Personal Wealth Management / Market Analysis

Terrorism Is Tragic But Markets Are Resilient

Stocks have historically proven resilient to terror. We expect they will again after attacks in Spain and Finland.

Life goes on at London's Borough Market weeks after the terror attack there. Photo by Elisabeth Dellinger.

Last Thursday, 13 people were killed and more than 100 injured as terrorists struck in Barcelona and Cambrils, Spain. The violence continued Friday as reports confirmed two dead and several more hurt in a stabbing in Turku, Finland. In the grand scheme of things, the loss of life overshadows anything investment-related. Now is the time for the living to pay respects to the deceased, count their blessings and remain vigilant against future attacks. For investors, though, remember that terrorism's historical impact on capital markets is small-terrorists are unlikely to deter markets for long.

We are sure you are as tired of reading these types of articles as we are of writing them. Unfortunately, the list of recent terrorist-related incidents runs long.

- 2016 ended with a truck killing a dozen people at a German Christmas market.

- The new year started with a horrendous attack at a Turkish nightclub.

- The UK suffered three attacks before the first week of June ended.

- France has been hit by numerous acts of terrorist violence over the past couple years-this year, there was a knife attack at the Louvre and a shooting before the presidential election

- Just last weekend in Charlottesville, Virginia, a neo-Nazi domestic terrorist sped into a crowd of people, killing one and injuring many others.

- Thirty-seven people died in a casino attack in the Philippines in June

- Not to mention scores of violent attacks in more volatile regions like the Middle East

That is a long-and sad-list to type. But markets haven't reacted with material negativity. Yes, stocks fell coincident with the news of the Spanish attacks-a sentiment-driven short-term reaction. But a longer view shows global stocks have bucked the serial violence and risen 12.0% YTD.[i] We anticipate that, to whatever extent Spain and Finland impacted Thursday and Friday trading, the effect will prove similarly fleeting.

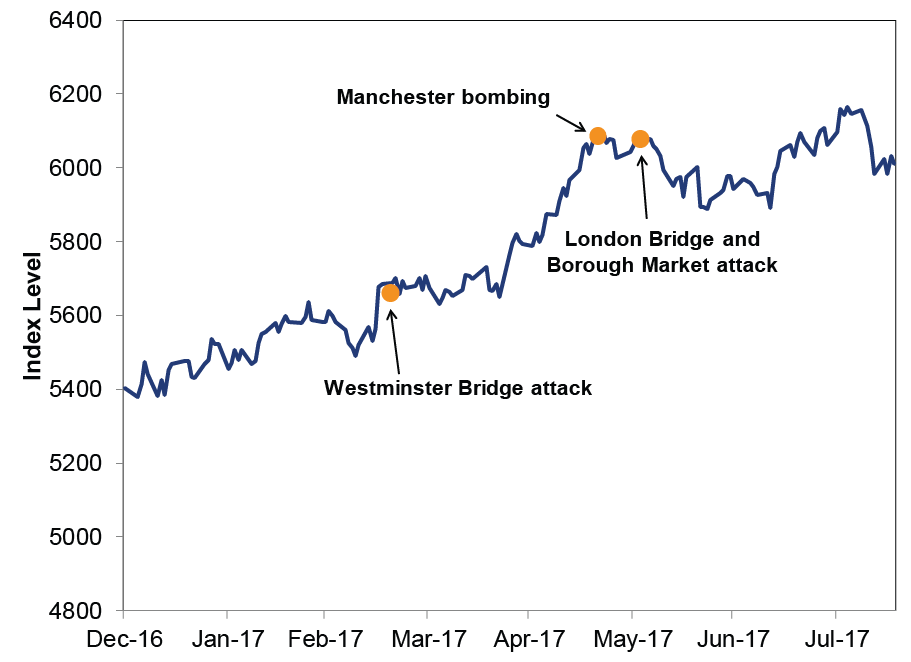

Consider how UK stocks-up 11.2% YTD-have fared despite several attacks on its soil. (Exhibit 1)

Exhibit 1: UK Stocks Carry On

Source: FactSet, as of 8/18/2017. MSCI UK Total Return Index, net dividends in USD, from 12/30/2016 - 8/17/2017.

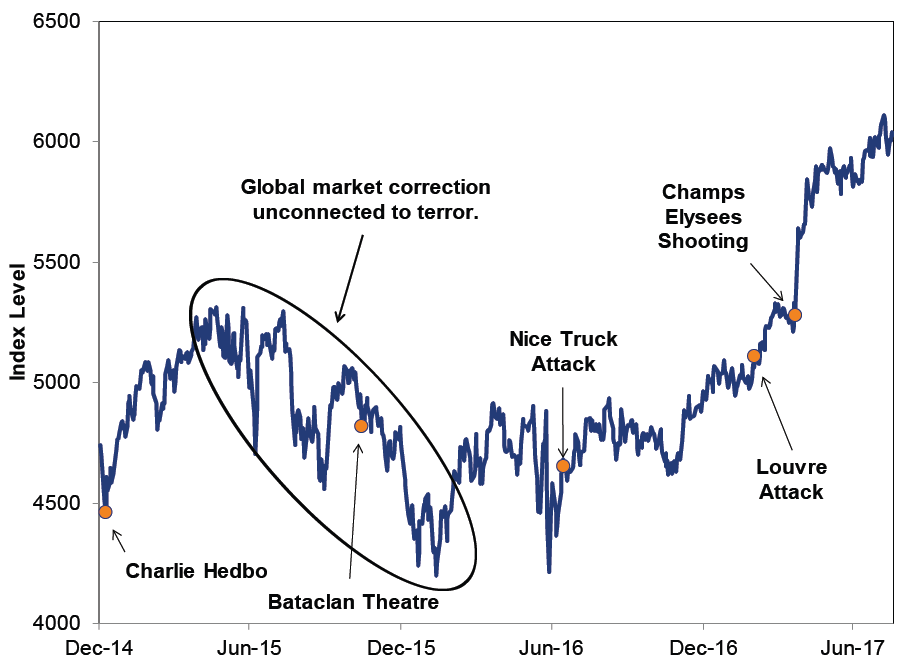

Taking a longer view, French stocks also show little influence from terror. (Exhibit 2)

Exhibit 2: French Stocks Too!

Source: FactSet, as of 8/18/2017. MSCI France with net dividends in USD, 12/31/2014 - 8/17/2017.

The unfortunate reality is terrorism is a part of modern life. This isn't breaking news-attacks on innocent civilians didn't just start happening in the past couple years. But terrorists seem to be increasingly employing small scale attacks, particularly those using innocuous, everyday items as deadly weapons. Practically speaking, we just don't think there is a lot authorities can do to prevent one or a few radicalized individuals from taking a vehicle and driving it into a crowd of people. We realize this is both depressing and scary, but it's the reality of the world we live in now.

Markets are aware too. This latest episode is unlikely to deter investors for long. Terrorist attacks don't fundamentally alter economic and political drivers. While they can hit sentiment in the short term, the surprise power is waning, given the frequency. As a result, terrorism lacks the power, punch and scale to meaningfully derail (currently positive) market drivers.

The world isn't a perfect place-never has been, and while we are hopeful, it probably never will be. As an investor, you can't wait for the pristine point when all fear is vanquished to invest. It's scary, but stocks are resilient-just like people. So offer a prayer or well-wish to those afflicted by recent violence and trust that free people will continue meeting-and overcoming-challenges presented by those who wish them harm.

[i] Source: FactSet, as of 8/18/2017. MSCI World Total Return Index, net dividends in USD, from 12/30/2016 - 8/17/2017.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.