 2021 after 2020’s spike—but absent further severe lockdowns (like China’s) affecting global supply chains, we think companies appear to be working through bottlenecks.

Exhibit 1: Global Supply Chain Pressures Elevated, but Easing

Source: Federal Reserve Bank of New York, as of 7/7/2022. Global Supply Chain Pressure Index, January 1998 – June 2022.

That may not be exactly attention grabbing when far more colourful headlines abound, but this is what we find so interesting: When headlines ignore or dismiss good news, in our experience, it is evidence of pervasive negative sentiment—what we call the “pessimism of disbelief”—which we find typically surrounds bear market (typically prolonged, fundamentally driven declines exceeding -20%) troughs. Not that we are trying to pinpoint the low of this downturn, in which global stocks have breached -20% when measured in US dollars, as we think doing so is impossible, but we find the sentiment noteworthy all the same.[i] In our view, it is what helps lay the groundwork for recovery as it makes positive surprise easier to attain.

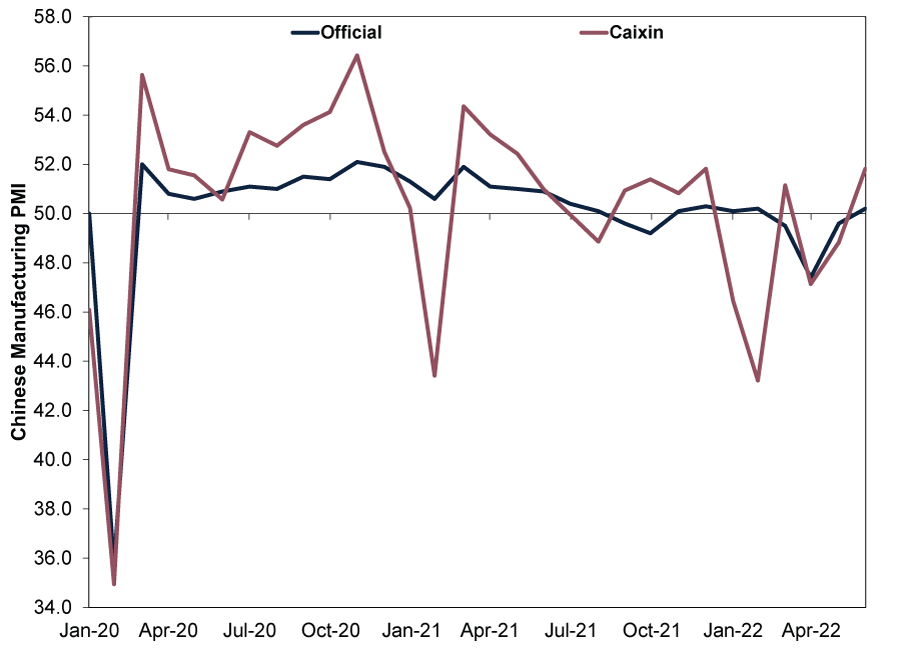

Speaking of Chinese lockdowns, which jammed up production globally—depleting inventories, emptying shelves and spiking prices for the available supply left—they are lifting.[ii] As broadly expected amongst commentators we follow, China’s reopening enabled more economic activity there, which appears likely to ripple globally. (Exhibit 2) The official manufacturing purchasing managers’ index (PMI) from the National Bureau of Statistics (NBS) climbed above 50—the dividing line between expansion and contraction—in June after being in contraction since March as COVID lockdowns shuttered major manufacturing regions.[iii] Whilst the NBS measure covers more large, state-owned enterprises, the Caixin PMI includes smaller, private-sector firms.[iv] It jumped higher into expansionary territory.

Exhibit 2: Chinese Manufacturing PMIs Expanding Again

Source: FactSet, as of 1/7/2022. China’s official and Caixin manufacturing PMIs, January 2020 – June 2022.

Many commentators we follow argue the reopening bounce will fade, and perhaps it will—we have found after the quick catch-up phase, growth usually reverts to pre-pandemic trends. But even those conditions augur well for the flow of goods globally, in our view. According to Caixin: “The return to more normal business conditions also helped to alleviate pressure on supply chains, as highlighted by a broad stabilisation of vendor performance in June. Notably, this ended a 24-month period of lengthening delivery times for inputs. ... Companies were generally upbeat in their forecasts as they anticipated further increases in production as the pandemic recedes and further improvements in client demand.”[v] With ports there also reopening and working through backlogs, this higher output will probably make its way to stores and factories worldwide.[vi]

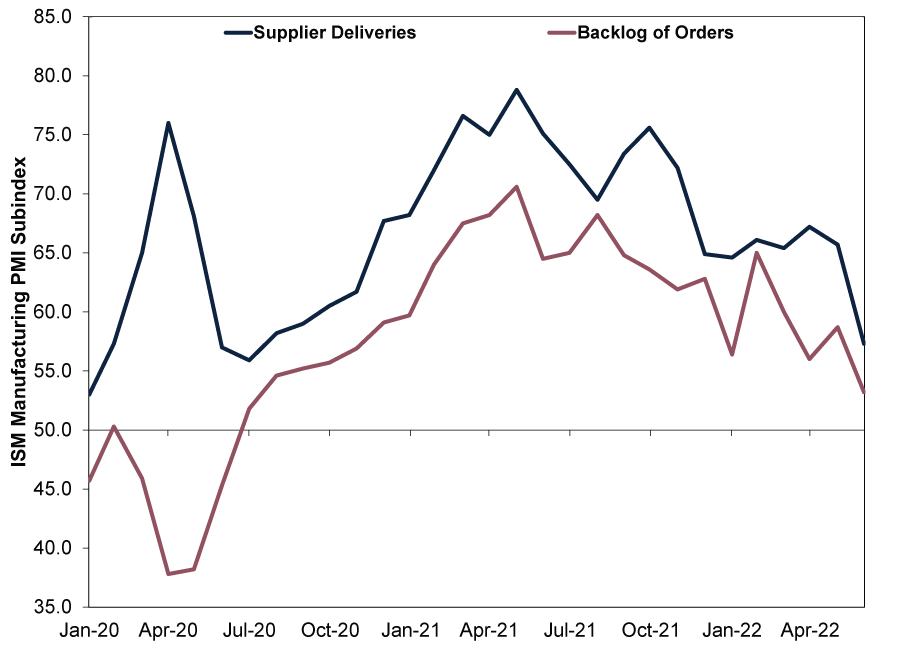

We also see evidence of supply chain improvement in the US. After hitting multi-decade highs last year, the Institute for Supply Management’s (ISM) manufacturing PMI subindex for supplier delivery times is getting back to normal. (Exhibit 3) So are order backlogs after 2021’s record highs.

Exhibit 3: US Supplier Delivery Times and Order Backlogs Falling

Source: FactSet, as of 1/7/2022. ISM manufacturing PMI supplier deliveries and backlog of orders subindexes, January 2020 – June 2022.

Now, these data are open to interpretation. Without context, they could signal weaker demand. So helpfully, ISM asks firms for extra colour. As the report notes regarding deliveries: “The index continues to reflect suppliers’ difficulties in meeting demand from panelists’ companies, but there are clear signs of easing. ... Transportation networks reflected improvement compared to May.”[vii] Then on backlogs: “Backlogs expanded in June at a slower rate, as output remains stable at relatively low levels and new orders have slowed due to excessive lead times and historically high prices.”[viii] To us, the responses suggest as bottlenecks clear—and costs come down—new orders are likely to resume. Whilst demand has seemingly paused amidst supply constraints, we don’t think it appears to have been destroyed.

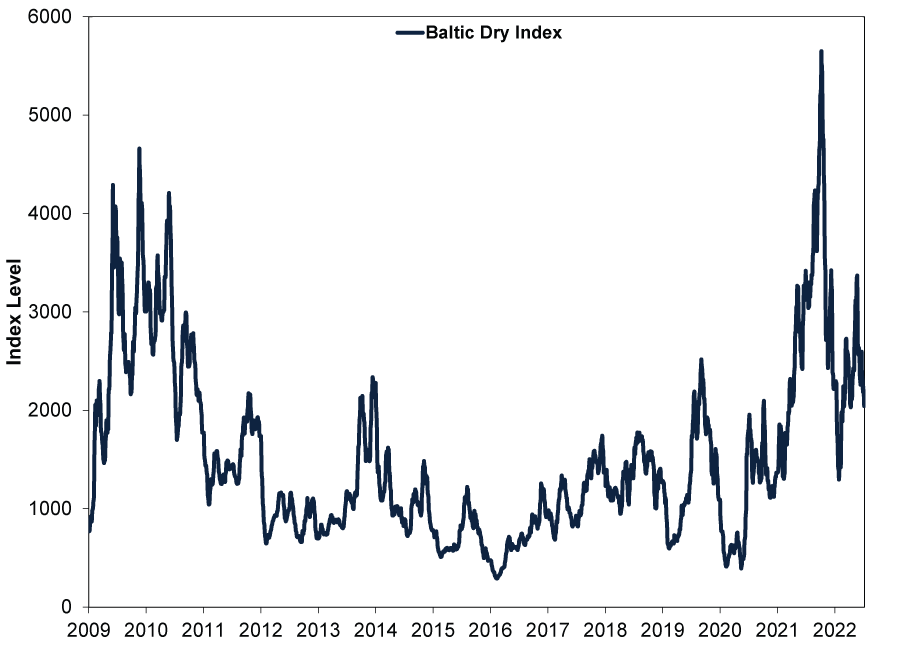

To see how transportation networks have improved and how new orders could pick up once costs come down, look at shipping prices. The Baltic Dry Index (BDI)—which to come full circle, Exhibit 1’s GSCPI incorporates—measures transport costs for bulk goods (think coal and steel). The BDI is down -38% from its year-to-date high on 23 May and is about a third of its October 2021 peak. (Exhibit 4) Unsnarling ports and booking ships still isn’t easy, but it isn’t prohibitive, either.[ix] Costs to ship goods are around where they were after 2007 – 2009’s recession, and they didn’t prevent recovery then.[x]

Exhibit 4: Transport Costs Climb Down

Source: FactSet, as of 8/7/2022. Baltic Dry Index, 1/1/2009 – 7/7/2022.

Despite clear signs we see of substantial improvement in global supply chains, headlines we follow don’t seem to acknowledge it. In our view, this is the pessimism of disbelief at work. But we think it is also when the potential for positive surprise is highest—and stocks generally start to recover, whilst most least expect it.

[i] Source: FactSet, as of 8/7/2022. Statement based on MSCI World Index return in USD with net dividends, 3/1/2022 – 7/7/2022. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.

[ii] “These Charts Show the State of the Global Supply Chain as China Eases Covid Lockdowns,” Lori Ann LaRocco, CNBC, 6/6/2022.

[iii] “China’s Covid Lockdowns Set to Further Disrupt Global Supply Chains,” Keith Bradsher, The New York Times, 15/3/2022. Accessed via the Internet Archive.

[iv] “China’s June Factory Activity Expands at Fastest Pace in 13 Months - Caixin PMI,” Staff, Reuters, 30/6/2022. Accessed via Yahoo!

[v] Source: S&P Global/Caixin, as of 1/7/2022. Caixin China General Manufacturing PMI, June 2022.

[vi] See note ii.

[vii] Source: ISM, as of 1/7/2022. Manufacturing PMI Report on Business, June 2022.

[viii] Ibid.

[ix] “Railroad Bottleneck at Nation’s Busiest West Coast Ports Reaches Inflection Point,” Lori Ann LaRocco, CNBC, 8/7/2022.

[x] Source: IMF, as of 8/7/2022. Statement based on global GDP, 2009 – 2010.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.