Personal Wealth Management / Market Analysis

A German Lesson on How Markets Work

Stocks move ahead of the economy.

If you have glanced at the financial news at all over the past year, you have probably seen one (or more) of the many, many warnings that Europe’s energy crisis would disproportionately roil Germany’s mighty industrial sector—hamstringing a big driver of the Continent’s largest economy. But against this mixed backdrop, German stocks have been rallying since late September—despite data that largely show the industry struggling. In our view, this is a reminder stocks look forward. In this case, they seemingly pre-priced heavy industry’s weakness—and moved on—before any improvement was clear.

We wrote a couple weeks ago about German GDP’s Q4 contraction, and while that initial estimate doesn’t provide a component breakdown, Destatis noted private consumption expenditure fell on a quarterly basis. Detailed results will come out next week, but some recently released, narrower gauges provide color in the meantime. On the factory front, December industrial production fell -3.1% m/m on a price-adjusted basis, and weakness was widespread.[i] Manufacturing (-2.1%) and energy production (-2.3%) both slipped while energy-intensive industries’ production—which fell for most of the year—contracted sharply (-6.1%).[ii] December factory orders rose 3.2% m/m on a price-adjusted basis, but the positive headline number comes with a caveat: Volatile large-scale orders skewed the result (e.g., for engines and turbines or spacecraft).[iii] Removing this bouncier category, orders contracted -0.6%, signaling flagging demand.[iv]

Rounding out the data, January CPI rose 8.7% y/y, a tick higher than December’s 8.6%.[v] On a harmonized standards basis (which EU nations apply for an apples-to-apples inflation comparison) prices rose 9.2% y/y, slowing from the prior month’s 9.6% rate.[vi] Now, there were some complicating factors likely affecting recent prices, as the government provided relief on households’ natural gas bills in December and an electricity price cap took effect in January—though we won’t have those numbers until the next estimate. Destatis didn’t provide January preliminary results for individual product groups, as the statistics agency shares only headline numbers when making changes to CPI’s base year—as was the case this year (updating from 2015 to 2020).

We aren’t going to sugarcoat anything here: These numbers aren’t good. They confirm German factories have taken a hit, demand is mixed and, despite some improvement, elevated prices remain a headwind. Whether or not Germany enters recession, the country’s industrial sector had a tough 2022—in line with stories of factories slowing production and some occasionally going offline due to high energy costs.

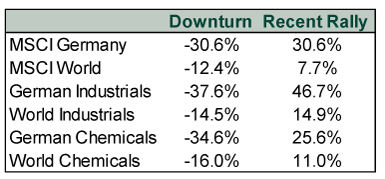

While the output data indicate the magnitude of the economic damage, they are old news to stocks. German stocks’ behavior over the past 15 months was consistent with pre-pricing an economic downturn. From their high in euros (to avoid strong US dollar skew) on November 17, 2021, German stocks fell -30.6% to their most recent low on September 29, 2022—a much steeper decline than global stocks’ -12.4% in euros over the same period.[vii] The sectors and industries that an energy crunch would likely hit hardest performed as you would expect, too. German Industrials—the country’s largest sector—plunged -37.3%, far worse than the MSCI World Industrials’ -14.5%.[viii] Same for the German Chemicals industry, which dropped -34.6% to the MSCI World Chemicals’ -16.0%.[ix]

Since that September low, hard-hit German stocks have also rebounded stronger than their global counterparts. That rally began right at Q3’s close—before all the developments the latest economic data just confirmed. (Exhibit 1)

Exhibit 1: German Stocks’ Downturn and Rebound

Source: FactSet, as of 2/16/2023. Returns are all in euros. MSCI Germany Index, MSCI World Index, MSCI Germany Industrials sector, MSCI World Industrials sector, MSCI Germany Chemicals industry, and MSCI World Chemicals industry returns with net dividends, 11/17/2021 – 9/29/2022 and 9/29/2022 – 2/15/2023.

We don’t think there is a disconnect here—rather, stocks are leading economic indicators. They are mostly efficient discounters of widely known information, digesting broadly held views, opinions, forecasts and data. In our view, stocks have been pre-pricing the prospect of a German recession since late 2021, when concerns about high energy prices, elevated inflation and supply bottlenecks contributing to a downturn first arose. Russia’s invasion of Ukraine early last year amplified those worries. Rather than wait for recession to become official—or for the data to even weaken—stocks moved first and pre-priced the probable negative economic impact in real time. Markets have since moved on, weighing emerging reality against those fearful forecasts. That reality doesn’t seem as bleak as what markets anticipated. Now markets seem to be looking ahead to the economic and political factors impacting corporate profits over the next 3 – 30 months—and the likely recovery. Hence, the rally.

We don’t know definitively whether a new bull market has started yet, as cyclical turning points are clear only with ample hindsight. But we think there is a critical lesson here for investors: Stocks don’t sound an “all-clear” signal. Waiting for official confirmation that a recovery has begun may mean missing out on the sharp rebound—which can be costly for investors seeking stocks’ long-term growth.

[i] Source: Destatis, as of 2/14/2023.

[ii] Ibid.

[iii] Ibid.

[iv] Ibid.

[v] Ibid.

[vi] Ibid.

[vii] Source: FactSet, as of 2/14/2023. MSCI Germany Index and MSCI World Index returns in euros with net dividends, 11/17/2021 – 9/29/2022.

[viii] Ibid. MSCI Germany Industrials sector and MSCI World Industrials sector returns in euros with net dividends, 11/17/2021 – 9/29/2022.

[ix] Ibid. MSCI Germany Chemicals industry and MSCI World Chemicals industry returns in euros with net dividends, 11/17/2021 – 9/29/2022.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.