Factors to Consider Prior to Setting Your Asset Allocation

Before designing a retirement portfolio, it is important to first identify the following:

Most investors live longer than they expect thanks to ongoing medical advancements. Life expectancies can also vary, so when planning as a couple, it’s advisable to plan your investment time horizon based on the partner or heir with the longest life expectancy.

Choosing Your Asset Allocation

If you are relying on your investment portfolio to partially or totally fund your retirement, your portfolio’s returns must be enough to help ensure you can take your desired withdrawals throughout your investment time horizon and not run out of money.

Some investors think they should stop investing in stocks once they retire, perhaps shifting their assets to “less risky” investments with lower volatility. If you’ll need to rely on investment income for the rest of your and your partner’s lives, it’s possible your portfolio will need to keep growing after you retire. Making a material change away from a growth-focused strategy might increase the risk that your portfolio depletes before intended. Hence, stocks are often an essential component for long-term investors seeking portfolio growth to achieve retirement goals.

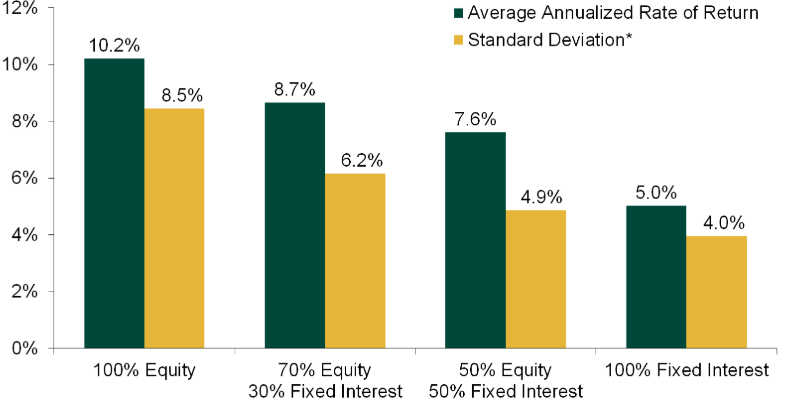

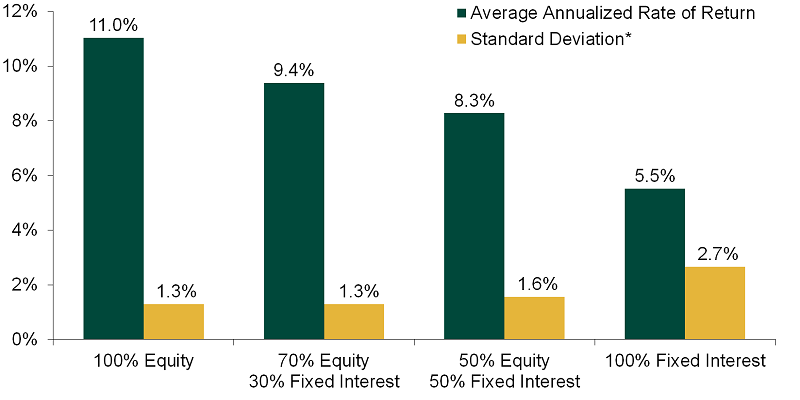

Stocks have generally offered higher returns than bonds, cash and other securities, but also have higher short-term volatility. However, as the investing time frame increases, stocks exhibit a higher likelihood of positive returns. The following exhibits illustrate hypothetical portfolios with different allocations to stocks and bonds, measured over 5- and 30-year rolling periods. Over 30-year rolling periods, portfolios weighted toward stocks maintained a higher average return with lower volatility than portfolios with higher bond exposure. We believe these longer time frames are better proxies for an investor’s true retirement investment time horizon.

5-Year Rolling Periods

30-Year Rolling Periods

*Standard deviation represents the degree of fluctuation in historical returns. The risk measure is applied to 5- and 30-year annualized returns in the above charts.

Source: Finaeon, Inc., as of 2/12/2025. Average rate of return from 12/31/1925 through 12/31/2024. Equity return based on Finaeon, Inc.'s World Return Index, Fixed Interest return is based on Finaeon, Inc.'s Global USD Total Return Government Bond Index.

Measuring Short-Term Concerns Against Long-Term Success

When reviewing your asset allocation, it’s important to look beyond short-term volatility. Consider the risk of not reaching your long-term goals or, worse, running out of money during retirement. An overly conservative approach could seem less risky and more comfortable in the short term, but may not generate the returns needed to grow your portfolio sufficiently. This may result in unexpected and potentially unpleasant changes to your lifestyle.

Once you choose the right allocation, it’s important to stick with it, absent major changes to your long-term goals. Changing your allocation in reaction to short-term volatility is almost always a mistake, in our view. Discipline can often be the difference between meeting or missing your goals.

Additional Retirement Income

At Fisher Investments, we can help you determine how to fund your retirement, including the optimal amount to take from your investment portfolio if withdrawals are needed. During the goal-setting process, we help you determine how much money you need each year to support your desired lifestyle. Then, we consider where that money comes from: portfolio withdrawals or non-investment income. If you have non-investment income, we’ll help you determine what you should expect to receive each year.

Common Non-Investment Income Sources

- Salary: If you plan to work during retirement, include your expected salary. Only include direct payments from your employer (versus a business investment or partnership).

- Pension: If you have an employer pension, determine how much you expect to receive each year and whether that amount will increase or decrease over time.

- Social Security: If you’re currently taking Social Security, then you know how much to expect. If you haven’t started yet, you’ll need to determine when to start receiving benefits and how much to expect each month.

- Business and Real Estate: If you maintain an interest in a business or investment property, this could produce non-investment income; however, these income sources are often more susceptible to uncertainty than Social Security benefits or a guaranteed pension.

Common Investment Income and Cash-Flow Sources

- Stock Dividends: Dividend-paying stocks can play a role, but they shouldn’t be your sole focus. Dividends aren’t guaranteed and many dividend-paying stocks are concentrated in a few sectors. Like all major stock categories, there will be periods of outperformance and underperformance.

- Homegrown Dividends: Homegrown dividends are generated by selling stocks for cash flow. This approach allows greater flexibility in maintaining your portfolio balance and carry the potential to offset gains or losses.

- Bond Coupons: If you own a bond, you’re essentially lending money to a borrower. In return, the borrower repays your initial investment at a predetermined date, while paying interest along the way (i.e., coupon payments).

- Cash: Cash is readily accessible and can be a useful source for immediate or unexpected income needs. However, holding too much cash can mean missing essential portfolio growth and falling short of income needs.

- Annuities: Annuities are insurance products that offer regular payments over time, once annuitized. They can carry a variety of risks that can easily overwhelm the benefits: high fees, complex restrictions like surrender charges, and fixed payments that don’t account for inflation.