Personal Wealth Management / Economics

How Bleak March Data Can Help Markets Anticipate the Future

Worldwide data are weak, which we think helps shape sentiment towards the immediate future.

Back on 24 March, we pointed out the steep drops in IHS Markit’s March preliminary purchasing managers’ indexes (PMIs, surveys tallying the percentage of companies reporting an increase in business activity) as early signs of the economic fallout from society’s COVID-19 response (e.g., social distancing requirements and business closures). Last Friday, the more detailed, final figures emerged—and we think it is fair to say they were even uglier, with numbers worse than the flash readings across the board.[i] When we covered the preliminary gauges, we noted the importance of remembering equity markets have historically tended to move before the economy—and this, of course, remains a crucial point now, in our view. But we think the broad reaction to the final figures also illustrates how equity prices can incorporate widely expected data before the results are released, a point we think is worth considering.

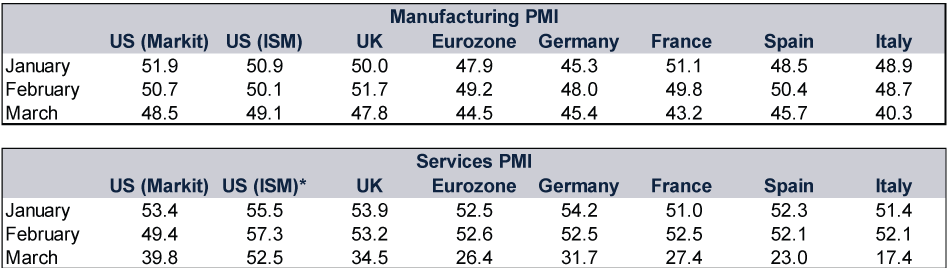

Final PMIs are just a more complete look at the data that underpin Markit Economics’ preliminary version, including more granular looks at individual countries. Hence, we can now see the stark influence of Italy’s lockdown—and how hard-hit Spain has been. But we also now have the Institute for Supply Management’s (ISM) US PMI, offering a second look at America. Exhibit 1 shows the final PMIs across a range of major Western nations over the past three months. In all these cases, according to the surveys’ methodology, readings below 50 mean more firms reported contracting activity than expanding (and vice versa).

Exhibit 1: Major Manufacturing and Services PMIs

Source: FactSet, as of 3/4/2020. *ISM’s gauge doesn’t directly compare to the others, as it is a non-manufacturing index including industries the others don’t cover, including mining and oil drilling.

Virtually all the final gauges, especially in European services PMIs, were down from the preliminary—to say nothing of the massive declines from February.[ii] The services gauges are particularly stark. Considering that most major economies are predominantly services-based, this does not bode well for output.[iii] Italian services’ 35-point plunge to an astounding 17.4 reading is the most extreme example, but Spain, France and Germany posted similar drops.

As we noted in our prior coverate, the manufacturing gauges seem inflated by one component—supplier delivery lag times. In ordinary times, these would signal strong demand that suppliers couldn’t keep up with—a positive. But these are not normal times, and those gauges’ big positive contributions are a likely negative in disguise, as they indicate the severe supply disruptions caused by social distancing protocols. That factor also underpins ISM’s relatively lofty US manufacturing and non-manufacturing readings. The supplier delivery components of these two read 65 and 62.1, respectively. A 55-reading in order backlogs also inflated the non-manufacturing gauge. We suspect temporary closures and other business interruptions explain it, not a surge in demand.

Now, because the US is a few weeks behind Europe in seeing the full effects of COVID-19 and the related closures, it is highly likely the relative strength in America’s PMIs versus continental Europe’s will fade in April’s data. Based on our experience analysing economic data, we think market participants are highly likely to base their expectations off these European data, using them to conjure a loose range around a consensus estimate that also accounts for how the situation evolves in America. They will probably extrapolate them to conjure estimates for other things—like analysts at Markit did on Friday in noting that eurozone PMI readings translate to a -10% annualised GDP decline.[iv]

Now, we don’t think those output extrapolations are necessarily correct, mind you. PMIs measure only growth’s breadth, and gross domestic product (GDP) is a government-produced measure of the magnitude of economic output. But that isn’t the point. Rather, we think these opinions, views and studies help forge the investing public’s view of what data will look like. Market participants act on these views in real time—we think that is how markets can effectively anticipate economic conditions before any data even hint at them.

To think forward, we believe one must think like markets. Upcoming data are likely to be bad, if not very bad. But by the time they come, we think markets will likely have weighed that view, underpinned by early hints like Friday’s PMI readings. Eventually, and perhaps it has already happened, those expectations will be worse than a less-bad-than-expected reality that follows. According to our research and study of past market turning points, that is a key part of the formula for a new bull market to begin.

[i] Source: IHS Markit, as of 3/4/2020.

[ii] Ibid.

[iii] Source: Organisation for Economic Co-operation and Development, as of 3/4/2020. Statement based on gross domestic product by industry.

[iv] See Note i.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments UK has developed several informational and educational guides tackling a variety of investing topics.