Global Diversification

Many investors understand the benefits of diversification. The idea of spreading your portfolio investments across different asset classes, sectors or market capitalizations to help reduce volatility makes sense and can be vital to long-term investment success.

While investors often have diversification in mind when developing an investment strategy, many US investors aren’t nearly as diversified as they think. The reason? They often fail to look outside of their home country—forgoing additional investment opportunities and potential sources of international diversification.

Domestic + International = Global Investing

While it is true the US is the world’s biggest, most dynamic and diverse economy, other countries make up a significant part of the global economy. The US represents more than half the value of the world’s stock market and about 26% of the global economy.[i].

Exhibit 1: MSCI World Country Weights

Country leadership tends to alternate. Since investors have no easy way of knowing which country will outperform in a given year, it can be beneficial to invest in both domestic and international markets at any given time.

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.

Options for Global Diversification

US investors have several choices when it comes to adding international stocks to their portfolios. If you have a smaller portfolio, you could invest in international-focused mutual funds and exchange-traded funds (ETFs). However, high net worth investors with larger portfolios may be able to better achieve sufficient diversification by purchasing individual international stocks, domestic stocks and other securities. Global investing may mean conducting additional research, but the benefits can be worth any extra effort involved.

A Potentially Smoother Ride with Global Benchmarks

International and domestic equities can yield significantly different returns from year to year. However, these differences can even out over long periods of time. Building your investment portfolio by referencing a global benchmark index can help give you a solid framework for portfolio construction. Generally, the more diversified a benchmark index is, the lower the volatility should be. For example, if you build your portfolio based on a benchmark based only on US small cap growth stocks, that group of companies will likely experience more volatility over time than a broader US index like the S&P 500.

Similarly, building a portfolio that references a global stock benchmark may help reduce your portfolio’s volatility even further than tracking only a US stock benchmark over time. This is because the broader global approach can give you the investment opportunities to help offset the risk of steep dips or spikes experienced by a single country, sector or business.

We live in a global economy, and many of the macroeconomic forces acting on US stocks may impact international stocks differently. Though returns from US and non-US stocks are often correlated, they don’t always behave similarly. Blending US and international stocks may help lower volatility over the long term.

Reducing Risk through Global Diversification

Adding international stocks to your portfolio can help spread market risk across countries, currencies, industries and companies. Think of it as a way to help diversify away some of the risk related to regional geopolitical tensions, changes in economic conditions, natural disasters or other unexpected events. By diversifying in this way, you may help reduce the risk of investing in only one country.

The broader your investment choices, the more opportunity there generally is to help diversify away sector, size, style and single-country risk. You can still experience downside volatility, but diversifying across global stocks can help smooth the volatility a bit and build more of a cushion than a narrower domestic opportunity set might.

Capitalize on Rotating Country Leadership

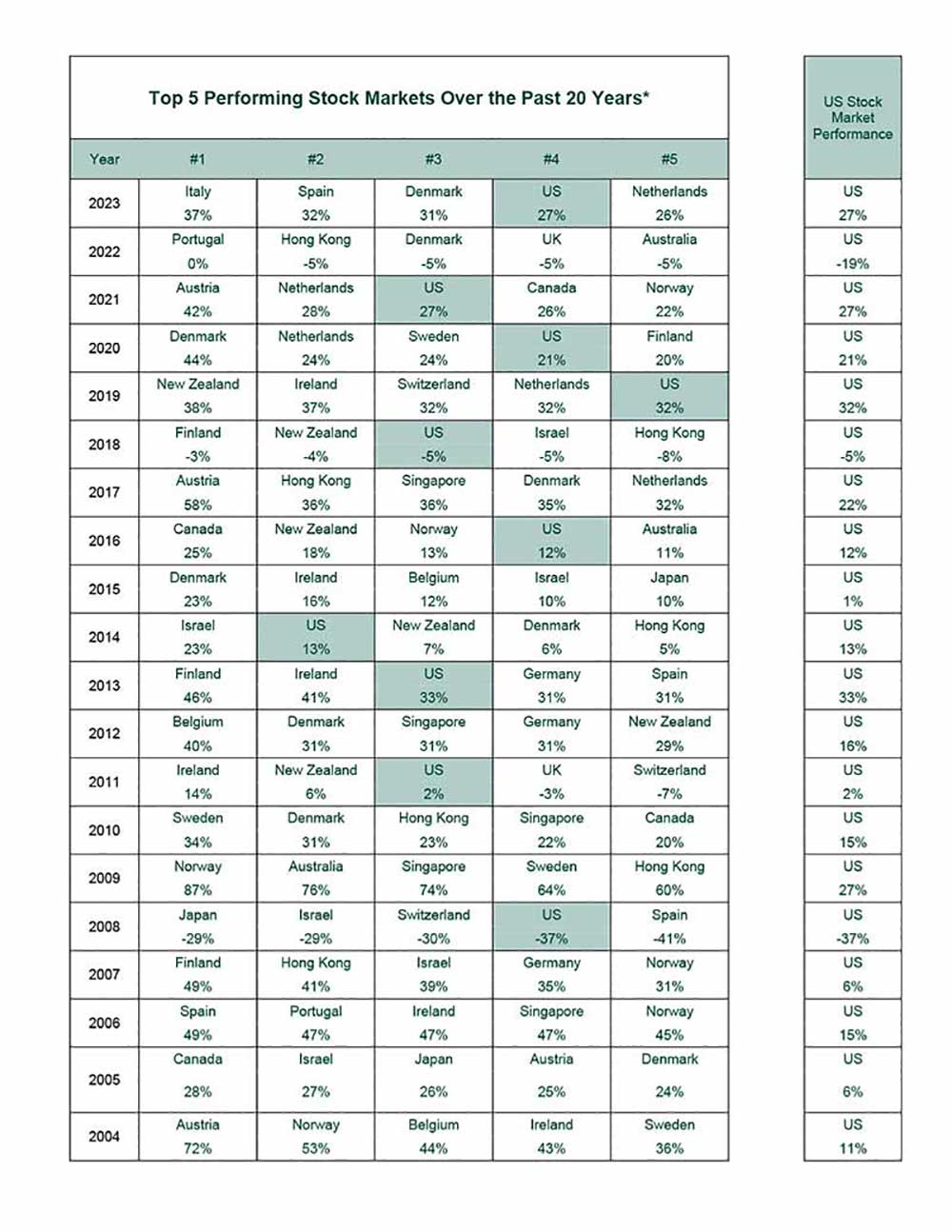

In addition to exposing you to additional risk, investing only in US stocks can also lead to missed growth opportunities in other countries. Between 2002 and 2021, the US was one of the five top-performing countries only nine times, as shown in Exhibit 2.[ii] If you failed to invest internationally during that time, you may have missed out on some of the best growth opportunities in more than half of those years.

Exhibit 2: Top-Five-Performing Stock Markets Over the Past 20 Years

No single country is a top performer all the time, and there is no perfect way to know whether US or international stocks will emerge as a global leader or for how long. Deciding to invest in only one part of the world at the wrong time could prove to be a costly mistake.

In addition, some of today’s largest and fastest-growing companies are located outside of the US. While the US might make up a significant portion of certain sectors—like Information Technology and Industrials—some of the largest Materials and Energy companies are actually located outside of the US.[iii]

We Can Help with Global Investments

Analyzing financial markets is no easy task, and navigating global markets can be challenging for many investors. If you would like to learn how Fisher Investments can help you diversify your portfolio among US and international investments, contact us today!

[i] Source: FactSet. The portfolio above reflects the MSCI World Index as of 7/31/2024. The MSCI World Index measures the performance of selected stocks in 23 developed countries. Values may not sum to 100% due to rounding. Pacific includes four developed market countries: Australia, Hong Kong, New Zealand and Singapore

[ii] Source: FactSet, as of 1/5/2023. The above returns reflect the Total Returns of the top 5 performers of the 23 developed countries that comprise the MSCI World Index, 12/31/2002 - 12/31/2022. All returns are presented in dollars. All returns are net of international withholding taxes, except for US, which are gross.

[iii] Source: FactSet; MSCI World Index as of 9/2/2022.