Personal Wealth Management / Market Analysis

The Long-Term Perspective Lacking in the Recent AI Craze

The 1970s offer an interesting parallel.

Editors’ Note: MarketMinder doesn’t make individual security recommendations. The below merely represent a broader theme we wish to highlight.

ChatGPT did not write this article.

Believe me, I tried. Prompt after prompt. Question after question. Darned thing refused to state a thesis and support it. It couldn’t analyze or take a stand.[i] All it could give me was a deluge of mealy mouthed on the one hand/on the other verbal ballast. The stuff of mindless search engine-baiting web copy and maddening chat bots, not anything creative. In my opinion, anyone saying this is an imminently huge investment wave is reaching.

I hear many saying they want to invest in AI. But that is a bit of a misnomer: The term is a big catch-all. ChatGPT, the fad du jour, is one manifestation. There are loads of others, all using and applying machine learning in different ways. Some focus on data science. Others zero in on image recognition. Task automation is another biggie. Then of course we have boondoggles like self-driving cars. Contrary to the impression you might get from the ChatGPT headlines, AI has also been around a long, long time. Here in Silicon Valley, .ai startups have been a dime a dozen for years. Legions have failed. I am hard pressed to even call the AI enthusiasm generated by ChatGPT heat chasing, considering there is a lot of evidence that an AI startup bubble inflated and popped years ago. Now, in this longer-term perspective, it seems more like we are seeing the late stages of that implosion, with large, publicly traded companies slashing AI funding and headcount. It was all rather like the blockchain craze, just with fewer international eyeballs on it.

ChatGPT comes from the generative pre-trained transformer (GPT) corner of the AI realm. GPT’s other offshoots have learned to create art, and it won’t be long until you can tell a program “Write a symphony that blends the styles of Mozart and Kraftwerk” and get a strangely melodic and spacy opus back in three seconds. But that also introduces one of the chief problems standing in the way of this technology’s full use in the long term: It is potentially a giant, repeat violation of the Digital Millennium Copyright Act and other intellectual property law. The aforementioned artificially created art is all based on other people’s original works. ChatGPT, which was trained on previously existing articles, web copy and social media posts, basically spits out a collage of other people’s work. Now, one could argue all art is theft. The White Stripes aped Led Zeppelin, who emulated Robert Johnson. But there is a sharp line between tribute and plagiarism, and the courts have largely sided with songwriters whose chord progressions mysteriously appeared in someone else’s work. Who knows how legal standards will evolve as GPT use becomes more widespread, but several artists are keen to see legal precedents crack down.[ii] That is a potential long-term business risk. (And, perhaps, a business opportunity for those who dream up solutions.)

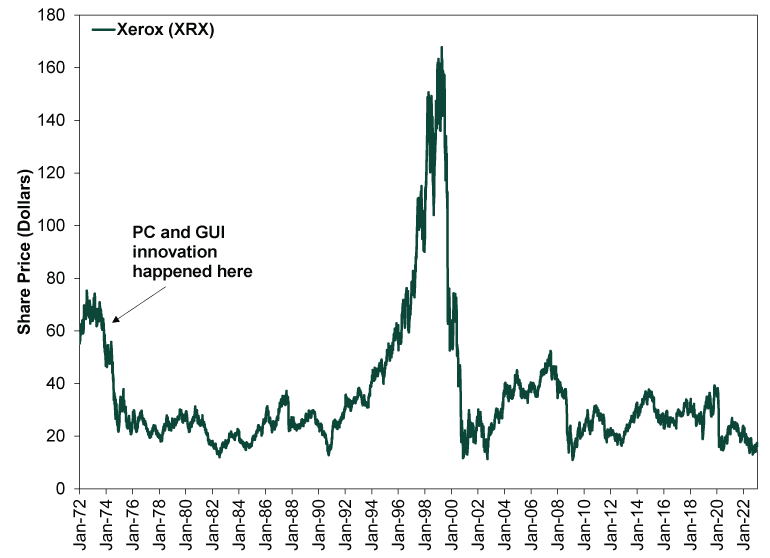

People liken GPT technology to the advents of the personal computer and the Internet, implying this is the start of Tech’s next great wave—which must certainly sound appealing after more than a decade of widespread whining that Tech was tapped. And hey, maybe it is true. But it also makes me think a lot about Xerox PARC. This was the groundbreaking research outlet that pioneered the PC and graphical user interface (GUI) in 1973. Those breakthroughs went stratospheric, reshaping life as we know it. But it wasn’t a commercial enterprise. It was a pure research entity, much like the company behind ChatGPT, and it was wholly owned by Xerox (XRX). And, well, that would have made capitalizing on its breakthroughs by owning the developer juuuuuuuuuuuust a bit complicated. As Exhibit 1 shows, the breakthroughs happened about two decades before XRX boomed alongside Tech in the 1990s, and those two decades were basically a wilderness for its shareholders.

Exhibit 1: Beware Investing on Breakthrough Hype

Source: FactSet, as of 2/10/2023. Xerox stock price, 1/21/1972 (first trading record) – 2/9/2023.

In other words: The exciting-but-niche developments at the bleeding edge of Tech then were too limited to base an investment on. In my view, the very same holds about much of AI now. Companies involved may have valid exposure on the margins of their businesses, but it isn’t central to them—and one shouldn’t base an investment thesis to own or not own something on that.

Here is my entirely speculative wild guess about how AI will go. Some of its applications will spawn pure-play companies and mini-industries that go through speculative bubbles. Most of that will probably play out in the not-publicly traded world, leaving angel investors with big tax writeoffs. Meanwhile, clever machine learning researchers, many of them probably self-taught, will continue training algorithms to do some very cool things in the real world. You might see improvements in medical imaging, credit evaluation and other seemingly everyday things. Companies will probably use machine learning to cut costs and get more efficient. Much like 3D printing, the Internet, semiconductors and other core technological developments, the real long-term winners will probably be the creative users in all the industries that use the tech to generate earnings over time. There will probably be some nifty investment opportunities. Maybe you will start one of these businesses!

But if you do, chances are you will probably start with a model that developers have trained and loaded onto a public site like GitHub—yes, you read that right, a lot of the base code in this world is open source and available to anyone with a working knowledge of Python. Tech startups with a .ai domain might get some notoriety for packaging these into user-friendly applications, but they will be far from the only players on the field, especially as the hardware that underpins machine learning gets faster, more powerful and cheaper. Who will win? Only time will tell.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.