Personal Wealth Management / Market Analysis

Mixed Messages in America’s Services Surveys

One grew, one contracted. What to make of it?

Right in time for the increasingly politicized is this a recession debate, July services purchasing managers’ indexes (PMIs) for the US rolled in with some mixed messages Wednesday. Behind Door Number One: the Institute for Supply Management’s (ISM) Services PMI, which accelerated to 56.7 from June’s 55.3.[i] Considering readings over 50 indicate expansion, this implies the US’s vast services sector accelerated last month. But behind Door Number Two, we have S&P Global’s Services PMI, which fell to 47.3 from June’s 52.3.[ii] While this split doesn’t do much to un-muddy the economic waters, we also don’t totally think it needs to. The “recession” debate is largely political, and whatever you call it, we think it is clear stocks have been pricing in economic weakness. What matters from here is how the landscape develops over the next 3 – 30 months, and recession labels won’t tell you anything about this.

Between the locked Wikipedia entry for “recession” and politicians’ seemingly newfound obsession with the National Bureau of Economic Research (NBER)—not to mention the debate’s partisan nature—we feel compelled to lead with a bit of MarketMinder history. We have never used “two sequential GDP contractions” to determine a recession and have always deferred to the fine folks at NBER’s definition: “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”[iii] We will occasionally note that some people choose to define a recession as two consecutive quarterly contractions, but we do not call that a “technical recession,” as some do, and we aren’t even sure what that would mean. Besides, sticking to the two consecutive contractions definition would cause you to omit the very real recessions that occurred in 1960 and 2001. It would also lead you to miss two-fifths of 1970’s recession and the first year of 1973 – 1975’s.

But also, what is really the point of putting a label on this? One could argue that the present situation is a repeat of Q2 and Q3 1947. Then, like now, GDP fell twice in a row, due largely to an inventory drawdown, but consumer spending stayed strong. NBER doesn’t call that a recession, which seems defensible. But that didn’t keep stocks from suffering a long bear market due to the fallout of extended rationing and interest rate controls after WWII. Recession label or no, it was a bad time economically and in the stock market. Similarly, even if the present period doesn’t go down in history as a recession, we have dealt with a stock bear market, and households globally are swallowing inflation-adjusted pay cuts. Tough times are tough times whatever NBER’s Business Cycle Dating Committee decides to call them. Most importantly, whatever the label, it becomes clear far too late in the game to be of any use to investors. Stocks are leading indicators. They fall ahead of recessions, not after them. So if this is a recession, we could very well be long into a new bull market before the label becomes official.

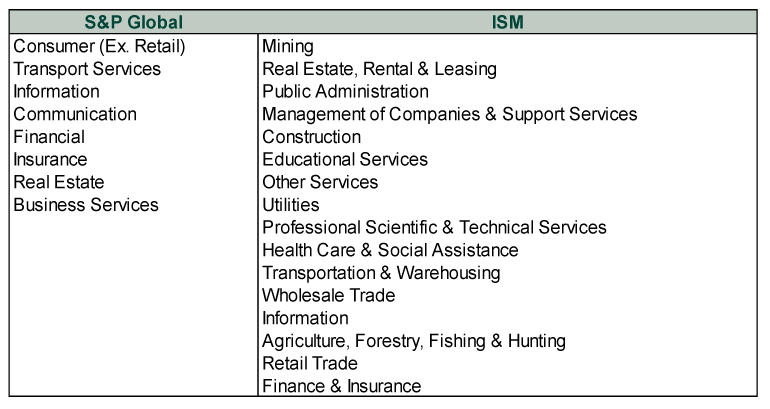

Either way, again, we are in a situation where stocks started falling in January, when indicators looked strong across the board, then hit their most recent low in mid-June, by which time indicators were decidedly mixed. S&P Global’s services contraction is new, but it is far from the only contractionary data point in the past few months. Then too, the two surveys, while similar, aren’t identical. ISM’s is older and has a longer performance history. S&P Global’s (formerly known as IHS Markit’s) surveys more companies. Their industry coverage also isn’t a perfect match, as Exhibit 1 shows.

Exhibit 1: Mismatched Services PMIs

Source: Institute for Supply Management and S&P Global, as of 8/3/2022.

If we had our druthers, the ISM’s gauge would still go by its old name: Non-Manufacturing Index. Because while it includes all services, it has some non-service things like construction, mining and agriculture. It also includes retail, which S&P excludes. Of the industries that are in ISM but not S&P, ISM’s release reports mining, public administration, utilities construction, health care and wholesale trade rose, while retail and agriculture fell. Of the categories they have in common, finance and insurance also fell, while the rest grew, according to ISM (S&P doesn’t offer industry-level commentary or information). In our view, it seems logical to presume the industry mismatch played a role in July’s divergence, especially when you consider how high oil prices have incentivized more US drilling (which is part of ISM’s mining component).

Crucially, both surveys showed new orders rising—a positive, as today’s orders become tomorrow’s production. Coupled with signs elsewhere of supply chain issues evening out, production could easily catch up in the months ahead. Both also showed price increases moderating, which may signal some inflation relief in the offing. So even with the mixed headline results, we see some encouraging nuggets underneath.

S&P Global’s contraction is still worth keeping an eye on, but one-off services contractions amid a broader economic expansion aren’t unheard of. It happened twice in the long 2009 – 2020 expansion. The present could also prove to be a false signal. Or, it could be the start of a private-sector contraction that fulfills the world’s mounting expectations for a recession. Yet while we acknowledge this possibility, we think it would be a mistake to pencil it in now, when the series that represents a broader swath of the economy (ISM) and has a much longer history is showing pretty darned widespread growth. So watch and see, but keep a level head and don’t overrate the forward-looking implications of data that likely influenced stocks over the past several months.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.