Personal Wealth Management / Market Analysis

Eurozone GDP: ‘Meh’ Tops Fears

Simply averting disaster qualifies as big positive surprise for stocks.

Here is the thing about stocks: They don’t need things to be perfect. Or great. Or even necessarily good. Sometimes, if expectations are low enough, “not disaster” does the trick. We think this has been a major stock market theme lately, with the MSCI World Index delivering a very fine January despite an onslaught of mixed economic data—and with Europe outperforming despite some headline results that, in a vacuum, could best be described as “meh.” The latest example? Q4 eurozone GDP, which slowed as two of the four largest economies contracted a bit. Not great, but not the worst-case crash everyone penciled in when energy costs spiked last year.

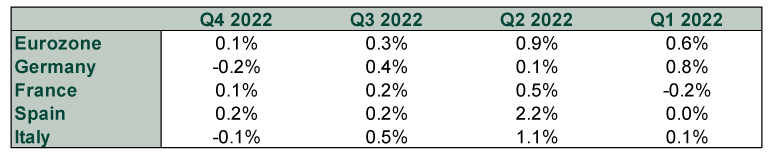

Exhibit 1 shows 2022’s quarterly GDP growth rates for the eurozone, Germany, France, Spain and Italy, all adjusted for inflation. As you will see, it is pretty fair to say things deteriorated as the year progressed.

Exhibit 1: Things Got Rough in the Eurozone

Source: FactSet, as of 1/31/2023. All figures are quarter-over-quarter, seasonally adjusted and inflation adjusted.

It is also fair to say most Q4 results didn’t exactly set the positive surprise board alight. In mid-January, Germany’s Federal Statistical Office estimated output was flat in Q4—it ended up contracting a bit on weak household consumption. Italy matched expectations, while France, Spain and the eurozone overall just barely beat.

Yet when we refer to reality beating expectations as being bullish, we aren’t talking solely about professional forecasters’ consensus estimates. Those are but one ingredient in the broader morass of investor sentiment. And not even necessarily the most important one. Economists’ expectations are sort of a niche indicator—not the sort of grandiose warnings and opinions that hog most headlines. Those headlines are important, as they both influence and reflect investor sentiment.

Last spring, summer and early autumn, the vast majority of European economic headlines projected sheer doom starting in Q4. Analysts and commentators extrapolated high oil and natural gas prices—and talk of big shortages—forward indefinitely, predicting sky-high energy prices and severe shortages would hammer Europe hard. Shops would be forced to turn down the heat, scaring shoppers away. High fuel costs would make online shopping expensive. Potential power rationing would risk reducing the workweek. Natural gas shortages would take whole factories and chemical plants offline. Falling GDP would be the least of it.

Yet none of that came true. The region filled gas reserves well ahead of schedule. Headwinds persisted as inflation peaked later in Europe than in the US, yet the biggest economies managed slight growth or very slight contractions—all better than the severe downturns most said would start materializing as 2022 closed. That makes the overall grinding results a relief, which is plenty to lift stocks.

Another bit of good news: One GDP report generally doesn’t suffice to wipe away bad expectations. In reviewing coverage of Q4 numbers, we saw a lot of guess it isn’t as bad as everyone thought, but there are still plenty of obstacles ahead. Some noted that Germany in particular could be lapsing into recession. Even the country’s Vice Chancellor and Economy Minister, Robert Habeck, thinks one looms—despite Chancellor Olaf Scholz’s claims to the contrary. Others focused on the risk of a diesel shortage reducing Europeans’ mobility, causing economic problems from here. In its updated World Economic Outlook, also out this week, the IMF noted the eurozone’s seeming resilience but still penciled in a sharp 2023 slowdown to 0.7% full-year growth—an anemic forecast that seemingly leaves plenty of wiggle room for a short recession at some point this year.

So it would appear pessimism is beginning to thaw. But that means plenty of wall of worry should remain for stocks to climb. Think back to Sir John Templeton’s famous description: “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” Now, it is too soon to proclaim last October’s low the 2022 bear market’s official trough. Stocks are up nicely since then, and we are bullish, but short-term moves are unpredictable, and another down leg could lurk. But for argument’s sake, if that was the low and investors have already worked through much of their pessimism, that would just mean we are segueing into “grow on skepticism.” That stage can last a long while, and it is typically a very nice one. And if it features more grinding economic data? So much the better to keep sentiment from running too hot too fast.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.