Personal Wealth Management / Market Analysis

Look Beyond 2022’s Rocky Start

The bull market looks likely to continue this year.

Editors’ Note: Our commentary is politically agnostic, as we prefer neither party nor any politician. We assess political trends for their potential economic and market impact only.

Less than one week in, and 2022 probably feels a lot different from 2021. After finishing last year on a massive upswing, stocks have stumbled in the young New Year. Where stocks entered 2021 in a blaze of optimism, sentiment is now more muted, with fears seemingly lurking around every corner. Our advice: Take a deep breath. For while we think this bull market is very likely to continue and deliver solid full-year returns, the bulk of those returns probably come later in the year, with much more of a grind early on. For long-term growth investors needing market-like returns to meet their goals, we suspect patience is the watchword.

Note: This doesn’t mean the early part of the year is destined to be bad, or that the recent sentiment-driven swings are indicative of how it will play out. As we will show you shortly, midterm election years are routinely back-end-loaded, averaging small positive returns early, with more variability, before a second-half surge.

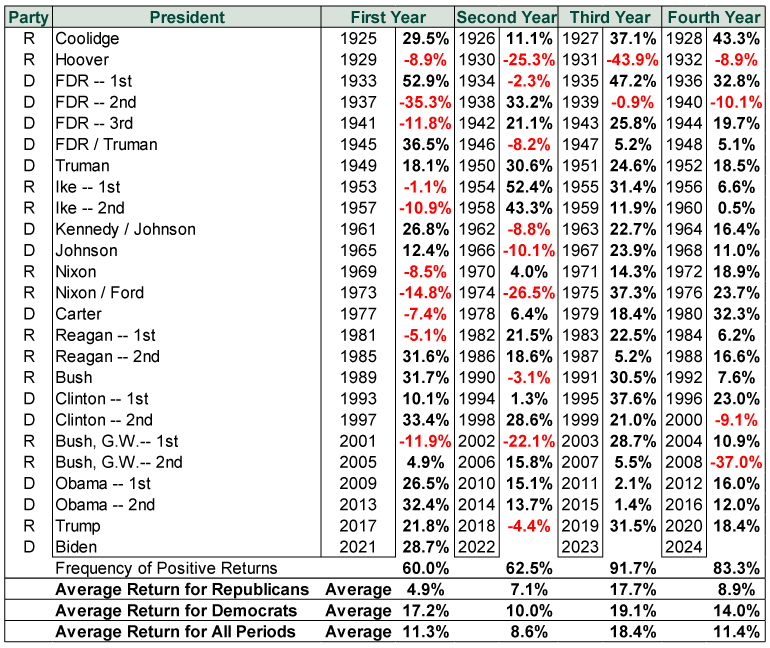

US politics—particularly midterm elections—go a long way to explaining stocks’ likely trajectory this year, in our view. As Exhibit 1 shows, the second year of a president’s term has the lowest average return of all four years in the presidential cycle—not because it is regularly weak, but because returns are more variable. The S&P 500 is usually up big or down, without much between. In our view, the positive years usually happen when midterms increase gridlock, which reduces stocks’ legislative risk aversion. That typically brings big tailwinds late in the year—which carry on into year three, historically the best of the cycle.

Exhibit 1: The Presidential Term Anomaly

Source: Global Financial Data, Inc. and FactSet, as of 1/4/2022. S&P 500 total returns by calendar year, 1925 – 2021.

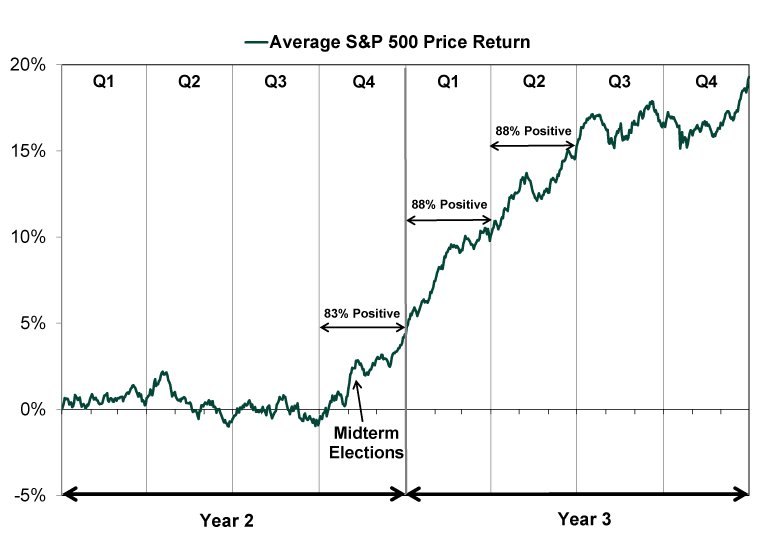

But the path to that late-year boom usually isn’t smooth. As Exhibit 2 shows, returns are usually a grind for the first three quarters of the midterm year, which are positive only 57% of the time.[i] That is better than 50/50—and not a reason to avoid stocks, in our view, but it is also below stocks’ average frequency of positivity in calendar quarters. It isn’t until stocks start pricing in the high likelihood of increased gridlock later in the year that the party really starts. This, of course, isn’t a timing tool. We could get stellar midterm returns earlier than this. But we think the pattern is instructive and can help you frame expectations.

Exhibit 2: Midterm Years Are Usually Back-End Loaded

Source: Global Financial Data, Inc., as of 8/10/2021. S&P 500 Index price returns in second and third years of the presidential cycle, 1925 – 2019.

We think the midterm campaigns have a lot to do with this grind, as politicians’ shouting about contentious issues raises uncertainty. All the noise can make it hard for people to see the simple truth that midterms usually favor the party in opposition to the president. That isn’t an ideological statement, mind you—we thought 2018’s midterms favored Democrats, and now we think sitting in opposition gives Republicans the edge. That edge gets a boost this year from a factor we think likely contributes to weaker sentiment early on: redistricting. Thus far, the new electoral maps appear to have created a few more Republican seats, but notably, they have also added safe seats on both sides while reducing the number of swing districts.

This matters. In swing districts, incumbents’ main task is seeing off a challenge from the other party. That gives them an incentive to tack toward the center and moderate their tone and rhetoric—an incentive that holds for both parties. But in safe seats, an incumbent’s biggest threat isn’t the other party, but a primary challenger. Many centrist Democrats face potential challenges from the party’s progressive wing (or vice-versa), while several centrist Republicans are trying to fend off challenges from the GOP’s populist flank (or vice-versa). These folks therefore have an incentive to be loud and extreme. More safe seats in 2022 therefore means a louder, more shrill campaign, with both parties spouting extreme rhetoric while the handful in swing districts beg everyone to pipe down. The added shouting probably weighs on sentiment more than a typical midterm campaign, contributing to the early-year grind. But it also likely sets sentiment very low, teeing up even bigger late-year returns than usual as increased gridlock becomes ever-more apparent.

International political drivers likely chart a similar course. France and Australia hold national elections this spring, adding to the early-year uncertainty. In the UK, Prime Minister Boris Johnson’s political capital is draining rapidly in the face of scandals and rising living costs. This has prompted a mounting rebellion within his Conservative Party, which may lead to a leadership challenge—especially if the opposition Labour Party continues gaining in the polls. This situation will eventually resolve one way or another, likely leading to falling uncertainty and more gridlock—just as the Australian and French results will bring clarity. But early on there will likely be jitters aplenty.

Politics isn’t the only factor likely to hold sentiment down. Markets’ reaction to the prospect of an early-year Fed rate hike is likely a foretaste of the grind we can expect as inflation, Omicron (and perhaps more variants), geopolitical tensions and more filter through headlines. These fears might even look right for a while, if scare stories prompt a pullback or correction (a short, sharp, sentiment-fueled drop of -10% to -20%)—which can happen at any time, for any or no reason, scare story or no.

But it won’t last forever. People will see Fed moves lack much power over the economy. The base effects that drove up the year-over-year inflation rate in 2021 will start dampening it around mid-year. Supply chain issues will even out as the world gets increasingly better at living with endemic COVID—which we are already starting to see, as the US and UK resisted Omicron lockdowns. The more people see life continuing alongside the virus—and economic indicators holding up—the more power the fears will lose. All of this clearing fog should contribute to falling uncertainty later this year—aiding returns.

So stand firm. If you need long-term growth to reach your personal goals, capturing bull market returns is vital. The precise timing of a late-year rally is unknowable, but you have to be in it to win it. We often say stocks’ long-term returns are the reward for staying patient through volatility along the way, and we think 2022 will be a shining microcosm of this. And of course, your friendly MarketMinder editors will be here to help guide you through.

May you all have a healthy and happy 2022.

[i] Source: Global Financial Data, Inc., as of 1/6/2022.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.