Personal Wealth Management / Politics

Setting Expectations With Turkey and Greece

Turkey and Greece offer a timely reminder to separate hype from reality.

A week into summer and based on financial publications we cover, moods are warming toward a couple parts of the old Ottoman Empire: Turkey and Greece. These Emerging Markets have a limited global market presence, but every now and then, we think they can illustrate key investment lessons.[i] Here is a big one we think they show now: Monitor how expectations align with reality. According to our research, when the former outpaces the latter, disappointment tends to follow—a factor we think is worth keeping in mind given recent buzz surrounding political developments in Turkey and Greece.

A Turkish Delight for Investors?

After Turkish President Recep Tayyip Erdogan won last month’s general election, extending his 20-year reign by another 5 years, some financial commentators we follow argued Erdogan’s new appointments could prompt market-friendly economic policy changes. His naming internationally respected economist Mehmet Simsek and former US bank executive Hafize Gaye Erkan as finance minister and governor of the Central Bank of the Republic of Turkey (CBRT), respectively, stirred hope amongst some market analysts we track of a pivot to more traditional economic policies (and away from the unorthodox view—which Erdogan subscribed to—that high interest rates cause inflation).[ii] We noticed expectations were high leading up to the CBRT’s June meeting, and we read some analyst projections that the CBRT’s benchmark interest rate would double, triple or even quadruple in response to sky-high inflation (which clocked in at 39.6% y/y in May).[iii]

Given those predictions, last Thursday’s 650 basis-point hike from 8.5% to 15% disappointed some market observers we follow. Other recent moves suggest the CBRT favours incremental changes over dramatic measures, as it tweaked, rather than dropped, a few rules that artificially propped up the lira. For example, Turkish banks have to hold lira-denominated bonds amounting to a certain percentage of their foreign exchange deposits—and the CBRT dropped this securities maintenance ratio from 10% to 5%.[iv] Domestic financial institutions also must pay a higher maintenance requirement if lira-denominated securities were less than 60% of total deposits—now the threshold is 57%.[v] The upshot of these updates, according to our analysis: relaxing the government’s push for Turkish consumers and businesses to hold fewer US dollars—a policy akin to capital controls, which historically can prevent money from flowing to where it may be most efficiently deployed, based on our research.

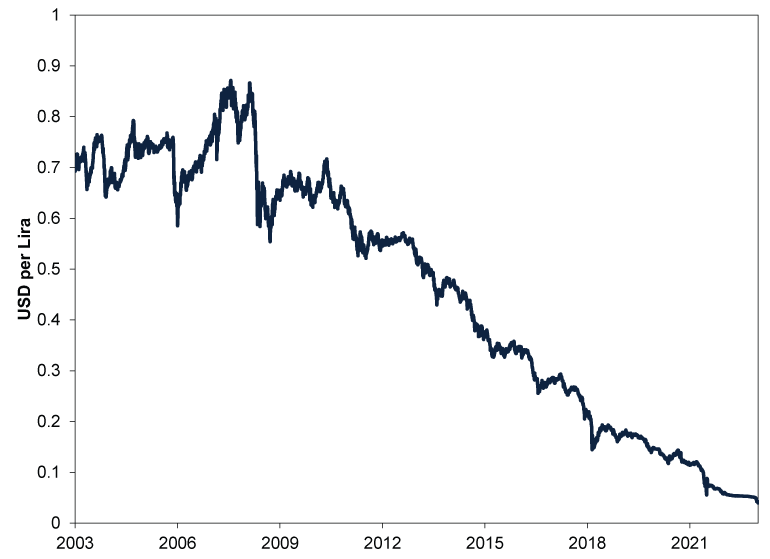

In response to these moves and the news the CBRT no longer appears to be using reserves to buy the currency, thereby propping up its value, the lira fell to a record low against the US dollar earlier this week.[vi] We don’t think this is surprising: Policymakers removed their support for the currency, and the interest rate hikes seemingly have a way to go before meeting markets’ expectations. That said, the lira’s weakness isn’t a secret: It is down -25.3% relative to the dollar year to date and has steadily weakened for the better part of the past decade.[vii] In our view, this suggests markets are well aware of Turkey’s long-running economic issues, which include high inflation and the government’s frequent economic intervention.[viii] (Exhibit 1)

Exhibit 1: The Lira in the Erdogan Era

Source: FactSet, as of 26/6/2023. USD per Turkish lira, 23/6/2003 – 23/6/2023.

Looking ahead, we don’t think conventional economic policies are a given in Turkey, even with Simsek and Erkan at the helm. Simsek has said the Treasury and Finance Ministry will take a gradual approach in order to reduce the risk of disruptive side effects, implying more measures to restore normal market functioning are in store.[ix] That is possible, but in our view, what matters for markets is how reality meshes with expectations. Erdogan has a history of replacing policymakers that didn’t play by his book. Consider, over the past five years, Erdogan fired three central bank governors; installed his son-in-law as finance minister (who later resigned, ostensibly due to health reasons); and sacked a finance minister for publicly opposing CBRT rate cuts.[x] Erdogan even axed the head of the state statistics agency for reporting record inflation.[xi] If expectations for normal economic policy in Turkey get too hot relative to even mild progress, we think that could tee up disappointment for markets.

What to Make of a Greek Revival

Greece has a new government after centre-right New Democracy took 40.5% of the country’s second national vote in as many months on Sunday, as incumbent Prime Minister Kyriakos Mitsotakis’s decision to dissolve parliament after winning May’s election paid off. Under the new electoral system, winning parties that pass the 40% threshold receive bonus parliamentary seats—so New Democracy looks set to take 158 seats in the 300-seat parliament. The new majority government was sworn in Monday, and voter and investor expectations seem high. As one Greek pensioner put it, “I expect a lot (from the new government) … The main thing is the health system, the economy, so we can live (decently) because things are difficult.”[xii] Similarly, we have seen investors theorise a Mitsotakis government will continue to push reform progress and put the nation on track to reclaim an investment-grade rating on its debt.[xiii]

However, in our view, forward-looking markets have likely pre-priced much of this hope already. Greek stocks are up 32.7% year to date, vastly outpacing broader Emerging Markets (0.2%).[xiv] With the bar so high, can the government meet lofty expectations—let alone exceed them? Time will tell, but according to our research, governments with outright majorities don’t necessarily pass everything they promise on the campaign trail. The Hellenic Republic can look to the French Republic for that lesson, as President Emmanuel Macron’s huge coalition majority in 2017 didn’t yield major legislative change.

[i] Source: FactSet, as of 29/6/2023. Statement based on market capitalisation of Turkey and Greece, respectively, as percentage of MSCI Emerging Markets Index, as of 28/6/2023. Market capitalisation is a measure of an equity market’s size, calculated by multiplying share price times shares outstanding.

[ii] “Explainer: Are Turkey’s Efforts to Fix the Economy Working?” Suzan Fraser, Associated Press, 19/1/2022.

[iii] Source: FactSet, as of 28/6/2023. Inflation refers to broadly rising prices across the economy.

[iv] “Turkey Central Bank Simplifies Rules Under New Governor,” Inci Ozbek, Bloomberg, 25/6/2023. Accessed via Yahoo! News.

[v] Ibid.

[vi] “Turkish Lira Flat After Touching Record Low, Central Bank Reserves Up,” Nevzat Devranoglu and Ali Kucukgocmen, Reuters, 27/6/2023. Accessed via Nasdaq.com.

[vii] Source: FactSet, as of 26/6/2023. Statement based on change in USD per Turkish lira, 31/12/2022 – 25/6/2023.

[viii] See note ii.

[ix] “Lira Slump Deepens as Turkey Insists on Gradual Changes,” Staff, Bloomberg, as of 23/6/2023. Accessed via MSN.com

[x] “Turkey’s Erdogan Appoints a Former Goldman Executive as its New Central Bank Chief,” Lee Ying Sha, CNBC, 9/6/2023; “Son-in-law's Instagram Resignation Hurts Erdogan, Turkish Officials Say,” Orhan Coskun and Nevzat Devranoglu, Reuters, 9/11/2020, accessed via Yahoo! News; and “Nebati Replaces Elvan as Turkey's New Finance Minister,” Ezgi Erkoyun, Daren Butler and Ece Toksabay, Reuters, 2/12/2021, accessed via Financial Post.

[xi] ” Erdogan Fires Statistics Chief Amid Inflation,” Staff, Deutsche Welle, 29/1/2022.

[xii] “Greek conservatives storm to victory in repeat election,” Renee Maltezou and Angeliki Koutantou, Reuters, 25/6/2023. Accessed via MSN.com

[xiii] “Greek Assets Surge as Vote Puts Nation on Path to Credit Upgrade,” Aline Oyamada, Bloomberg, 22/5/2023. Accessed via Yahoo! News.

[xiv] Source: FactSet, as of 29/6/2023. MSCI Greece Index and MSCI Emerging Markets Index returns with net dividends, in GBP, 31/12/2022 – 28/6/2023.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.