Personal Wealth Management / Market Analysis

On Britain's Rising Rates and Debt Service

Whilst some of Britain’s debt costs are linked to inflation, our research shows interest payments aren’t soaring.

Editors’ Note: MarketMinder Europe doesn’t make individual security recommendations. The below merely represent a broader theme we wish to highlight.

Whenever long-term interest rates rise, we find it isn’t long before financial commentators’ focus turns to debt—national debt. It already seemingly has in Britain, with 10-year Gilt yields closing August at their highest since early 2014—2.8%.[i] Our research shows that level isn’t high by global or historical standards. Nor do we think it ties to concerns about the UK’s creditworthiness, as we will explain—rather, we think it is part of a global, sentiment-fuelled wiggle as investors continue overthinking monetary policy institutions’ interest rate hikes. We doubt it sticks for long. Yet it is raising some eyebrows amongst financial commentators we follow because a relatively sizable portion of the UK’s outstanding debt has inflation-linked interest rates, making Britain’s debt service costs more sensitive to consumer price levels than America’s.[ii] Even with this factored in, however, we don’t think UK debt is a ticking time bomb likely to hit the economy or markets in the foreseeable future.

The raw numbers here might seem alarming. UK net debt (which excludes intra-government holdings, or those that the government owns itself) outstanding tops £2 trillion and finished fiscal 2021/2022 at 98.2% of gross domestic product (GDP).[iii] According to the official figures, 30% of the total Gilt pile is inflation-linked, and like rail fares, that linkage is to the antiquated Retail Price Index (RPI), which hit 12.3% y/y in July, creating the spectre of a rapidly rising interest rate bill.[iv]

We appreciate that financial commentators who highlight this risk are focussed on debt service costs, which we think is the best way to look at it. After all, national debt isn’t due all at once. What matters is interest and principal payments due. Governments usually cover principal repayments by refinancing maturing bonds with newly issued bonds. We have long observed that the UK, like the US, doesn’t have problems on this front given Her Majesty’s Treasury’s sterling reputation.[v] We think that renders interest payments the swing factor.

Yet the inflation-adjustment isn’t as simple as applying the RPI inflation rate to the principal value. The Debt Management Office (DMO) helpfully provides a simple tutorial on how the maths work. All inflation-linked bonds have a fixed base rate at issue, which is below the coupon rate for conventional Gilts of comparable maturities. For example, the 50-year index-linked Gilt issued in November 2021 has a base rate of 0.125%, whilst the conventional 50-year Gilt issued in February 2022, when market-based rates were little changed from November 2021, pays 1.125%.[vi] That base rate then gets multiplied by the cumulative change in the RPI since the bond’s issuance (current RPI divided by RPI at issuance) at a three-month lag.

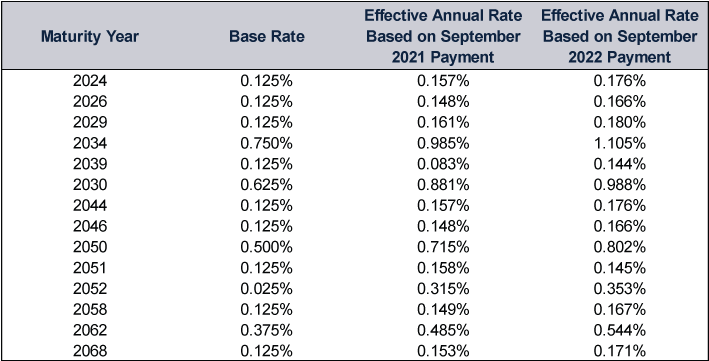

So let us consider the annual rate the coupon payments on that November 2021 bond due next month imply. First, divide June’s RPI level by September 2021’s. That gives you a ratio of 1.10275.[vii] You then multiply that by the base rate, which gives us 0.14%—far below the market rate.[viii] Now, index-linked Gilts’ redemption amount also adjusts the principal for inflation. And bonds that have been in issuance longer normally have larger built-in inflation premiums, but even there, the immediate payment seems to be much less than financial publications we read imply. Exhibit 1 demonstrates this with all the outstanding index-linked Gilts with interest payments scheduled in September that have been in circulation for longer than a year. (We are using these bonds because the DMO has already officially calculated the September payments, making a year-ago comparison possible.)

Exhibit 1: Effective Annual Interest Rates for UK Index-Linked Gilts With Payments Due in September

Source: DMO, as of 31/8/2022. Lists only bonds issued more than one year ago, hence our earlier example isn’t included.

Moreover, the UK’s overall debt service bill remains quite low. Total interest costs for fiscal 2021/2022 were just 12.1% of total tax revenue.[ix] Interest payments’ share of tax revenues were more than double that throughout the 1960s, 1970s and 1980s, yet that didn’t bring a Greece-style debt crisis or default.[x] Our research shows the economic upheaval that occasionally arose in the 20th century’s second half, including Black Wednesday and the Winter of Discontent, stemmed primarily from external factors (defending the European Exchange Rate Mechanism for the former, and political issues and the energy crisis for the latter). If Britain could afford paying over 30% of tax revenues on interest at times in the mid-to-late 20th century, we think it likely can afford paying around 12% now, plus whatever inflation adds to the pile—especially with issuance slowing significantly this year thanks to the end of COVID relief borrowing and economic growth lifting tax revenues.[xi] We know the latter is a very sore spot for those whose salaries have jumped into higher tax bands now that the rate thresholds aren’t indexed to inflation, but from a pure public finance standpoint, objectively, we think it helps.[xii]

None of this is to argue that all is well and rosy in the UK economy right now. We think the higher energy price cap, announced late last week, is a headwind for households.[xiii] Spiralling energy costs are reportedly hitting small businesses hard as well, and shortages of CO2 and other important feedstocks are another negative.[xiv] Most forecasts from commentators we follow project recession (a broad decline in economic activity), and they could well be right. But, in our view, all of these factors are quite well-known to stocks, which we think limits the likelihood of some massively negative surprise from here. Meanwhile, warnings about national debt from financial publications add to the negative sentiment that appears to surround UK stocks, in our view, which we think is creating opportunities for uncertainty to fall as investors gradually realise, however subconsciously, that a crisis doesn’t loom.

[i] Source: FactSet, as of 31/8/2022. UK 10-year Gilt yield on 31/8/2022.

[ii] Source: Debt Management Office (DMO), as of 31/8/2022.

[iii] Source: DMO, as of 31/8/2022. Net debt includes debt owned by the Bank of England as part of its quantitative easing programme (officially named the Asset Purchase Programme), as this debt is marketable, meaning, it will eventually be available for sale. GDP is a government-produced measurement of economic output.

[iv] Source: Office for National Statistics (ONS), as of 31/8/2022.

[v] Pun intended.

[vi] Source: DMO and FactSet, as of 31/8/2022.

[vii] Source: ONS, as of 31/8/2022.

[viii] We are intentionally simplifying this for clarity and argument’s sake. The actual coupon payments, which are paid semiannually, would divide this figure by two, and the inflation-adjustment would change every six months.

[ix] See Note iv. Statement refers to annual interest costs as a percentage of the combined annual revenues on production taxes (which includes value-added tax), income and wealth taxes, and other taxes.

[x] Ibid.

[xi] Ibid.

[xii] “Two Million More People Paying Higher Rate Tax,” Beth Timmins, BBC News, 30/6/2022.

[xiii] “Ofgem Updates Price Cap level and Tightens Up Rules on Suppliers,” Ofgem, 26/8/2022.

[xiv] Source: FactSet, as of 31/8/2022. Statement based on Brent Crude Oil spot prices. “UK CO2 Shortage: ‘Serious Concerns,’ Says Food and Drink Industry,” Anthony Wright, Gasworld, 25/8/2022.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.