Personal Wealth Management / Politics

The Recent Past, Present and Future of the Debt Ceiling

There are lasting lessons from this saga we hope the investing public internalizes … but probably won’t.

Editor’s Note: This post deals in politics, so please note that MarketMinder favors no politician nor any political party, assessing developments solely for their potential market impact (or lack thereof).

We could. But now isn’t time for us to go all we told you so. Congress striking a last-minute debt-ceiling deal commentators unquestioningly tout as “saving us from default” days ahead of a deadline was simply too predictable. This is how debt-ceiling fights go. Yet somehow, every time it comes up, pundits suddenly seem to get mass amnesia and fear this time is truly different. But 2023’s wasn’t different—and we have strong doubts the next time will be, either. Let us take a quick tour of the year’s debt-ceiling theatrics, detail the deal the GOP and Biden administration struck—and explain why this likely won’t be the last debt-ceiling fight in history. Print this column out for use when the debt ceiling comes back in 2025.

President Biden’s signing the deal Friday ends a saga that has run basically all year. It began in early January, when the newly elected Congress convened and the Republicans struggled to nominate a speaker in several rounds of votes. Knowing the US government was nearing the $31.381 trillion limit, headlines abounded with worry: How could a divided government with a fractious House majority possibly pass a debt ceiling increase given the immense partisan angst?

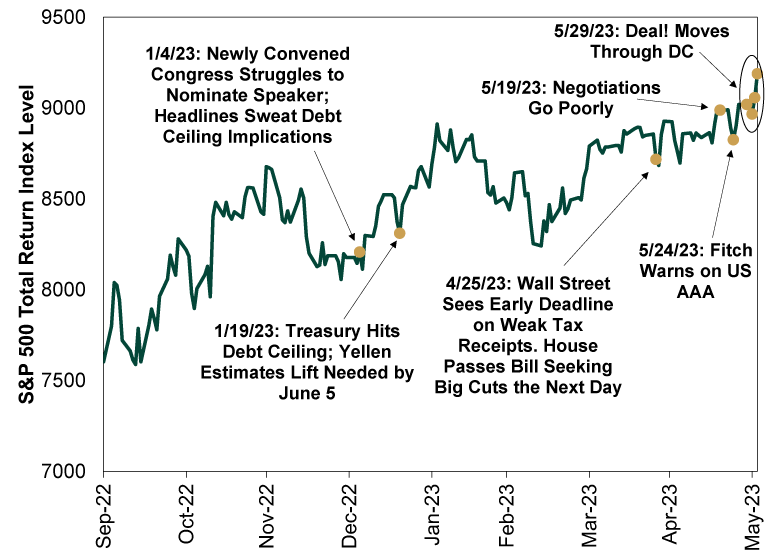

Days later, on January 19, Treasury confirmed the government had hit the debt ceiling, with Treasury Secretary Janet Yellen writing that it must be lifted by June 5 for the government to meet all its payments. In between those marks, there have been hundreds of columns written erroneously handwringing over “default” and cooking up bizarre means to subvert the ceiling when Congress failed to reach a deal. Wall Street’s and the Treasury’s estimated deadlines have shifted around, leading many to fear time was growing short. Politicians’ acrimonious talk has been common, alongside on-again, off-again negotiations. But as Exhibit 1 shows you, US stocks have been overall rising throughout the spat.

Exhibit 1: Debt Ceiling Looms, Stocks Go Up

Source: FactSet, US Treasury, CNN, Bloomberg and The Wall Street Journal, as of 6/2/2023. S&P 500 total return index, 9/30/2022 – 6/2/2023.

Moreover, as Bloomberg reported when the House passed the deal, agreement on this year’s debt ceiling deal was more bipartisan than any in the last decade, as 165 Democratic representatives and 149 Republicans voted for it. Of the occupied House seats, 37.9% of Democrats and 34.3% of Republicans voted for the bill—the most even support of any debt-ceiling lift since 2011.[i]

Maybe someone ought to show that stat to credit-ratings agency Fitch, which based its decision to put America on negative credit watch last week in large part on “political partisanship [that] has brought about repeated debt-limit brinkmanship.”[ii] Yet despite the broad deal passed with ample time to spare by historical standards, Fitch could still downgrade. As we noted last week, 2011’s Standard & Poor’s downgrade came after the deal lifting the debt ceiling was done. And, of course, ratings agencies are comprised of people (we think)—not a market function. You can’t presume they will behave in a fashion that may seem linear and logical. That being said, downgrades usually don’t send rates skyrocketing.

What’s the Deal?

The deal wasn’t just bipartisan from a vote standpoint—it was a compromise that let both sides claim a win or two while, in reality, not changing much. Happily, it suspends the debt ceiling until January 2025, kicking the can until after 2024’s presidential election. That will give everyone plenty to campaign on without having the Damocles sword of “default” hanging over the proceedings.[iii] And it potentially sets up another fun House speaker battle similar to January 2023’s!

As for what Congress duct-taped to the debt ceiling suspension, the biggest item getting headlines is the non-defense budget “cuts.” These are not spending cuts, despite the terminology some have used in describing this—rather, they are smaller future projected spending increases. Under the deal, non-defense spending will be flat in 2024 and rise 1% in 2025. Meanwhile, defense spending will rise 3% in 2024 and another 1% in 2025. Yes, yes, yes, this is slower than inflation presently. But governments never really negotiate this stuff in real terms. Regardless, this isn’t draconian austerity that likely risks tipping the US economy into recession, as some feared. It is also not some deficit-slaying hero budget, as some cheered. It is just business as usual.

Under the hood, non-defense spending did get rejiggered a bit. Remember that $80 billion IRS funding increase that inspired so much chatter in last year’s Inflation Reduction Act (IRA)? Congress is now reallocating some of it, slashing the projected funding by $21.4 billion (including a $1.4 billion clawback of funds already doled out) to beef up other programs. Consider this your friendly reminder that spending passed by one Congress regularly gets revised by the next one (and the one after that, and the one after that, and …). It also reallocates $27 billion in unspent COVID aid money, further supporting spending elsewhere.

There was also compromise on the welfare front, which is entirely sociological but illustrates just how bipartisan this deal was. When House leadership initially proposed using the debt ceiling deal to tighten work requirements for food benefits, the White House came out with a hard no. But both sides sanded down their positions, and the final deal tightens requirements for able-bodied adults without dependents while eliminating them for veterans, homeless folks and young people just out of foster care. Each side got a bit of what they wanted, while leaving enough to campaign on next year.

Lastly, the deal speeds up large energy and infrastructure project permitting, addressing another perceived shortcoming of the IRA. Lately, the permitting process has taken nearly five years, but the deal caps the timeline at two. It also streamlines the process, putting the reviews under the purview of a single federal agency—ending the byzantine system where multiple agencies demanded a say, dragging things out. And it speeds up the last permits for the Mountain Valley Pipeline, which never made it into the final IRA. Here, too, there was some bipartisan cheer … as well as plenty of room for heated 2024 campaigning.

So in the end, we have about the most vanilla debt ceiling deal you could imagine. It buys a decently long reprieve while tinkering with a few issues at the margins but mostly extending the status quo. It lets both sides boast and complain simultaneously. And it gives plenty for these people to fundraise on next year, which is of course the real utility of the debt ceiling to begin with.

Why the Debt Ceiling Won’t Disappear Forever

At the same time, this is obviously a suboptimal way to set fiscal policy. Accordingly, there is a lot of talk about eliminating it, to which we give a hearty hear, hear! It is an arbitrary measure, a political tool that doesn’t actually limit debt. Rather, it just sets up one of the world’s most annoying political circuses. Would that it went the way of the dodo. But don’t hold your breath, as we don’t see a viable path to its demise in the near future.

There are currently three main ways the debt ceiling could bite the dust, but none look realistic. The first is a suit filed by the National Association of Government Employees earlier this month, which doesn’t outright challenge the debt ceiling in principle but argues that by enabling the Executive Branch to cancel spending previously passed by Congress if the Treasury can’t cover all payments due, it violates the separation of powers. The suit argues that for the debt ceiling to be constitutional, Congress would have to set “the order and priority of payments once that limit is reached, instead of leaving it to the President to do so.” Further, it says: “Nothing in the Constitution or any judicial decision interpreting the Constitution allows Congress to leave unchecked discretion to the President to exercise the spending power vested in the legislative branch by canceling, suspending, or refusing to carry out spending already approved by Congress.”

In theory, the court could agree and strike down the debt ceiling entirely, ordering Congress to rewrite the statute to comply with the ruling. However, we are skeptical that it will get anywhere near that far, as the union was filing under the threat of furlough if failure to lift the ceiling resulted in a partial government shutdown. That threat is now gone and the presiding judge postponed the hearing that had been scheduled for this week. It is now off the docket indefinitely and seemingly stands little to no chance of emerging from purgatory.

Elsewhere on the legal front, the Biden administration has mooted asking the courts to declare the debt ceiling incompatible with the 14th Amendment, which states “the validity of the public debt of the United States … shall not be questioned.” The logic: If the 14th Amendment requires the government to pay its debt, and the debt ceiling puts that in question, then the Constitution supersedes the statute. Before the debt ceiling deal was final, there were rumblings that the Biden administration could use this logic to continue issuing debt, unilaterally defying the ceiling. That didn’t happen, of course, leading Biden to hint he may pursue legal action before the ceiling comes around again in hopes of killing it pre-emptively.

This, too, seems like a stretch—and not just because the Supreme Court has taken a wholly different interpretation of the 14th Amendment, which points to prioritizing interest payments above all others. Rather, there simply isn’t a case right now. The White House can’t just ring up the Supreme Court and ask them to deliver an opinion on a key question ad hoc. There must be a case, and it must wend its way through the system. Any filed today would likely hit the same wall as the federal union’s suit—the lack of a timely and relevant question to decide. There is no logical trigger for a lawsuit until it becomes an urgent question in 2025.

The third option is probably the least likely by far: Congress simply voting to abolish it. We reckon the fat lady will sing at the largest ski resort in the ninth circle of Dante’s inferno as pigs fly overhead before this happens. As much as they all complain about it, they like it too much! Both sides like the grandstanding. They like the finger pointing. They like the viral social media clips. They like having fresh content for fundraising emails. They like having big wedge issues to hype on the campaign trail. This is among their favorite toys. They won’t give it up. No politician would ever surrender something so useful and lucrative. Better to wield it while the opposition is in power, and decry it when your party leads. That is the history of this tool.

When the Next Fight Comes …

With the debt limit unlikely to vanish, how you approach fear over it is key for investors. So here are a few principles worth keeping front of mind.

- When the debt ceiling arises, the question isn’t how bad would a “default” be. Nor does failing to lift the ceiling mean the government “runs out of money,” as we have heard so much lately. The right question is: Would failing to lift the debt ceiling ensure default?

As we have written many times, the answer is no. Default is one thing: failure to pay US Treasury bond interest and principal. The government can roll over maturing bonds without breaching the limit, so interest is the only question—and the government gets ample tax revenue to cover that. Furthermore, it is constitutionally required to pay debt interest before other expenses.

- As noted, the debt limit is a political tool, used to extract concessions from the opposition that you can market to your base. As repulsive as it may be, think like a politician for a moment: If failing to lift the ceiling actually threatened default and a financial calamity, how would that bolster your support?

- For all the talk of acrimony, it is overwhelmingly likely Congress will act. For one, if they didn’t and America didn’t default, “poof” goes the tool’s effectiveness, in politicians’ eyes. But at the same time, as this year shows, they won’t do so too soon, using it to gain maximum attention and eyeballs.

So when we get to 2025 and the debt ceiling is back from the suspended abyss, remember that the financial apocalypse you have been told it risks is a false fear—something extremely unlikely to actually materialize. Don’t let the lessons of countless fights fade from your mind.

[i] “Debt-Limit Deal Passes the House, Easing US Default Concerns,” Erik Wasson and Billy House, Bloomberg, 5/31/2023. We calculated percentage support by dividing votes for by total occupied House seats (including those who didn’t vote).

[ii] “Fitch Places United States' 'AAA' on Rating Watch Negative,” Staff, Fitch Ratings, 5/24/2023.

[iii] We know. But we’re using this in the modern colloquial sense, not the strict literary allusion sense.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.