Personal Wealth Management / Market Analysis

Into Perspective: March’s Inflation Uptick

Investors are still fighting the last war.

Every now and then, the stock market does something that seems to confirm whatever narratives—usually fearful—have surrounded it for months. Usually it is just short-term volatility, meaningless noise, but you wouldn’t know that from the mountain of articles reading into it. The latest example came Wednesday, when March’s inflation report showed the US Consumer Price Index (CPI) accelerated unexpectedly, allegedly ending June rate cut hopes. The S&P 500 dropped over -1.0% intraday before recovering a bit to close down -0.9%, fueling talk of higher-for-longer rates being bad news for investors.[i] We aren’t in the business of predicting short-term volatility, and it is possible a pullback is at hand. Sentiment can cause sharp swings any time, for any or no reason. But we doubt this weighs for long. In our view, this is a case of investors fighting the last war, not actual deterioration in the bull market’s fundamental drivers.

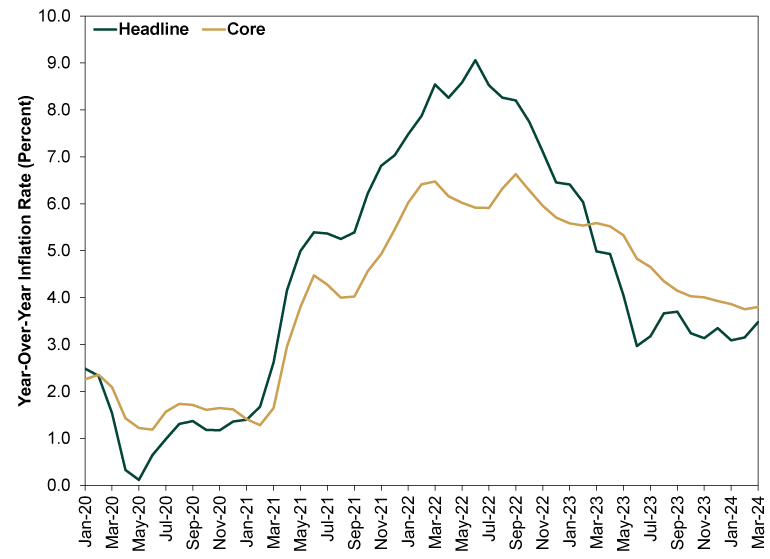

The headline inflation rate ticked up from 3.2% y/y in February to 3.5%, outstripping expectations for 3.4%.[ii] The acceleration came primarily from energy costs, which snapped a year of deflationary readings to rise 2.1% y/y.[iii] Core inflation, which excludes food and energy, held steady at 3.8% y/y as deeper deflation in goods prices offset a small acceleration in services.[iv] And in longer-term context, it is hard to see much cause for alarm in the headline increase. As Exhibit 1 shows, CPI has been rangebound since last summer. Prior jumps didn’t presage sustained increases, and conditions don’t support one now. Not with broad M4 money supply basically stalled after contracting for over a year straight (and still contracting if you exclude US Treasurys from the calculation).[v]

Exhibit 1: Rangebound Inflation

Source: FactSet, as of 4/10/2024.

As Nobel laureate Milton Friedman often preached, inflation is always and everywhere a monetary phenomenon—too much money chasing too few goods and services. Monetary excess played a big role in 2022’s inflation spike, colliding with supply chain issues and the energy and commodity price spike that followed Russia’s invasion of Ukraine. That excess has worked its way out of the system, partly through subsequent monetary contraction and partly through the economic growth that helped absorb it. Meanwhile, supply chains improved and China reopened from its long lockdowns, improving global goods supply. There is a lot of talk now about higher commodity prices renewing inflation risk, but this ignores that commodity prices are up on anticipation of faster growth and factory builds across Emerging Markets. This adds to the world’s productive capacity, which is disinflationary.

These are basic concepts, but investors have a hard time seeing it, probably because sentiment is getting in the way. In investing, there is a time-honored tradition of fighting the last war—that is, being on high alert for a repeat of whatever purportedly caused the prior bear market. After the 2007 – 2009 global financial crisis, investors went ghost-hunting for a subprime mortgage repeat in municipal debt, Dubai’s debt and eventually the eurozone periphery. After the COVID lockdown bear market in 2020, all attention went to variants and reimposed restrictions. And now, a year and a half from a bear market that fell on inflation and rate hike fears—along with many others—we have outsized scrutiny on prices and rates. This is normal investor behavior, and its manifestation today is a sign there is still a big wall of worry for stocks to climb despite sentiment’s improvement year to date.

We think this climb is likely to happen as markets continue weighing fundamentals looking 3 – 30 or so months out. Earnings are growing, and US companies have a lot of bandwidth for new investments after nearly two years of cutbacks in anticipation of a recession that never arrived. Business investment is also rising in the UK and Japan, where—along with the eurozone—green shoots are sprouting. Gross margins globally are fat enough that businesses can handle slightly higher input costs without jacking up prices anew, and wage growth—a trailing inflation indicator—continues helping households regain purchasing power. The pump is primed for the global economy to continue surprising to the upside.

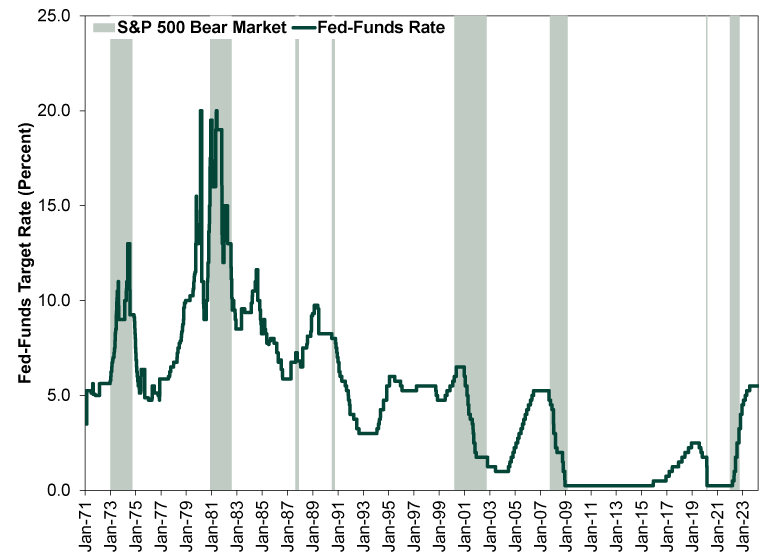

Even if the Fed doesn’t cut as swiftly as some hoped! Stocks don’t depend on the Fed slashing rates. We know this, because the entirety of this bull market accompanied either rate hikes or high rates. US GDP accelerated in a high-rate environment in 2023’s second half, and now growth appears to be broadening out to manufacturing against the high-rate backdrop. Earnings are recovering amid high rates. Investment is picking up alongside high rates. Society may not like high rates, but it has adapted and remembered how to grow an economy despite them—much as it did throughout the mid-to-late 20th century. Which is another thing: The mass perception of interest rates seems skewed by the anomaly that was the 2010s. Longer-term, rates are actually pretty darned normal, if not low.

Exhibit 2: An Antidote to Interest Rate Recency Bias

Source: FactSet, as of 4/1/2024. Fed-funds target rate, 1/8/1971 – 3/28/2024.

None of this precludes further volatility, of course. As Ben Graham taught, markets may weigh fundamentals in the long run, but in the short term they act like voting machines, swinging on sentiment. People have strong feelings about inflation and rates, and those feelings might register in markets a while longer. But we doubt it is anything more than the typical volatility that starts and ends without warning. Look back at Exhibit 1. Inflation is in a much tighter range than in 2022, and the Fed’s preferred measure (the Personal Consumption Expenditures price index) is even closer to its target of 2.0% y/y over time. Stocks are pretty good at pricing in small wiggles and kerfuffles and moving on.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.