Personal Wealth Management / Market Analysis

Quick Hit: ‘Corporate Profits Recession’ and Stocks—There Is No ‘There!’ There

It isn't unusual for corporate profits to occasionally show a negative blip in a bull market.

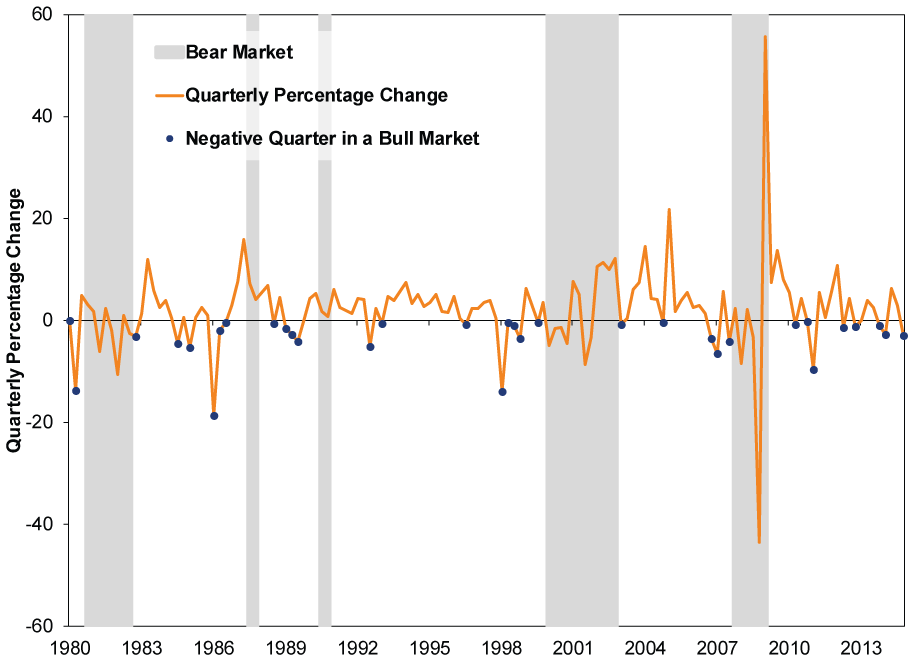

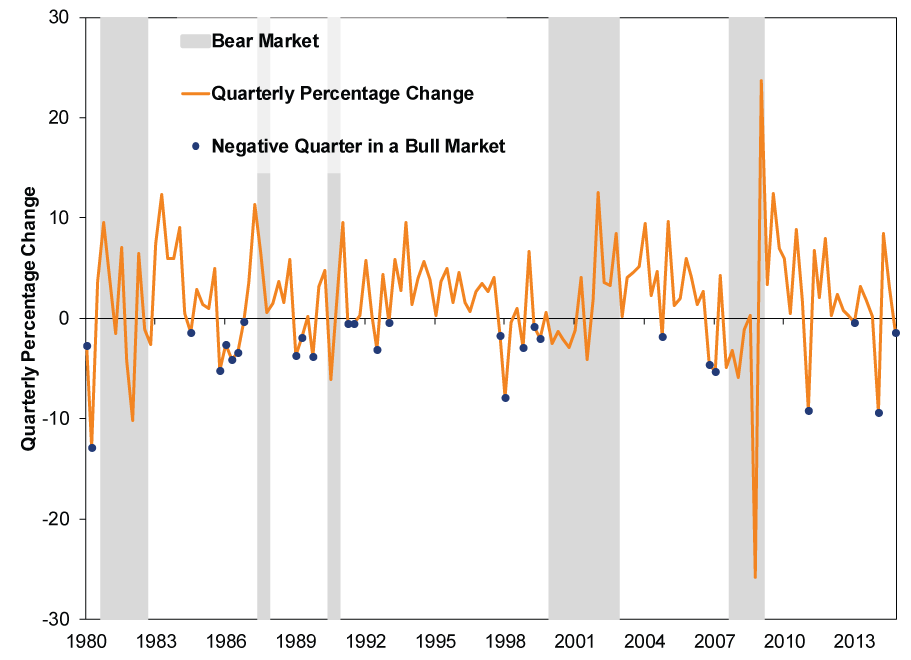

In Friday's third revision to Q4 US GDP growth, one thing that seemed to catch a few eyeballs was a drop in US Corporate Profits[i], which some hyperbolically labeled "the worst news." Others claim a "profit recession"-whatever that means-looms. But here is the thing: A down quarter for corporate profits is not unusual amid a bull market. Here are two charts to illustrate the point. The first shows the Bureau of Economic Analysis' measure of corporate profits excluding depreciation. The second includes depreciation. The gray bars indicate bear markets and the blue dots denote a negative quarter of profits in a bull market. As you can see, such dips aren't exactly rare and occur at random points throughout a bull market and expansion.

Exhibit 1: US Corporate Profits After Tax Without Inventory Valuation and Capital Cost Adjustment

Source: US Bureau of Economic Analysis, Q1 1980 - Q4 2014. Bear market dates are 11/28/1980 - 8/12/1982; 8/25/1987 - 12/4/1987; 7/16/1990 - 10/11/1990; 3/24/2000 - 10/9/2002; and 10/9/2007 - 3/9/2009.

Exhibit 2: US Corporate Profits After Tax With Inventory Valuation and Capital Cost Adjustment

Source: US Bureau of Economic Analysis, Q1 1980 - Q4 2014. Bear market dates are 11/28/1980 - 8/12/1982; 8/25/1987 - 12/4/1987; 7/16/1990 - 10/11/1990; 3/24/2000 - 10/9/2002; and 10/9/2007 - 3/9/2009.

Stock Market Outlook

Like what you read? Interested in market analysis for your portfolio? Why not download our in-depth analysis of current investing conditions and our forecast for the period ahead. Our latest report looks at key stock market drivers including market, political, and economic factors. Click Here for More!

[i]Note: This is the Bureau of Economic Analysis's measure, which is different than public company earnings.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.