Personal Wealth Management / Market Analysis

Fund Flows and Capitulation

What those awaiting a mass exodus from stocks seem to miss.

As stocks continued retracing their summertime rally last week, pundits offered no shortage of reasons more pain must be in store—rising rates, Fed moves, Europe’s energy crisis, weakening earnings estimates and high-ish valuations barely scratch the surface. Lurking underneath all of this is the assumption that complacent investors haven’t factored these in, with the primary evidence being that they have yet to capitulate. That is, investors haven’t thrown in the towel en masse and fled from stocks. That observation is true enough, yet we think it is a stretch to argue capitulation is a precondition for a recovery. That investors historically have often capitulated near market lows doesn’t mean they must or always do so. And we see a big reason why a mass exodus from stocks is unlikely this time around.

Simply: If you leave stocks, where do you go? Inflation looks set to eat cash alive. Gold is down far more than stocks since March. Commodities broadly are down, too, after fears of the war in Ukraine causing big shortages proved overstated. Crashing crypto is hardly the stereotypical safe haven fearful stock investors would flee to. Even the most traditional “safe” alternative, bonds, are down double digits since peaking in early January 2021. We aren’t saying these assets won’t recover, and we happen to think bonds’ decline is sentiment-fueled and out of touch with the bond market’s longer-term supply and demand fundamentals. But fear arguably reigns there, making it an unattractive destination for people tempted to react emotionally to stocks’ declines.

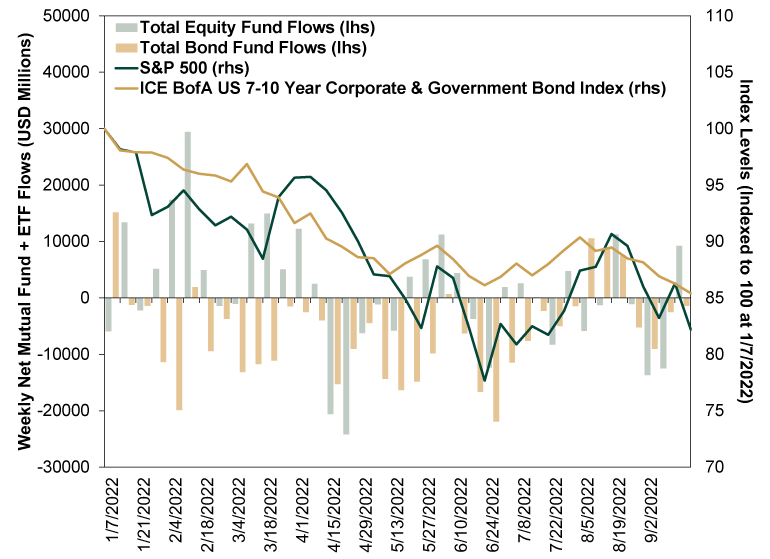

Lest you think our point is merely theoretical, we made some charts of stock and bond fund flows. Exhibit 1 shows weekly year-to-date flows for both, with US stock and bond returns overlaid. As you will see, investors have pulled much more money from bonds than stocks, much more consistently, this year. That isn’t shocking when you consider how fund flows work: They tend to follow returns. Bonds’ decline, though shallower than stocks’, has been relatively steadier and lasted longer, seemingly leading to a steady stream of outflows. Stocks’ decline, by contrast, concentrates in short bursts followed by seemingly fast rebounds. Flows have escalated at relative lows, but not to an astounding degree.

Exhibit 1: Year-to-Date Fund Flows and Returns

Source: FactSet, as of 9/21/2022. Weekly estimated total bond and total equity mutual fund and ETF net flows, 1/7/2022 – 9/16/2022, and S&P 500 and ICE BofA US Corporate & Government Index (7 – 10 year) weekly total return index levels, 12/31/2021 – 9/16/2022.

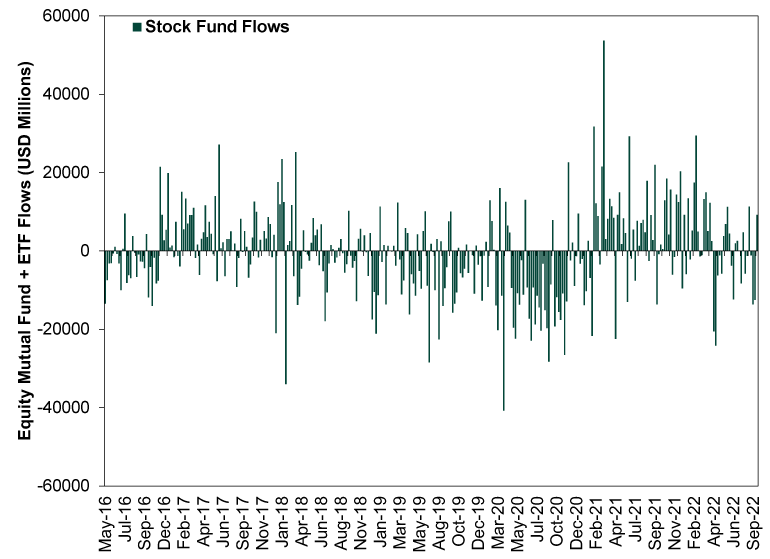

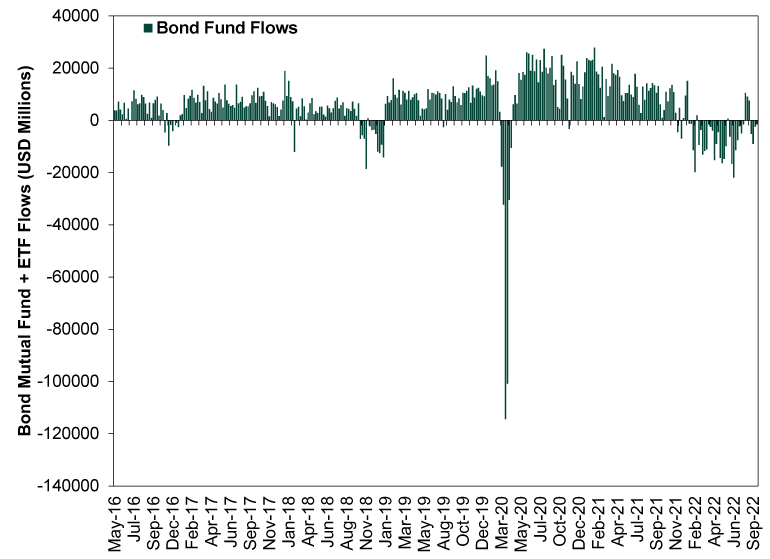

As Exhibits 2 and 3 show, both of these recent fund flow trends are unusual. In past times of stress, stock fund flows have been deeply negative for a long time—see that huge cluster in 2020 for one example. Today’s occasional outflows pale in comparison. But today’s streak of bond outflows dwarfs anything in the short history of combined ETF and mutual fund flows. The magnitude of outflows may have been bigger in 2020, but it was far shorter. Outflows today also exceed those that accompanied fears of the Fed’s balance sheet runoff slamming bond markets in 2018 and the weird sentiment-fueled wiggle after 2016’s presidential election.

Exhibit 2: A Longer History of Stock Fund Flows

Source: FactSet, as of 9/21/2022. Weekly estimated total equity mutual fund and ETF net flows, 5/6/2016 – 9/16/2022.

Exhibit 3: A Longer History of Bond Fund Flows

Source: FactSet, as of 9/21/2022. Weekly estimated total bond mutual fund and ETF net flows, 5/6/2016 – 9/16/2022.

If people are broadly fleeing bond markets amid worldwide handwringing over rising interest rates, inflation and a bear market in one global bond index, then fearful stock investors probably won’t flock there. Investors inclined to capitulate to stocks’ decline don’t seem likely to run to a market where people, maybe even the same people, are perhaps capitulating. If you are driven by fear, it doesn’t seem likely you would exchange one scary asset for another.

More likely, the lack of an attractive destination for fearful stock investors creates a sort of resigned paralysis. Sighing and hanging on absent a better alternative. Perhaps that apathy is how deep pessimism toward stocks will manifest in investor behavior this time, defying those who avoid stocks because not enough people have sold yet.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.