Personal Wealth Management / Economics

More May Data Hint a Recovery May Be Underway

In which we explain the nascent recovery in retail sales and industrial production.

Has America’s economic recovery begun? The US released retail sales and industrial production on Wednesday, and both rose for the first time since most of the country went into an institutionally induced coma in hopes of slowing COVID-19’s spread. Retail sales jumped a record-high 17.7% m/m, triggering oohs and ahhs from analysts.[i] Industrial production met far less fanfare after it rose just 1.4% m/m.[ii] We wouldn’t read much into the sizable difference in growth rates, as lockdowns hit retailers and heavy industry differently. Rather, each report offers some clues as to how the US economy is responding as states and counties begin reopening.

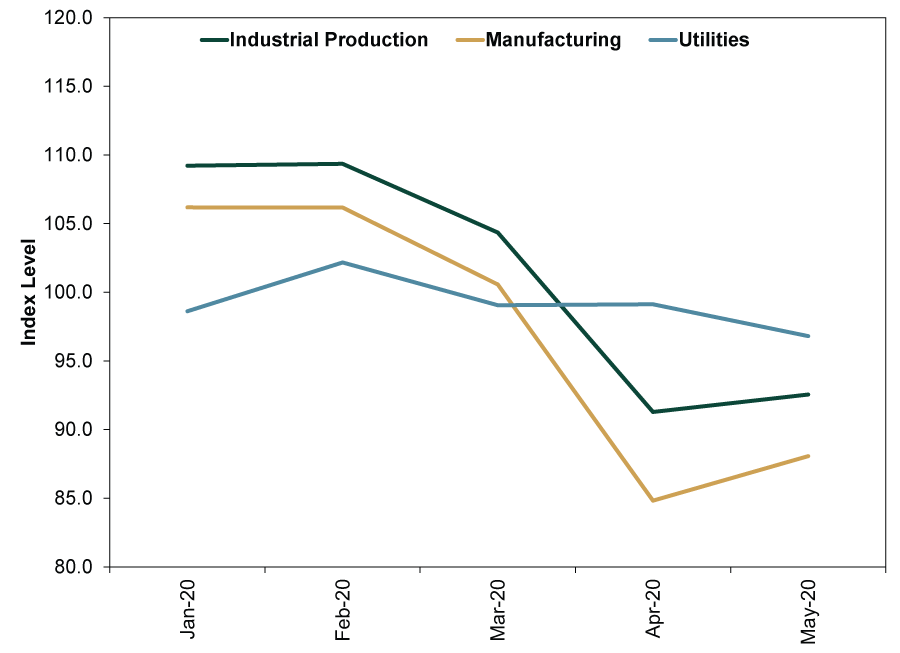

Exhibit 1 shows industrial production year to date. As you will see, May’s rise doesn’t come close to erasing the lockdown-driven declines. Total output remains 15.4% below its year-to-date high in February.[iii] But the headline number is a bit deceiving, as falling utilities and mining (mostly oil drilling) production skewed it downward. For utilities, this is unsurprising. Mild spring weather likely conspired with lingering business closures to sap demand for electricity. For mining, it is equally non-shocking, as the -6.8% m/m drop comes as producers likely continued responding to very low oil prices.[iv] As for manufacturing, the largest subset of industrial activity, it enjoyed a stronger rebound, at 3.8% m/m. But, like the headline number, since it crashed harder overall during the lockdowns, factory output was still -17.0% below February’s year-to-date high.[v]

Exhibit 1: Industrial Production and Selected Components, Year to Date

Source: FactSet, as of 6/16/2020. Industrial production, manufacturing production and utilities production, January 2020 – May 2020.

There are a number of potential reasons for manufacturing’s weaker rebound relative to retail sales. For one, the Commerce Department’s manufacturing report shows that, at least through April, factory inventories inched up during the pandemic. That suggests that even as factories reopened, they likely had at least a small overhang to work through. However, this is just an educated guess, as May’s report won’t be out until June 25. Inventories aside, factories don’t simply produce goods in hopes people will buy. They make goods when businesses order them, and those order books took a huge hit during lockdown. Not only did new orders stop flowing in, but customers also canceled orders left and right, wrecking factories’ backlogs of unfilled orders. You can see that in the Commerce Department’s report (which includes factory orders) as well as the Institute for Supply Management and IHS Markit’s purchasing mangers’ indexes. As these businesses reopen and work through their own inventories, they should submit new orders, bolstering factory output.

Retail sales, by contrast, have fewer prerequisites for a recovery. All they need is for stores to reopen, which began happening in much of the country in May. In our view, this explains retail sales’ much larger rebound.

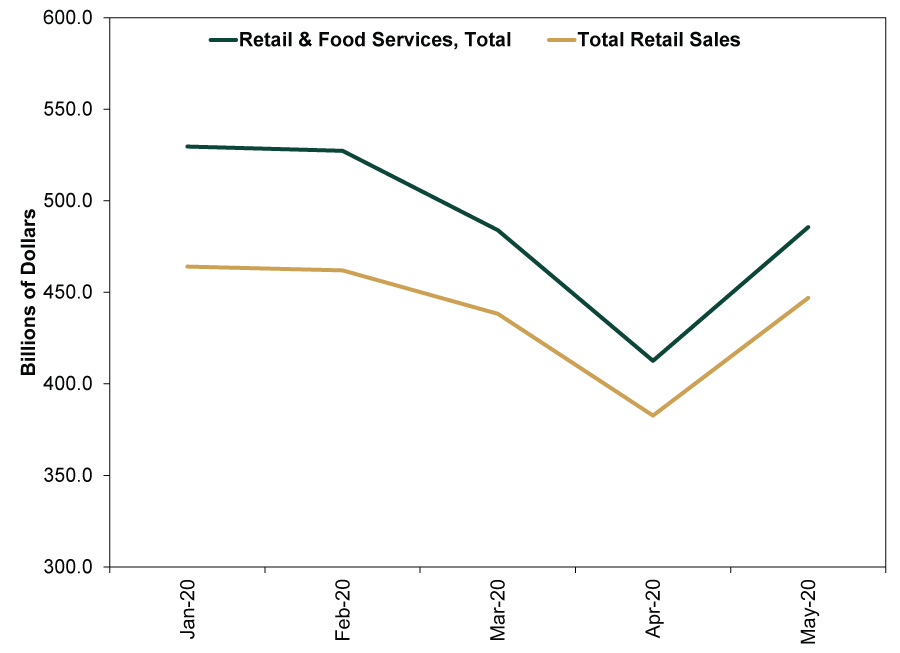

Exhibit 2: Retail Sales’ V-Shaped Recovery?

Source: FactSet, as of 6/16/2020. Retail and food services sales and retail sales, January 2020 – May 2020.

You can see the impact of reopenings best if you look at the various subcategories. The biggest rebound came in pure clothing and accessories stores, where sales rose 188% m/m.[vi] Yes, that is 188% m/m. Sporting goods, hobby, book and music shops bounced 88.2%.[vii] These huge percentage jumps in non-essential stores’ sales far outpaced food, general merchandise (think: Target and Wal-Mart) and home improvement stores, many of which were deemed essential and open during shelter-in-place. Sales at restaurants and bars, meanwhile, rose only 29.1% and remain 41% below their January high.[viii] Compare that with pure retail, which is nearly back at breakeven. We think the discrepancy is pretty easy to explain.

While most shops are now open provided they follow social distancing guidelines in counties that are further behind the reopening curve, restaurants and bars are mostly limited to outside dining, some indoor dining in certain areas, and takeout. This has led many restaurants to delay reopening, as they just don’t have enough tables to justify the overhead costs if they were to go back to business. Others got very little notice on their counties’ guidelines, requiring them to delay for a few weeks to rearrange tables to accommodate social distancing and adopt new sanitation procedures.

The main takeaway from this report, in our view, is that there is perhaps more pent-up demand than many expected. Before the report came out, there was a lot of talk about record-high unemployment, COVID fears and overall lack of animal spirits keeping people at home even as stores reopened. Overall and on average, that doesn’t seem to be the case. Note, too, that California’s major metro areas didn’t let shops reopen until early June. Some metro centers in other states, including Portland, Oregon, haven’t reopened yet. New York City just began reopening earlier this month! To us, that suggests it was a lack of shopping opportunities, rather than a lack of shoppers, that kept sales from bouncing higher in May.

Not that demand is back at pre-pandemic levels even where shops are open. The Bay Area contingent of your friendly MarketMinder editors has done some boots-on-the-ground research since our shops opened, and we have noticed plenty of hustle and bustle in our towns, but not near normal levels for this time of year. There were plenty of people strolling with shopping bags, our shopkeepers were encouraged by how many sales they had made, and most restaurants with open outdoor seating were filled to their limited capacity at brunch. At the same time, parking was a little too easy to come by, and it was easy to social distance on the sidewalks. So while a recovery does seem to be underway, it is early, with much room to improve.

On the bright side, most pundits seem to echo our cautious optimism. Retail sales’ improvement didn’t send sentiment and expectations soaring. There was a lot of “yah it was good but” in the press’s commentary, even as many credited retail sales for stocks’ rise on Tuesday. To us, that is good news. It leaves more room for the recovery to continue delivering positive surprise, especially as people continue fearing a second wave of the virus and another round of lockdowns, such as China is currently dealing with in Beijing. In our view, the combination of tame expectations and a decent recovery should provide plenty of fuel for stocks.

[i] Source: FactSet, as of 6/16/2020.

[ii] Ibid.

[iii] Ibid.

[iv] Source: Federal Reserve, as of 6/16/2020.

[v] See Note i.

[vi] Ibid.

[vii] Ibid.

[viii] Ibid.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.