Personal Wealth Management / Market Analysis

British Rate Hikes Aren’t Bearish, Either

Stocks and UK bond yields usually do just fine after the BoE raises rates.

The Bank of England (BoE) meets Thursday, and the whole financial world expects policymakers to set the Bank Rate at 0.5%. Once upon a time, people considered this low—indeed, when former BoE Chief Mervyn King set the Bank Rate there at the end of 2007 – 2009’s financial crisis, it was an all-time low. But then his successor, Mark Carney, tested the lower bound further with a 25-basis point rate cut after the Brexit vote. A couple of rate hikes and one pandemic later, Carney’s successor, Andrew Bailey, dropped the rate down to 0.1% in March 2020. Now, if the BoE acts as expected, the move to 0.5% will be the second-straight rate hike—a first since 2004. As in the US, investors are penciling in several more rate hikes in the coming months, and many worry rate hikes will send long-term bond yields skyward and stocks spiraling. Yet also like the US, history disagrees.

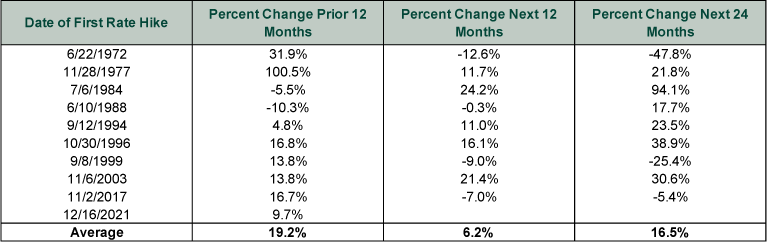

Exhibit 1 shows UK stock returns before and after the first rate hike in every completed tightening cycle since the MSCI UK’s 1969 inception. As it demonstrates, returns after rate hikes are positive more often than not, with only two rate hikes occurring within a year of a bear market beginning. The BoE wasn’t the bear market’s proximate cause on either occasion. In the early 1970s, it was the fallout from transatlantic price controls and the oil shock. In 2000, it was the Tech bubble’s implosion, which rippled globally after starting in the US that March. The only other time when returns 12 months after a rate hike were materially negative was following November 2017’s increase. Then, UK stocks got caught up in global stocks’ twin corrections, which stemmed first from trade war fears and then, at yearend, from the wave of hedge fund selling we discussed a few weeks back. The BoE’s rate hike preceded the first correction by nearly three months.

Exhibit 1: BoE Rate Hikes and UK Stocks

Source: Bank of England and FactSet, as of 1/31/2022. MSCI UK Index price returns in USD, 6/22/1971 – 12/16/2021.

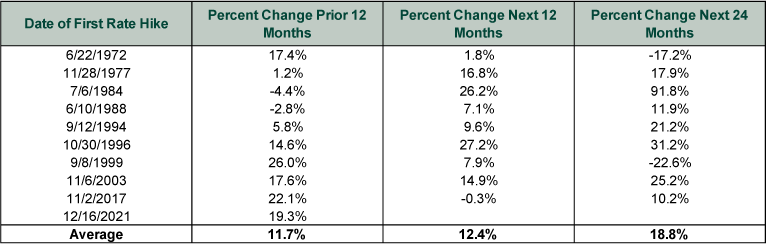

Global returns tell a similar tale, as Exhibit 3 shows, with returns higher on several occasions. In our view, this doesn’t mean UK stocks are inferior—rather, it demonstrates that most of the time, central banks start hiking rates relatively late in a bull market. This matters because the UK’s stock market tilts heavily to value, which usually leads in a bull market’s initial stages. Growth stocks usually take the reins later, which often leads the UK to underperform in maturing bull markets. Note that two of the three times UK stocks did better than global after an initial rate hike—1994 and 2003—the hikes came early in those respective bull markets, before growth assumed lasting leadership.

Exhibit 2: BoE Rate Hikes and Global Stocks

Source: Bank of England and FactSet, as of 1/31/2022. MSCI World Index price returns in USD, 6/22/1971 – 12/16/2021.

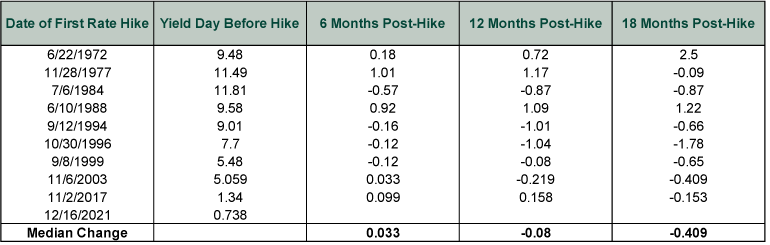

Long-term gilt yields are similarly unbothered by BoE rate hikes, overall and on average. As Exhibit 1 shows, 10-year gilt yields fell much more often than not after rate hike cycles kicked off. The median yield change was barely positive over the next 6 months and negative over 12 and 18 months. We think the reason for this is fairly simple: Markets pre-price widely expected moves, and the BoE—like the Fed—is much more a rate follower than a rate setter. It tends to react to past inflation and data, while long-term rates move ahead of expected inflation. So by the time the BoE raises rates in hopes of curbing inflation, long rates have moved both on the expectation of the inflation the BoE is reacting to and the expectation of the rate hike itself. That saps surprise power, usually leaving rates to fall in the aftermath. Bonds, like stocks, love defying conventional wisdom and broad expectations.

Exhibit 3: BoE Rate Hikes and 10-Year Gilt Yields

Source: Bank of England and Global Financial Data, Inc., as of 1/31/2022. UK 10-year benchmark government bond yield, 6/21/1972 – 12/15/2021.

Some argue rates are especially likely to rise this time because the BoE plans to start letting maturing gilts roll off its balance sheet once the Bank Rate reaches 0.5%—a UK version of the US’s “quantitative tightening” fears. Here, too, we don’t think the consensus view is likely to come true. For one, 10-year US Treasury yields fell, cumulatively, while the Fed let its balance sheet shrink late last decade. Rates did rise at times during that stretch, but the move wasn’t huge or sustained, and it didn’t disrupt the economy. Two, again, bond markets are forward-looking. The BoE released its plan to let its balance sheet run down way back in August 2021. At the time, Bailey said the Monetary Policy Committee would cease reinvesting the proceeds of maturing bonds when the Bank Rate rose to 0.5% and start selling bonds once it hit 1%. That meeting occurred on August 5, when 10-year gilt yields were at 0.525%.[i] They have since risen over 60 basis points, to 1.191% on January 10, before settling back down a bit.[ii] That sure looks to us like markets pricing in impending action.

Mind you, we don’t think rising long rates are a bad thing. Stocks don’t move opposite bond yields, a critical fact most bearish theories today seemingly ignore. Moreover, rising long rates help keep the yield curve steeper, which over a century of economic theory and data show is generally positive for the economy looking forward. That isn’t a market timing tool, but it does suggest capital should keep flowing to productive people and businesses, which adds to economic growth and supports corporate profits. That is what you own a stake in if you own stocks. In our view, it is a telling sign of sentiment that people broadly fear an economic positive—that suggests to us there is plenty of room here for reality to surprise and help propel stocks up the wall of worry. That doesn’t preclude sentiment-driven swings and negativity in the near term, as the past few weeks attest, but we do think it should help stocks rise later this year, as the fog of uncertainty gradually fades.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.