Personal Wealth Management / Financial Planning

Why Use a Global Benchmark

No region is permanently superior to any other.

With a few days left in the year, the S&P 500 is up 29.2%—poised to outperform developed-world stocks outside the US.[i] Some might add, “again.” You see, since the post-lockdown bull market began in March 2020, US stocks are far ahead of the rest of the world, which comes after the overall US-led 2009 – 2020 bull market. This may have some questioning the benefits of global diversification. Why invest globally, when the US has led so frequently of late? But in our view, that notion is recency bias at work. Take a longer view to see that no country—not America nor any other—is likely to lead forever.

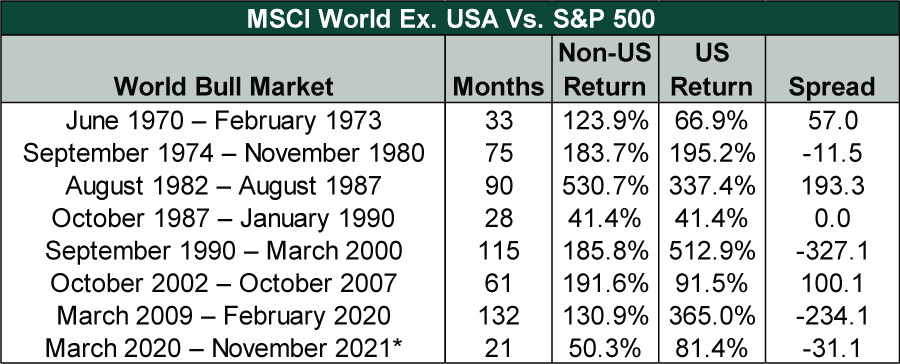

Exhibit 1 shows why investors shouldn’t ignore the rest of the world. In the eight world bull markets since 1970—including the current one so far—the MSCI World Index excluding the US led the S&P 500 in three, drew about even in two and lagged in three.

Exhibit 1: World Bull Markets, Non-US and US Returns

Source: FactSet, as of 12/28/2021. MSCI World ex. USA return with net dividends and S&P 500 total return, December 1969 – November 2021. Note: Returns use month-end data, which won’t match returns using daily data. *So far.

Yes, three of the past four bull markets—including the present—have been US-led. We think the US will likely continue leading in this bull market, too, as it is home to most global Tech and Tech-like companies. Regardless, we think it is a mistake to assume US leadership will persist always and forever—perhaps one based on recency bias, which presumes what just happened will run indefinitely.

Leadership moves in cycles, not only on a country basis, but for styles and sectors, too. That often drives regional relative performance. Notably, as the table above depicts, America’s outperformance during the 1990s, 2009 – 2020 and current world bull markets coincides with long stretches of Tech- and growth-stock leadership. The only bull-market-long break in its leadership occurred in the aftermath of 2000’s dot-com crash, when Tech largely languished during 2002 – 2007’s bull market.

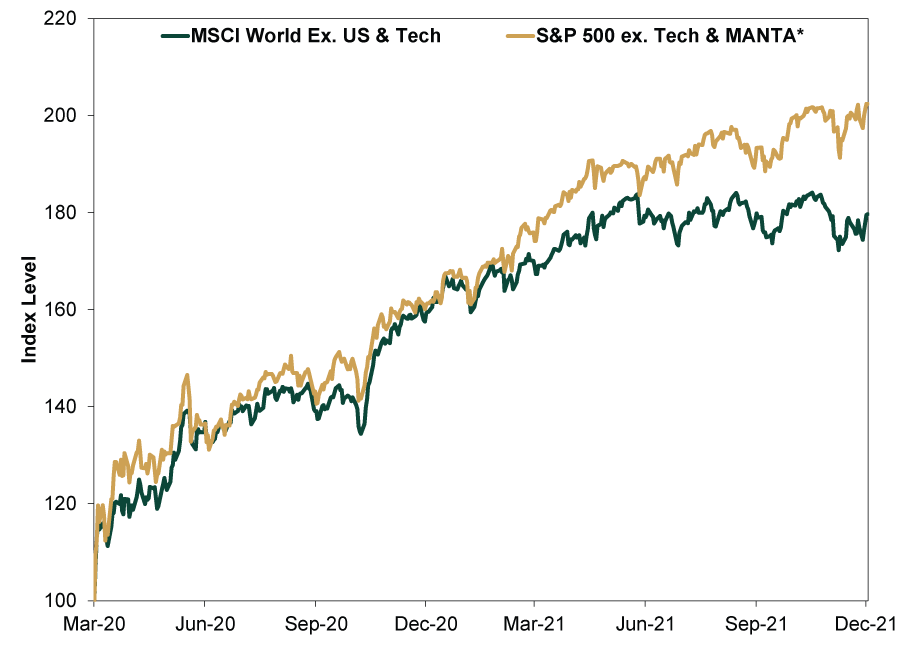

Exhibit 2 shows this differently. If you exclude the Tech sector and a handful of huge, growth-oriented, Tech-like stocks in Consumer Discretionary and Communication Services, the US’s lead versus the rest of the world shrinks markedly. Consider the current bull market. If you took out Tech and America’s Tech-like stocks, returns from the US and non-US world were roughly even through this June. Since then, they have diverged, mostly as US Consumer Discretionary (sans Tech-like firms) and Health Care stocks have pulled ahead of their non-US counterparts. We suspect this could be due to COVID variants and relative lockdown effects hitting non-US sentiment disproportionately. If it is sentiment-driven, we would expect the gap to close before too long.

Exhibit 2: US Outperformance—Mainly a Technological Illusion

Source: FactSet, as of 12/28/2021. MSCI World excluding USA and Tech return with net dividends and S&P 500 excluding Tech and MANTA total return, 3/23/2020 – 12/24/2021. Indexed to 100 at 3/23/2020. *Meta (née Facebook), Alphabet (née Google), Netflix, Tesla and Amazon.

In any event, looking under the hood like this shows you why an America-only focus can be needlessly limiting. Global positioning gives you more opportunities to diversify Tech and Tech-like holdings. Tech and similar growth stocks globally have outperformed, for the most part. Just outside the US, their weightings are smaller. There are also better opportunities for non-Tech growth outside the US, including Pharmaceuticals (many are European) and select Machinery firms targeting long-lasting economic trends (e.g., Japanese industrial automation specialists).

Not only that, but an important tenet of investing is to always know you could be wrong. In our view, that suggests you should have some exposure to value stocks just in case. The menu of value-oriented companies is bigger outside the US. Positioning portfolios for what you don’t think is especially likely can pull you through the times when things don’t go your way. We don’t think it will, but if growth falters and value stocks take up the mantle, getting some broad exposure to value can be to your advantage.

A global benchmark provides you more options—and opportunity, which we think is invaluable for long-term investors. In our view, that is the essence of global diversification: allowing you to achieve wise portfolio management.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.