Personal Wealth Management /

Don’t Let the Politicking on Gas Prices Fool You

Wednesday’s Congressional hearing was classic grandstanding—unlikely to yield anything meaningful for gas prices (or stocks).

Editors’ Note: As always, our commentary is intentionally non-partisan. We favor no politician nor any party and assess political developments for their potential economic and market impact only.

Congress indulged one of its favorite pastimes Wednesday: a public roasting of energy executives. Lately, politicians, mostly Democratic ones, have accused the industry of price gouging, and a couple of Senators have proposed windfall profits taxes. Wednesday’s hearing appeared aimed at building momentum for this effort, with members of the House Energy and Commerce Committee demanding to know why gas prices have risen more (in percentage terms) than oil and not eased alongside crude in recent weeks. For their part, Republican politicians seem mostly to rely on the same talking points we recently discussed here. Experience, economics and simple logic tell me that anything Congress does to “fix” this situation will probably do more harm than good, so it is a blessing for stocks that gridlock will likely block any bills Wednesday’s hearing spawns. Let us explore why that is the case.

The allegations at the hearings are similarly more politics than substance. For one, gas prices have ticked down slightly for three straight weeks.[i] This hasn’t fully reversed the spike, of course. But then again, oil prices haven’t fully reversed the war-fear-fueled jump. WTI crude oil—the US benchmark—is down from $123.64 on March 8, but at $96.23 as of Wednesday’s close, it is still above pre-invasion levels.[ii] Now, gas prices tend to follow oil at a lag, so gas’s failure to match oil’s rate of decline over the past four weeks isn’t a shock. But politicians rarely let facts get in the way of a good rant, so the House committee made a fun chart. It showed gas prices staying high and mostly level for the past week while oil bounced lower—but for fun and maximum shouting, it had oil and gas on separate y-axes and skewed the axis intervals so that gas prices looked higher than oil. As you would expect, they gestured to this chart a lot.

The oil execs, who were probably thankful to be appearing via video conference rather than having to sit in Congress physically, offered some simple, logical answers why gasoline prices haven’t matched the magnitude of oil’s retreat. Some cited rising costs and shortages of drilling equipment as well as transportation bottlenecks. Others pointed out that the industry is still dealing with the wild swings induced by lockdowns, which brought swift production cuts—and then a need for fast restarts when the companies didn’t have the labor or equipment to oblige.

Those are all good points. I would offer a third reason: Oil isn’t the only big ingredient in gasoline. Yes, friends, the ethanol mandate is still a thing. Gasoline sold in the US is required to have a certain amount of ethanol blended with refined petroleum—typically around 10% of every gallon. Ethanol is a “renewable” fuel derived from corn, which has jumped in price since Vladimir Putin invaded Ukraine—which is a major producer of both wheat and sunflower oil. The invasion wiped out Ukraine’s exports of both, scrambling demand for alternative grains, cereals and cooking oils. Corn falls in the center of that Venn diagram, as it is a grain that also—like sunflower—makes a cooking oil with a high flash point. Corn is now up 42.2% over the past six months, and unlike crude oil, it hasn’t backed down from the post-invasion spike.[iii] Demand from all corners is keeping the price high, and that is feeding into prices at the pump.

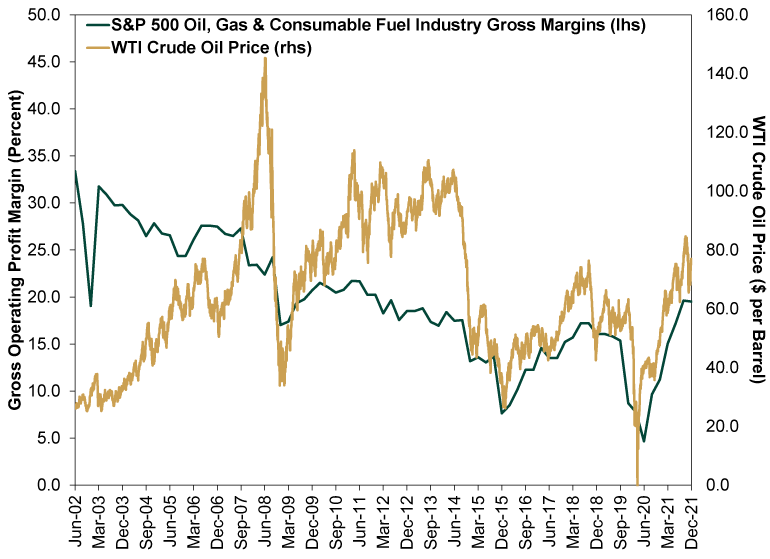

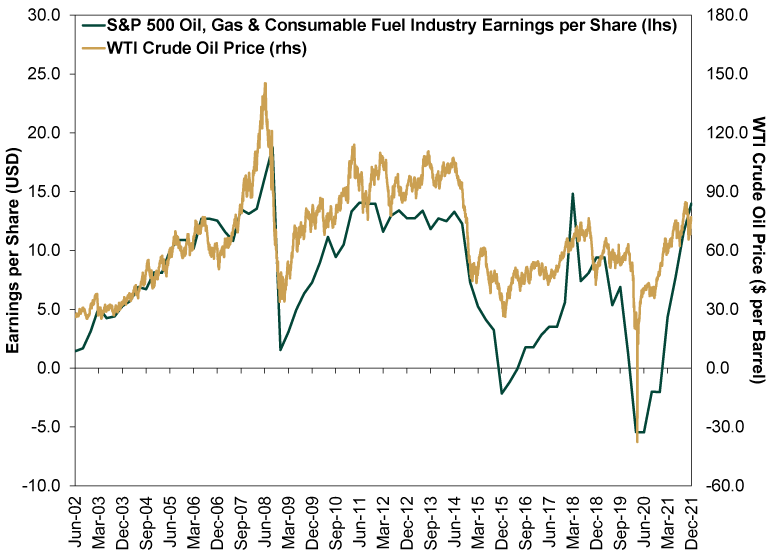

But Congressional hearings are rarely about facts, especially when the facts put Congress’s past deeds in a bad light. True to form, most of this hearing seems like a masterclass in midterm politicking: find hot-button issue, press the blame button and advance a policy solution, even though it isn’t likely to pass. Enter a couple of Senators’ windfall tax proposals. Many claim these taxes are necessary because Energy firms are restraining supplies and production to keep prices up, tied to “financial discipline” demanded of oil firms by investors. We understand the emotional appeal, but for one, there isn’t much evidence of actual windfall profits. Consider Exhibits 1 and 2, which show US Oil, Gas and Consumable Fuel companies’ gross operating profit margins and earnings per share, respectively, alongside WTI oil prices over the past 20 years. As you will see, gross margins were actually smaller in Q4 2021 (the latest data available) than in much of the early 2000s, when oil was much lower than it is today. Now, margins and earnings alike are roughly in line with the early 2010s, the last time oil was expensive.

Exhibit 1: S&P 500 Oil Companies’ Gross Margins

Source: FactSet, as of 4/6/2022. S&P 500 Oil, Gas & Consumable Fuel Industry gross operating margins, quarterly, and WTI crude oil price, daily, 6/30/2002 – 12/31/2021.

Exhibit 2: S&P 500 Oil Companies’ Earnings per Share

Source: FactSet, as of 4/6/2022. S&P 500 Oil, Gas & Consumable Fuel Industry earnings per share, quarterly, and WTI crude oil price, daily, 6/30/2002 – 12/31/2021.

We also have to remember the reason companies are talking up discipline: The long stretch of rock-bottom (and even negative) earnings when oil was dirt cheap in the mid-2010s, following overproduction earlier that decade, and during the pandemic. Cost cuts endured during these stretches probably help explain earnings’ fast recovery after the pandemic. Right now, businesses have significant doubt as to how long this oil price spike lasts, as the widely feared shortage doesn’t appear to be materializing. Russian crude, as we wrote yesterday, still has plenty of buyers. If that persists and the war ends relatively soon, one can easily see prices falling further back pretty swiftly.

Above and beyond that, though, Energy is a cyclical business, and companies won’t survive if they can’t bank on having good times to counterbalance the bad. If eventual profits can’t offset losses, there is no math there for shareholders or creditors. Essentially, a windfall tax implemented now would punish companies for surviving. Moreover, it would destroy the incentive to invest. What is the point in stomaching the high upfront costs it takes to drill and pump new wells if there is a risk the government will confiscate your profits retroactively? How can you plan? Retroactive taxes kill investment, and doing this in the oil and gas industry would probably whack US oil production, making prices even higher over time.

On the bright side, the likelihood this goes anywhere rounds to zero. The 50/50 Senate hasn’t managed to pass anything contentious and probably won’t start now—not with Democratic Senator Joe Manchin, who has effective veto power, representing a state with a big natural gas and coal industry. Midterms currently look poised to deepen gridlock next year. Angry tweets and shouts might stoke fear and hit sentiment, as is normal during midterm campaigns, but markets should quickly see this is likely to go nowhere.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.