Personal Wealth Management / Market Analysis

A Singular Lesson From Last Year’s Oil Price Cap

Don’t overrate the impact of high-profile variables on complex global markets.

In December 2022, the G7 implemented a price cap on Russian oil. Pundits viewed the measure as a global oil supply headwind—and another challenge for energy markets—in an already tough year. Fast forward to today, and those feared supply shortfalls didn’t manifest. In our view, this is a reminder not to overrate a single variable’s impact on supply and demand—reality is often more complex.

Rewind to 2022’s start, when global crude oil prices were at $77.24 a barrel.[i] By the eve of Russia’s invasion of Ukraine, prices had risen to $99.29 a barrel (partly on war fear)—spiking to as high as $133.18 on March 8 after fighting started. At the time, many feared the war would prompt Western sanctions and corresponding Russian retaliation—hurting global supply and causing shortages.[ii] Oil prices slipped below $100 over the next month as supply held steady and worst-case projections didn’t come true.

But that steady supply annoyed Western leaders seeking to reduce the oil revenues that funded Russia’s war effort. So officials started mulling new ways to defund Moscow and zeroed in on a price cap, contributing to oil’s rebounding to $129.20 on June 8.[iii] Then, markets did what they normally do: They assessed the fundamental supply and demand landscape more rationally. In this case, as the talks dragged on, it became clear the price cap wouldn’t take Russian crude off the market and was mostly symbolic. By the time the cap of $60 per barrel took effect on December 5, crude was down to $83.36.[iv]

In our view, markets’ assessment proved correct. Though sanctions had some bite—Moscow’s oil and gas export revenue fell by nearly -40% y/y in January 2023—Russian supply didn’t leave the market.[v] A recent Bloomberg analysis found Russian oil revenues rebounded this year, and Western officials acknowledged the price cap wasn’t working well.[vi] One primary contributor: Russia’s “shadow” fleet (hard-to-trace ships) has evaded sanctions, selling to nations (e.g., China and India) that didn’t comply with Western restrictions. Take India, which has been one of the biggest buyers of Russian crude over the past two years. Indian refineries have ample supply to produce surplus diesel and sell it abroad—including to Europe.[vii]

These aren’t the only reasons global oil supply hasn’t tanked. Or even necessarily the main ones. Global production is a whole lot bigger than any country or group of countries. For example, Russia and other members of OPEC+ may have cut oil output, reportedly extending target cuts again—the cartel plans to make an additional 2.2 million barrels a day (bpd) in voluntary oil-supply cuts based on 2024 production targets from January 2024 through March. Yet American oil production currently tops Russian and Saudi, surging to an all-time high this year. The US produced 13.2 million barrels per day (mbpd) as of September 2023—up 7.4% y/y and higher than the 12.8 mbpd monthly average from January – August.[viii] Other non-OPEC nations also pumped more.

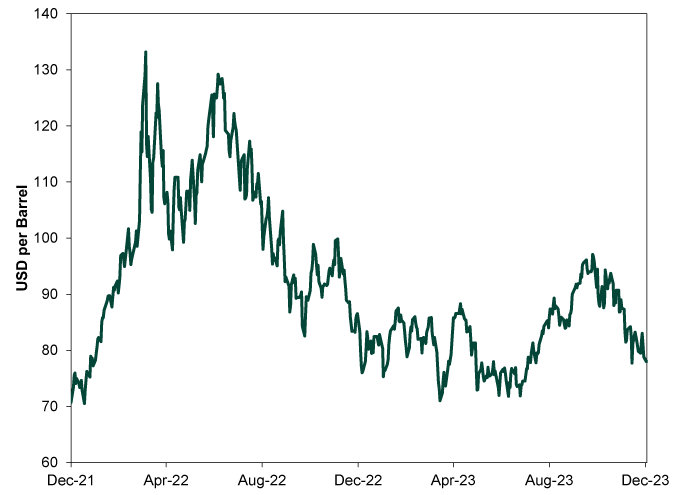

The upshot: Global oil supply and demand have been more balanced than feared this year. The EIA projects global liquid fuels production will total 101.54 mbpd in 2023 while global liquid fuels consumption is at 101.04 mbpd, both of which are up from 2022’s levels (99.99 mbpd and 99.16 mbpd, respectively).[ix] Hence, despite some bounciness, crude oil has remained range-bound in 2023. (Exhibit 1)

Exhibit 1: Global Crude Oil Prices, December 2021 – December 2023

Source: FactSet, as of 12/5/2023. Global Brent crude oil spot price, 12/3/2021 – 12/4/2023.

The key lesson here: Don’t overrate a single variable’s impact on a complex, global market. Issues like price caps and high-profile production cuts drive headlines. But do they fundamentally alter supply and demand—or merely shift the makeup of one, the other or both? In the case of oil, we think it is the latter. Sanctions may look strong on paper, but incentives are stronger. Russia had incentive to find workarounds. Non-participating countries had incentive to buy discounted crude from a pariah for their own benefit, whether that benefit was cheaper local energy, profits from reselling abroad or both. OPEC+ production target cuts look big, but when you consider the cartel has long struggled to meet its targets, the cuts start packing less punch. Cutting output also means surrendering some market share, which other producers are happy to gobble up—especially at today’s crude prices.

In our view, markets are simply too vast, complex and disorganized for any one single supply or demand input to rock the whole. That is worth keeping in mind whenever headlines fear (or cheer) a single variable as good or bad for the economy and markets.

[i] Source: FactSet, as of 12/5/2023. Brent crude oil price on 12/31/2021.

[ii] Ibid. Brent crude oil price on 2/23/2022 and 3/8/2022.

[iii] Ibid. Brent crude oil price on 4/11/2022 and 6/8/2022.

[iv] Ibid. Brent crude oil price on 12/5/2022.

[v] “Russia's Oil and Gas Revenues Fell Nearly 40% in Jan, IEA Says,” Kate Abnett, Reuters, 2/23/2023.

[vi] “Russian Figures Suggest Western Oil Sanctions Not Working,” Staff, Bloomberg, 11/16/2023.

[vii] “Europe Is Guzzling Diesel From India, a Key Buyer of Russian Oil,” Prejula Prem, Bloomberg, 11/27/2023.

[viii] Source: EIA, as of 12/5/2023.

[ix] Source: EIA, as of 12/5/2023. “Short-Term Energy Outlook,” as of 11/7/2023.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.