Personal Wealth Management / Market Analysis

On That Debt Ceiling ‘X’ Date

Bond auctions show the low likelihood of disaster.

Another day, another forecast of when the US could “default” if Congress doesn’t raise the debt ceiling—this time courtesy of the Bipartisan Policy Center, which estimates the Treasury will have exhausted its “extraordinary measures” and cash on hand by “summer or early fall.” That mostly matches the Congressional Budget Office’s estimate that the so-called X date will occur in July – September, both of which are more optimistic than Treasury Secretary Janet Yellen’s prediction of June. Mostly, it strikes us as an attempt to goad Congress into acting. But even if it doesn’t work immediately, disaster is highly unlikely to ensue. One way to see this? Bond auctions.

As we have written many, many times over the years, default means one thing and one thing only: failing to pay bond interest or repay maturing bonds. Other missed payments are probably annoying for those affected, but they don’t constitute a default. To see the risk of an actual default, we think it helps to look at market-based indicators. Bond interest rates are a measure of default risk, so if the probability arose, we would expect rates to spike as demand for the issues likeliest to face default fell. It would likely be most visible in auctions of short-term Treasury bills scheduled to mature around the estimated X dates.

To explain why, we are going to have serve up some vegetables and get a bit technical. The Treasury sells T-bills at a discount, then repays them at par value (the effective yield is the percentage difference between the two). Thus, the Treasury technically can’t roll over T-bills as they mature without increasing the amount of debt outstanding, as the revenue they would receive in the new auction would be less than the amount it has to repay. So if there were a high likelihood of an actual debt default, this is probably where it would occur first. In our long, long, long history of too frequent, repetitive coverage of debt ceiling fights over the years, we have seen many argue investors would demand a deeper discount to buy these bills at auction, resulting in a high effective yield and probably very low demand.

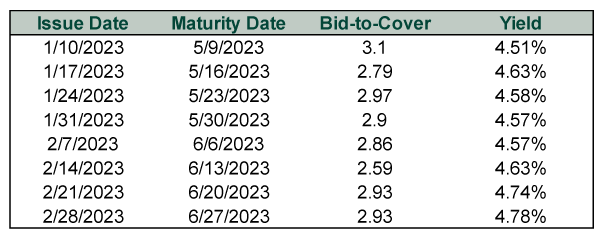

We aren’t seeing that right now. Exhibit 1 shows this year’s auctions of four-month T bills, with maturity dates in May and June—when Yellen estimates the X date will strike. But yields haven’t much budged, especially when you factor Fed short-term rate hikes in. Neither has demand, with the amount of bids hovering around three times the amount of bills offered.

Exhibit 1: 17-Week T-Bill Auctions

Source: US Treasury Bureau of Fiscal Service, as of 2/22/2023.

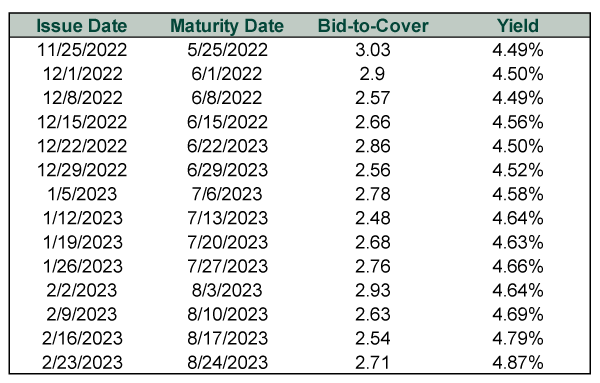

Six-month bills tell a similar tale, as Exhibit 2 shows. The maturity dates here range from late May to late August, smack in the middle of the other two X date forecasts making headlines. Yet here, too, the variability in bid-to-cover ratios and effective yields just looks like normal volatility.

Exhibit 2: 26-Week T-Bill Auctions

Source: US Treasury Bureau of Fiscal Service, as of 2/22/2023.

So what are the markets seeing? One could argue they know this kind of grandstanding over the debt ceiling is commonplace and has always ended with a deal raising the limit. But they may also see that interest payments are routinely below monthly Treasury revenues, giving the Treasury plenty of bandwidth to continue servicing debt without borrowing if it has to. They may know that the Supreme Court has interpreted the 14th Amendment as requiring the Treasury to prioritize interest payments, and past Treasury secretaries, nonpartisan watchdogs and the New York Fed—which actually makes the payments—have confirmed doing so is legal and feasible. Markets probably have figured out that if Congress decided to drag this thing out beyond the X date that the practical outcome would look a lot like a partial government shutdown, where certain vendors and workers go unpaid for a spell and some departments go offline temporarily while debt service continues. That isn’t good. But it isn’t a default—and no government shutdown ever caused a bear market.

Now, again, Congress has never let it get that far. They have raised the debt ceiling well over 100 times and almost certainly will again, probably at 11:59:59 PM before the X date. Or maybe 7:13 AM on the date itself. Or or or. But if they take even longer, as annoying as the bickering and grandstanding will probably be, the market is telling us it shouldn’t be a fiscal disaster.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.