Personal Wealth Management / Economics

Few Shocks in Recent Global Economic Data

A roundup of recent global economic data shows few surprises.

From the US Leading Economic Index (LEI) to flash purchasing managers’ indexes (PMIs) globally, we find recent economic data largely show existing trends continuing in early 2024. Here we will round up some of the latest releases and give a quick take on each.

The US LEI Flips Positive, Takeaways Still Few and Far Between

First up, The Conference Board’s LEI—an index comprising 10 indicators designed to anticipate shifts in economic growth—turned positive in February for the first time since December 2021, ticking up 0.1% m/m.[i] But before you huzzah and celebrate, let us consider: This comes after a two-year decline that didn’t presage recession (widespread economic contraction), largely because the LEI overrates manufacturing, around 10% of US gross domestic product (GDP) by value added.[ii] Perhaps recognising this extended run of faulty readings, The Conference Board said it didn’t project a recession would result from its gauge last month.[iii] Still, we observed the long downtrend caught many headlines in publications we follow, likely adding to recession alarms.

But now we have an uptick, with 7 of 10 components contributing.[iv] The factors shifting the trend: three manufacturing components (hours worked and two measures of new orders), building permits, jobless claims, an index of lending conditions called the Leading Credit Index (LCI) and stocks.[v] In our view, though, only new orders, the LCI and stocks are forward looking—for the economy, not markets—and manufacturing new orders cover only a small slice of it.[vi] Meanwhile, credit conditions have been easing since Q3 2023, based on the US Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices—one of the LCI’s components.[vii] That isn’t breaking news, in our view. Furthermore, and beyond the faulty downtrend before, this is just one monthly read: The six-month trend, which The Conference Board looks to as more telling, is still negative.[viii] At most, if the LEI keeps rising, we suspect it could help warm sentiment, but that is about it.

Is US Housing’s Big Chill Melting?

Elsewhere in America, existing home sales bounced 9.5% y/y in February.[ix] As widely reported, this was as 30-year fixed mortgage rates fell slightly, from over 7% to just under.[x] Sales may be thawing, as people still need to move—inventories rose 10.3% y/y—helping satisfy pent-up demand.[xi] But sales levels remain historically low, in the range of 2008’s trough following the housing bust.[xii] The difference between now and then: Supply is still tight, with months of supply (how long inventories can last at current sales rates) at 2.9, hovering near record lows.[xiii] Hence, prices rose another 5.7% y/y.[xiv]

Contrast that with months’ supply for new homes at 8.4—at the upper end of its historical range.[xv] With elevated mortgage rates continuing to lock up existing home inventories, new home construction has become a bigger driver in meeting housing demand.[xvi] Whilst it isn’t huge, new construction is the lifeblood of residential investment, the primary way real estate contributes to economic growth.[xvii] So we find ongoing bottlenecks in existing home supply, which contributed to prices’ February jump, are a boon for builders—and likely give a small boost to GDP from here. Now, data did show new home sales fell -0.3% m/m in February, but the trend is still up longer term.[xviii]

Flash PMIs Are Still Muddling Through

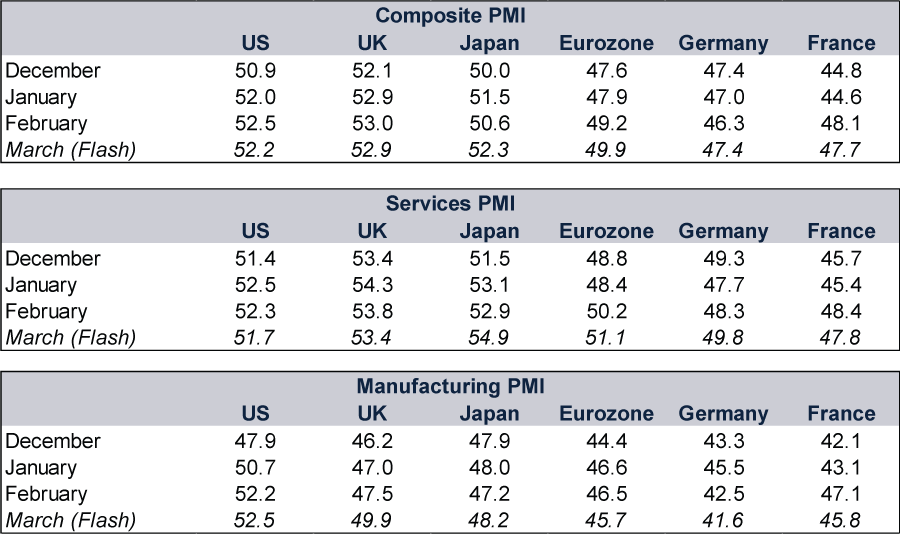

Looking globally, the latest flash PMIs—surveys measuring the breadth of growth—continue to be mixed. As Exhibit 1 shows, preliminary March PMI readings indicate business activity in the US, UK and Japan expanding overall, led by their services sectors. This contrasts with France and Germany—the eurozone’s two largest economies—where PMIs are below 50 (implying contraction) across the board.[xix] However, even with Germany and France still contractionary, the composite PMI for the eurozone as a whole is just a tick below 50, with the Continent’s dominant services sector expansionary for the second straight month.[xx] Note, too, that PMIs have been improving before any monetary authorities cut interest rates, which we think speaks to the global economy’s resilience—and widespread misperception cuts are necessary to either avoid recession or extend growth.[xxi]

Exhibit 1: Major Economy PMIs

Source: FactSet and S&P Global, as of 21/3/2024. Flash PMIs are preliminary estimates based on 85% – 90% of responses.

Japan’s Illusory Export Jump

Japan’s February exports rose 7.8% y/y, beating expectations, though they decelerated from January’s 11.9%.[xxii] Headlines we read touted this as the third straight month of growth with gains in all major trading partners (US, EU, China) and in diverse sectors—autos, semiconductor manufacturing and tourism. But hold on. This is all valued in yen, which has weakened -9.0% over the last year against the dollar, flattering export gains.[xxiii] On a volume basis, which strips the yen’s swings out, exports fell -1.6% y/y in February, partially reversing the prior two months’ growth.[xxiv] With optimism toward Japan rising in financial publications we cover—due partly to improving headline trade data—we think this is worth keeping an eye on.

Don’t Overthink Slowing UK Inflation

Lastly, the UK Consumer Price Index (CPI) decelerated to 3.4% y/y from 4.0%—its slowest in two and a half years—as inflation (increasing prices economy-wide) continues to subside globally, even in heretofore stubborn areas.[xxv] Improvement was broad-based, with even supposedly slow-to-improve services inflation falling to 6.1% y/y from 6.5%.[xxvi] This doesn’t seem to be inspiring much cheer amongst commentators we follow, though: Whilst easing prices undercut their warnings over faster inflation, the UK’s National Living Wage is set to rise 9.8% in April, rekindling them.[xxvii] But that isn’t how inflation works, in our view: Wages tend to follow inflation—they don’t lead or drive it. To us, this alarm over a false factor—painting rising wages as negative—shows sentiment is still sceptical, which likely helps reality top expectations.

Overall, in our view, the last week in data doesn’t reveal much new or surprising information for markets. We think the existing trends prevailing at yearend mostly seem to remain—and form a benign backdrop for stocks.

[i] Source: The Conference Board, as of 21/3/2024.

[ii] Source: US Bureau of Economic Analysis (BEA), as of 22/3/2024. GDP is a government-produced measure of economic activity.

[iii] “Leading Economic Index No Longer Signals US Recession -Conference Board,” Staff, Reuters, 20/2/2024. Accessed via Yahoo!

[iv] See note i.

[v] Ibid.

[vi] See note ii.

[vii] Source: Federal Reserve Bank of St. Louis, as of 25/3/2024.

[viii] See note i.

[ix] Source: NAR, as of 21/3/2024.

[x] “February Home Sales Spike 9.5%, the Largest Monthly Gain in a Year, as Supply Improves,” Diana Olick, CNBC, 21/3/2024.

[xi] Source: FactSet, as of 25/3/2024.

[xii] Ibid.

[xiii] Ibid.

[xiv] See note x.

[xv] Source: Federal Reserve Bank of St. Louis, as of 25/3/2024.

[xvi] “NAHB: Builder Confidence Increased in March,” Bill McBride, Calculated Risk, 18/3/2024.

[xvii] Source: BEA, as of 22/3/2024.

[xviii] Source: FactSet, as of 25/3/2024.

[xix] Source: FactSet, as of 25/3/2024. Statement based on German and French GDP.

[xx] Source: ECB, as of 26/3/2024. Statement based on eurozone services’ share of GDP.

[xxi] Source: Bank of England, ECB, US Federal Reserve and Bank of Japan, as of 26/3/2024. Statement based on monetary policy institutions’ monetary policy.

[xxii] Source: FactSet, as of 22/3/2024.

[xxiii] Ibid.

[xxiv] Ibid.

[xxv] Source: ONS, as of 20/3/2024.

[xxvi] Ibid.

[xxvii] Source: GOV.UK, as of 22/3/2024.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments UK has developed several informational and educational guides tackling a variety of investing topics.