Personal Wealth Management / Economics

Private-Sector Strength

Signs of private-sector strength continue to emerge in the US and abroad.

A smorgasbord of data released Thursday underscored the US private sector’s health.

Following US manufacturing’s surge earlier this week, December US services growth accelerated to 52.6 from 52.0 in November (recall, anything above 50 signals expansion). Business Activity, New Orders, Prices and New Export Orders drove most of the gain. Although the report slightly missed consensus expectations of 53.0, the result importantly supports the notion of continued US economic growth. Not to be left out, the UK has shown similar signs of economic resilience. Services PMI, representing nearly 75% of the UK economy, jumped to 54 in December from 52.1 the month before.

Those results corroborate what seems clear about corporations—they remain profitable. The US Q3 earnings season showed firms are lean, healthy and growing. Likewise, revenues have shown solid growth and even acceleration in recent quarters. Consumers, too, are stronger than many expect. December US retail sales handily beat expectations, rising 3.4% year over year, logging another new all-time high.

Relatedly, recent employment reports are starting to show considerable improvement. ADP private payrolls surged in December, marking the fourth consecutive month of accelerating hiring and the largest gain since

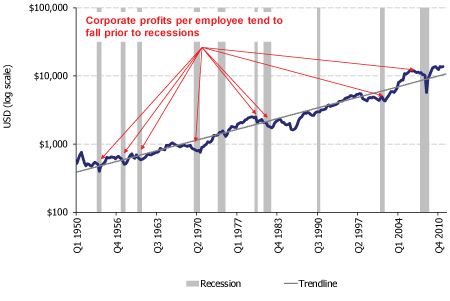

Early this morning, the BLS reported the unemployment rate ticked down slightly to 8.5%—the lowest in almost three years. Still, unemployment remains high and, as we’ve often written, is a late-lagging indicator.But when you marry private payroll data and corporate profitability, another gauge of private-sector health emerges. US corporate profits per employee are at all-time highs and show indications of rising further—see Exhibit 1. Historically, recessions tend to happen in environments of falling corporate profits per employee. Corporate profits per employee have soared 140% since reaching lows in Q4 2008—partly due to profits’ 133% gain, partly due to a -2.8% employment contraction. And corporations can boost profits per worker by laying folks off, if necessary. But as we indicated previously, what’s happened more recently is rising employment and rising profits per employee. Again, a good sign of private-sector vitality.

Exhibit 1: US Corporate Profit per Employee

Source: Thomson Reuters, Q1 1950-Q3 2011.

No one metric, of course, tells all about economic conditions. But together, manufacturing and service sector growth, higher retail sales, improving employment results and rising corporate profits per employee help illustrate the lion’s share of US economic activity—the private sector—is in robust health.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.