Personal Wealth Management / Market Analysis

On the Bond Bounce

Stocks aren’t the only rallying asset class.

As stocks rallied from October’s low, slowing inflation, modestly improving economic forecasts and better-than-expected European energy supply stole much of the spotlight. But there is another force quietly working in the background: the bond market. Not as a driver of the stock market, mind you, but a companion. Last year, both fell together on conjoined inflation and rate hike fears. But since autumn, both have flipped and rallied in tandem. As with stocks, bonds’ low will be clear only in hindsight. But the rally does look consistent with the 2023 rebound we expect.

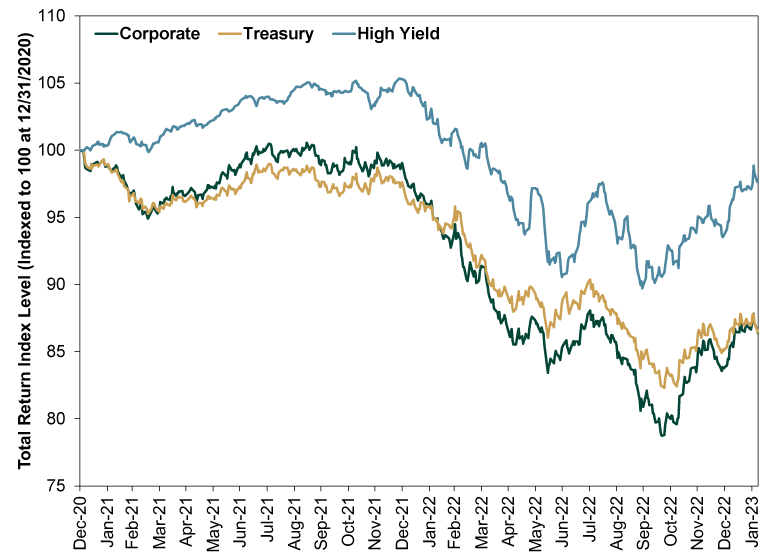

Exhibit 1 shows US Treasury, investment-grade corporate and high-yield bonds in total return terms (price movement plus yield) since 2020’s end—capturing their full downturn. Investment-grade corporates endured a full bear market, falling more than 20% from their high. Treasurys and high yields came close. But like stocks, all three have jumped from their respective lows, with corporates and high yield leading.

Exhibit 1: Bonds Are Bouncing, Too

Source: FactSet, as of 2/8/2023. ICE BofA US Corporate, US Government and US Cash Pay High Yield total return indexes, 12/31/2020 – 2/7/2023.

Bond prices and interest rates move in opposite directions, so it is probably no surprise that as long-term interest rates fell from their autumn high, bonds rallied. That is bond market mechanics 101. Corporates’ and high yields’ outperformance isn’t a shocker, either. While government rates exert strong influence over these categories, they also have higher perceived risk than Uncle Sam tied to corporate financial health. So it is rather normal for them to fall more on the way down—and what falls the most in a downturn usually bounces higher in a recovery.

To understand this, we find it helps to think more in terms of interest rates than price. Because corporate and high-yield bonds have higher default risk, they generally pay higher yields than the government. When economic times get tough—or are feared to get tough—perceived default risk rises relative to Treasurys, so their interest rates typically rise more than Treasury rates do. Or, to use the lingo, their credit spreads versus comparable maturity Treasury bonds widen. When things improve, corporate and high-yield rates will typically fall more as their perceived risk improves to a greater degree, so credit spreads narrow and corporates and high yield outperform. Long-term securities, which are more interest-rate sensitive, also tend to do better.

Whether or not bonds have notched their official low from last year’s downturn, we would expect this general trend to continue in a recovery—and we think that recovery is very likely to occur this year. Treasury yields move primarily on inflation expectations, which have come down quite a bit as inflation has eased. That means investors need less interest to compensate for inflation over the bond’s maturity. As inflation fears continue easing this year, Treasury yields likely keep falling—and bond prices keep rising.

That should benefit corporates and high yield, which should also receive tailwinds from improving economic sentiment and the general realization that things aren’t as bad as feared for Corporate America. Balance sheets are quite healthy overall, with high cash buffers. In Q3 2022—the latest data available—non-financial corporations had over $5.7 trillion in cash stockpiled.[i] That is down from just over $7 trillion in Q4 2021, but it is extremely high relative to history.[ii] It gives businesses a big buffer to keep servicing debt while earnings and revenues are a bit leaner.

Bonds’ downturn was one of 2022’s biggest frustrations. Investors with blended portfolios generally own bonds to reduce expected short-term volatility relative to an all-stock allocation. US bonds still accomplished that overall, falling less than stocks during volatile stretches, but that was the coldest of comfort for many. Yet over more meaningful timeframes, downturns don’t negate bonds’ purpose in portfolios or their ability to contribute to and help smooth overall returns. Periods like 2022 aren’t pleasant, for sure. And we can’t say with certainty the downturn is over. But recoveries can come quickly and often do when investors least expect it—and it wouldn’t shock us if what we have seen since the autumn were just that.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.