Personal Wealth Management / Economics

The Government Shuts Down

The government shutdown that began midnight Tuesday helps add clarity to the potential market impact of both recent budget squabbling and the debt ceiling.

Smithsonian visitors will be impacted by the government shutdown. What about stocks? Photo by Spencer Platt/Getty Images.

Political grandstanding and finger pointing hit a fever pitch Monday night as the clock ticked off the final seconds in the US federal government’s fiscal year 2013. As the clock expired, so did the continuing resolution (CR) funding government operations—triggering a government shutdown many have argued spells doom for stocks. Yet history shows government shutdowns have little influence over stocks—echoed once again Tuesday. In addition, this event portends a similar lack of impact should the debt ceiling debate result in a similar, temporary stalemate.

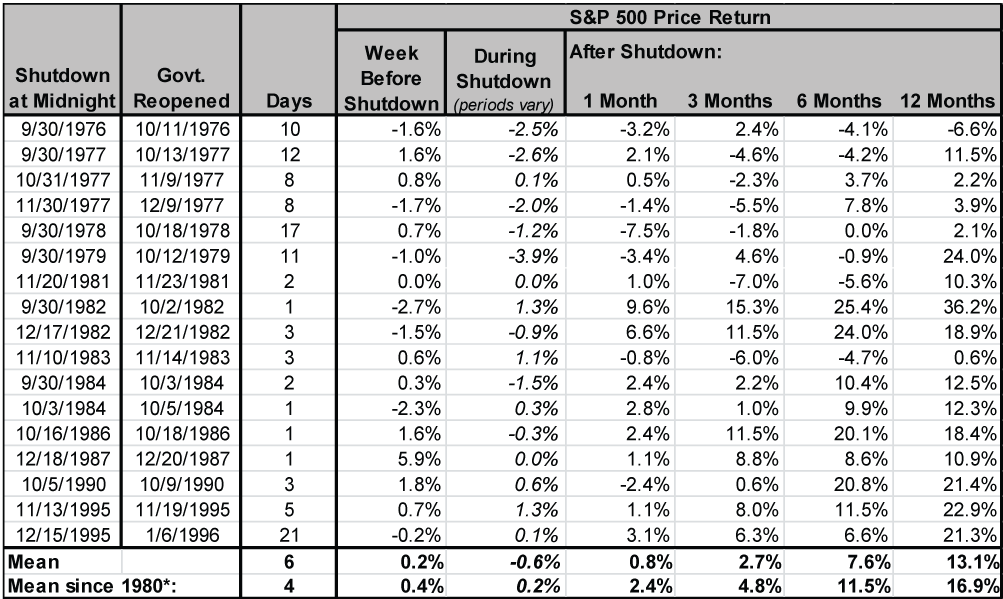

The latest shutdown is the 18th since the mid-1970s. The durations of the preceding 17 varied, ranging from one day to 21. Some argue there might be lasting sentiment impact from this event—that’s how you get some economists’ assumptions the shutdown will drag Q4 GDP down significantly. And if it would drag down the economy, one might presume there is a history of persistent equity market negativity during government shutdowns. Yet history shows little such influence. Exhibit 1 shows the 17 shutdowns since 1976. Prior to 1980, fewer agencies closed doors during shutdowns, making them arguably less comparable to today—operating on the presumption Congress didn’t intend them to close. The government’s more strict interpretation of the Antideficiency Act resulted in more sweeping closures since, but as shown, the average return during a shutdown is better in the post-1980 period. Either way, though, historical shutdowns have had little (if any) market impact in the short or long term.

Exhibit 1: US Federal Government Shutdowns and the S&P 500

Source: Thomson Reuters, Congressional Research Service, Fisher Investments Research.

This isn’t to say there is no impact. Government employees and contractors could feel the shutdown, in some way, shape or form. Those agencies and employees without a direct connection to the public safety may see delays or interruptions in work and pay. For them, the shutdown carries some short-term pain, though it’s overwhelmingly likely they’d be made whole retroactively when the shutdown ends.

In the present shutdown, White House filings show the most impacted agencies will be the National Park Service, the IRS, the Environmental Protection Agency (EPA), the National Labor Relations Board (NLRB) and the Commodity Futures Trading Commission (CFTC). 93% of EPA employees will be home, 99% of NLRB and 96% of CFTC. The Bureau of Labor Statistics is also affected—which may delay the release of September’s Employment Situation report, due Friday. Yet it’s hard to see how such closures will affect most American businesses’ profitability, particularly since many major American firms have a global reach.

What else can you glean from government shutdowns’ lack of impact? That you shouldn’t worry about the debt ceiling, either.

The Treasury is currently estimating the debt ceiling will be reached in about two weeks’ time (no official word on how the government shutdown may impact this as yet). Should lawmakers not raise the debt ceiling, the Treasury will have to take other steps, like prioritizing payments. They have ample tax revenue to cover payments on the federal government’s debt. (In fiscal 2013, debt-interest costs are estimated at 9% of federal tax revenue.) Meaning the US won’t default on its debt, provided the government puts debt service near the top of the priority list—an overwhelmingly likely step, if not constitutionally mandated. (Some claim the 14th Amendment’s Public Debt Clause in Section 4, as interpreted by the Supreme Court in Perry v. United States (1935) forbids default.)

A government with prioritized payments likely looks about the same as a shut-down government. Agencies and employees directly tied to public safety receive funding; the National Park Service closes; EPA, NLRB and CFTC shift to skeleton staff.

Tuesday at midnight, the uncertainty of a government shutdown evaporated—as did much of the debt ceiling debate’s uncertainty, for those choosing to see through the fog of political battles.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.