Personal Wealth Management / Market Analysis

Rising Rates, Stocks and the Myth of the Yield Chaser

What do rising interest rates mean for stocks?

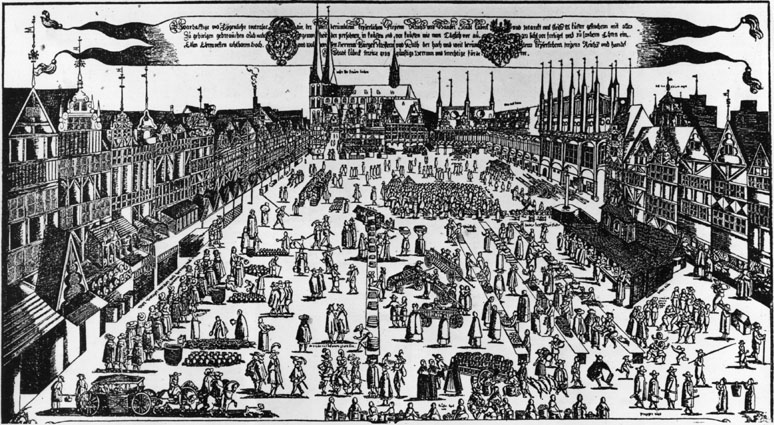

Rising interest rates shouldn’t much disrupt global commerce, which is currently bustling like this 18th-century drawing of a German bazaar. Photo by Hulton Archive/Getty Images.

Interest rates are rising, and if you believe the headlines, that’s bad for stocks. Or hard for stock investors to navigate. Or good for stocks. Confused? We don’t blame you. But we do have good news! You can tune out the noise, because bond rates don’t drive stocks. Myriad other fundamentals do, and those drivers point to more bull market.

Fact: Stocks can and do rise along with interest rates. They can also fall, zigzag or go sideways. Ditto for when rates fall. (Exhibit 1)

Exhibit 1: S&P 500 and 10-Year US Treasury Yields

Source: Federal Reserve Bank of St. Louis, as of 8/19/2013.

The chartspans nine equity bull markets, including the current one, and the 10-Year US Treasury yield has risen during each. Sometimes it rose (on balance) through a full bull and bear; other times it rose intermittently during a bull. Similarly, stocks have risen during periods of falling yields, but yields also dropped during most of the past two bear markets. There just isn’t a meaningful relationship between stocks and bond yields.

Some say there is a philosophical case for stocks to fall when rates rise this time—they claim investors will get yield-hungry and flip from stocks to bonds. However, this assumes folks have done the reverse in recent years—data strongly suggest otherwise. Rates have hovered near generational lows for much of this bull market, yet mutual fund flow data (a rough proxy for individual investor behavior) show bond funds had only four months of net outflows from March 2009 through May 2013. Stock funds, by contrast, had 30 months of net outflows. And in June and July—with rates rising—bond funds witnessed their biggest net outflows in five years. Yield, it seems, is less of a motivator than many think.

Consider why people typically own bonds, though, and this makes perfect sense. Investors’ asset allocations depend on their long-term goals. If an investor has an all-bond or blended stock and bond portfolio, they likely need or want lower expected short-term volatility. For these folks, jumping from bonds to stocks just because yields fell since 2009 wouldn’t have made sense—it would have thrown their portfolios’ expected risk and return characteristics out of whack. More likely, yield-chasing fixed income investors ditched US Treasurys for investment-grade corporates or other securities with more similar risk/return profiles. Not stocks.

Equity investors also have little reason to jump to bonds if rates rise. Most don’t buy stocks for yield—they usually own them for long-term growth. Provided stocks’ market outlook is favorable, switching from equities to an asset class with lower expected long-term returns wouldn’t make sense—the opportunity cost would be too high. That’s especially true when you consider rising yields means falling bond prices—bonds’ expected total return would be inconsistent with these investors’ goals.

Philosophical arguments aside, what’s most likely looking ahead? In our view, more bull market. Sentiment remains stuck between skepticism and optimism, and investors’ expectations are still too dour. Earnings are still growing and beating estimates. Economic data, though not stellar, are better than most appreciate. Leading Economic Indexes are high and rising globally. The forward-looking components of the US, UK and other nations’ PMI surveys are gangbusters. Air and shipping freight volumes are up, pointing to rising global trade. Reality likely continues beating expectations, lifting stocks higher.

Higher bond yields aren’t inherently negative for any of these—they just ... are. An interesting development, but for equity investors, that’s about it. Sure, there are potential risks for stocks—always are—but in our view, rising rates aren’t among them.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.