Personal Wealth Management / Market Analysis

Why the Strategic Petroleum Reserve Release Isn’t a Game Changer

The US and other countries’ coordinated move doesn’t change longer-term global oil supply much.

After weeks of signaling it was preparing to do so, the Biden administration announced today it will attempt to curb gas prices by releasing 50 million barrels of oil from the Strategic Petroleum Reserve (SPR), part of a coordinated release with China, Japan, South Korea, India and the UK. And in response to this forthcoming supply increase, global oil prices rose. Yes, a move designed to rein in oil prices seemingly had the opposite of its intended effect, illustrating the SPR’s complicated relationship with prices. While moves like these can have a short-term impact—predominantly through sentiment—they do little to change longer-term supply and demand fundamentals.

Oil prices are set globally, on world supply and demand fundamentals. The US’s 50 million barrel contribution to the global release represents less than 0.2% of global production.[i] The full global release will likely be around 65 to 70 million barrels, according to industry researchers’ calculations, which is nowhere enough to move the needle over any meaningful stretch.[ii] This is partly because OPEC also has a great deal of influence on global supply and is reportedly planning a counter move next week. Previously, OPEC was coordinating to increase output by 400,000 barrels per day. If the cartel decides to slow or pause production increases, it would likely neutralize the US’s coordinated supply release. In our view, markets are likely weighing the totality of the global supply landscape.

Even if OPEC sits tight, the SPR release likely has little long-term impact. It might help curb oil and gasoline prices by a bit in the near term, but it won’t alter the longer-term supply and demand landscape. That will depend on private producers boosting output, which is already starting. The US has added 67 oil rigs since the beginning of September, bringing total rig count to 461 as of last week.[iii] Last week’s industrial production report showed oil and gas well drilling rising 9.3% m/m in October, bringing the cumulative increase since July 2020’s low to 93%.[iv] The International Energy Agency (IEA) reported global oil production rose by 1.4 million barrels per day (bpd) last month and penciled in a further 1.5 million bpd increase over the rest of this year.[v] That is just a forecast, but it seems sensible to us based on the rise in drilling activity. As global output rises, it should help supply and demand come back into balance, which should help stabilize prices and ease the pain at the pump.

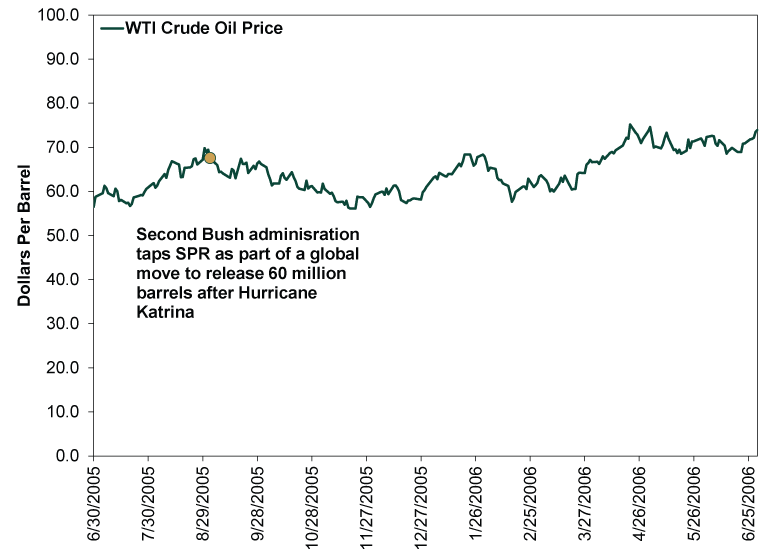

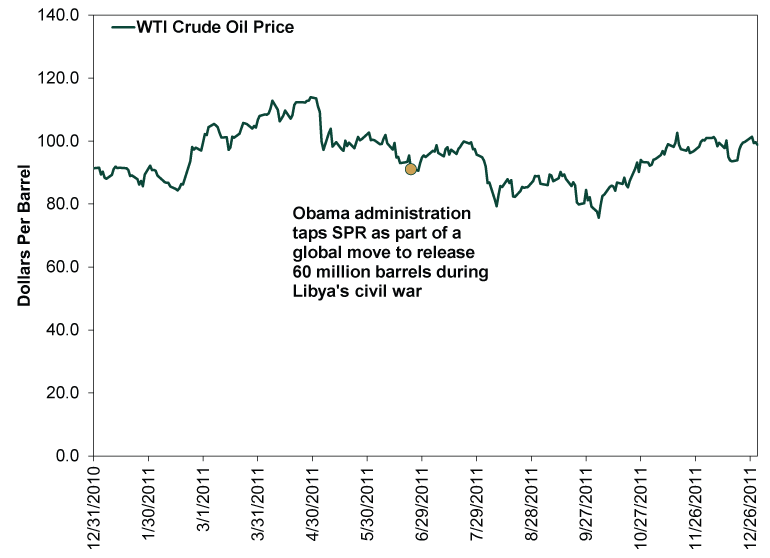

Perhaps the SPR release helps tide drivers over until then. But the history of emergency SPR releases’ impact on prices is spotty. While this is the first time the US has tapped the SPR for the express purpose of taming prices, rather than addressing an acute supply disruption, it is the fourth emergency release on record. The others happened during the first Gulf War in 1991, the aftermath of Hurricane Katrina in September 2005, and during the Arab Spring and Libya’s civil war in June 2011. The results were overall mixed. Crude oil prices did drop immediately after the first Bush administration announced the SPR release in the immediate aftermath of the first US air strikes, but it is an open question whether oil prices’ relief stemmed from the emergency action or the increased clarity on the war’s short duration. (Exhibit 1) Oil prices, like stocks, can be volatile in the run up to a conflict before stabilizing after the fighting starts. In 2005, the US’s release was part of a coordinated global move. Then, too, prices drifted lower as the release bought time for the Gulf Coast’s refineries to reopen after the storm. (Exhibit 2) But by late November, prices were rising again. Finally, in 2011, prices actually rose for a month after the global oil reserve release. (Exhibit 3) Perhaps they would have risen even more had the IEA not coordinated, but that counterfactual is unknowable.

Exhibit 1: SPR and Oil Prices, Gulf War Edition

Source: FactSet, and US Department of Energy, as of 11/23/2021. West Texas Intermediate (WTI) Crude Oil Spot Price, 9/30/1990 – 6/30/1991.

Exhibit 2: SPR and Oil Prices, Hurricane Katrina Edition

Source: FactSet and US Department of Energy, as of 11/23/2021. WTI Crude Oil Spot Price, 6/30/2005 – 6/30/2006.

Exhibit 3: SPR and Oil Prices, Libya Civil War Edition

Source: FactSet and US Department of Energy, as of 11/23/2021. WTI Crude Oil Spot Price, 12/31/2010 – 12/31/2011.

So if you are hoping for the SPR release to lighten the load on your pocketbook this autumn and winter, we suggest tempering your expectations. Maybe it shaves a few cents off the price at the pump, maybe not. But markets are extraordinarily good at solving problems like this, and they have already been hard at work telling producers it is time to ramp up. Those producers are listening, and soon they should deliver a more meaningful, lasting supply increase.

[i] Source: International Energy Agency, as of 11/23/2021.

[ii] “US Joins With China, Other Nations in Tapping Oil Reserves,” Timothy Puko and Alex Leary, The Wall Street Journal, 11/23/2021.

[iii] Source: FactSet, as of 1/23/2021. Baker Hughes Rotary Rig Count, Oil, 9/3/2021 – 11/19/2021.

[iv] Source: FactSet, as of 11/16/2021.

[v] See Note i.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.