Personal Wealth Management / Politics

Our Perspective as Russia Sabre-Rattles in Ukraine—Again

Fear of regional conflict can stoke volatility, but our research finds stocks typically move on quickly.

Buckle up. Satellite images show Russian troops are amassing along the border with Ukraine, and US intelligence agencies have reportedly warned European allies that an invasion is possible. NATO announced its solidarity with Ukraine Monday, raising the perceived risk of Western nations getting dragged into the conflict despite Ukraine not being a NATO member. We have already seen a few articles in financial publications we follow warning an invasion and conflict would bring terrible consequences for the global economy and stocks, and if tensions ratchet up, our experience suggests those warnings will probably get louder and more widespread. We encourage long-term investors to steel themselves against the associated fear now: In researching market history, we have found regional conflict is highly unlikely to cause a bear market (typically a deep, lasting decline of -20% or worse with an identifiable fundamental cause). So whilst fighting is tragic, and potentially a cause for near-term volatility, we think it is a mistake to overrate the threat to stocks.

Now, of course, we aren’t in the intelligence community and have no access to Russian President Vladimir Putin’s plans. This may be all a bluff. It may be yet another move designed to goad the EU into approving the Nord Stream 2 gas pipeline that bypasses Ukraine, although Germany decided Tuesday morning to delay approval anyway.[i] But in the event Russia does invade Ukraine, remember: Markets have sadly dealt with a number of regional conflicts and potential conflicts in recent years. The list is long. The first Gulf War and Bosnian War in the 1990s. US-led intervention in Afghanistan and Iraq and the Hezbollah/Israel dust-up in the 2000s. Libya and Syria in the 2010s. Russia and Ukraine in 2014 over the former’s annexation of Crimea and meddling in eastern Ukraine—and a host of others. In general, when reviewing historical MSCI World Index and S&P 500 returns, we found that if stocks registered the strife at all, they followed the same general trajectory: negativity as tensions escalated and armed conflict became an increasingly realistic possibility, then a recovery as the endgame became clear.[ii]

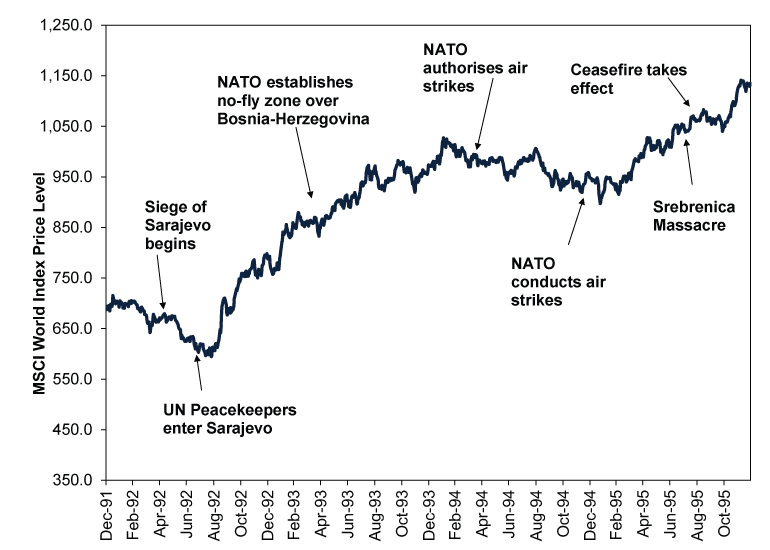

In cases where the endgame was armed conflict, we found that recovery typically arrived as or just after the fighting broke out.[iii] Not because regional war is bullish, but because the fighting ended the uncertainty over whether sabre-rattling would spiral into military action. It ceased the will-they-or-won’t-they and let investors weigh the conflict’s reach. In all these cases, even when major powers were involved, the conflict occurred on a very small swath of the global economy, with no impact on commerce in the developed world or major Emerging Markets. We think that clarity enabled markets to move on quickly. Exhibit 1 details one example: the Bosnian War, which was the most recent conflict on Continental European soil and therefore a particularly relevant comparison, in our view.

Exhibit 1: Stocks and the Bosnian War

Source: FactSet, as of 16/11/2021. MSCI World Index Price Level in GBP, 31/12/1991 – 31/12/1995.

Since good stock market data begin in 1925 with America’s S&P 500 Index in USD, we find that only one conflict has been a bear market’s proximate cause: World War II. In our view, only that war had a big enough footprint to wipe out a significant amount of economic activity. In 1939, when Nazi Germany’s adventurism in Continental Europe began, we think stocks were recovering from the bear market that began back in 1937.[iv] But Hitler’s seizure of the Sudetenland (then Czechoslovakian territory) stopped that rally in its tracks, which we think happened because it forced Europe to confront the full extent of Hitler’s territorial ambitions.[v] Stocks fell sharply as Hitler turned his focus toward Poland.[vi] When Germany did actually invade the country—and France and Britain declared war—the S&P 500 soared.[vii] The uncertainty of a failed attempt to appease Hitler was over.

Stocks headed mostly sideways for several months thereafter.[viii] But when France fell in May 1940—a surprise—the bottom fell out.[ix] The bear market continued throughout 1940 and 1941 as fighting ranged across multiple theatres.[x] Yet a new bull market began in 1942, three years before the war’s end, as stocks seemingly learned to live with the status quo and looked ahead to a time when the global conflict was over.[xi]

So when assessing conflict as a stock market risk, we think it is beneficial to think coldly and critically. Leave out feelings about the human toll. Focus on a simple question: What is the likelihood that, if fighting breaks out, it affects a large enough share of global economic output to cause a recession? Ukraine’s gross domestic product (GDP, a government-produced estimate of economic output) hit $155.6 billion (£115.9 billion) last year.[xii] Global GDP hit $84.6 trillion (£63.0 trillion).[xiii] With a t-r. Based on those numbers, Ukraine is just 0.2% of world output. Simple math dictates that a global recession (a broad contraction in economic activity) would need a much bigger hit, to the tune of a few trillion pounds. Even if NATO members did join the fray, as long as the fighting stayed concentrated in one pocket of Eastern Europe and didn’t engulf the entire Continent, we think stocks would likely move on relatively quickly—much as they did when Russia annexed Ukrainian territory in 2014.[xiv]

Some analysts we follow argue oil and gas make this time different. Russia is one of the main energy suppliers to Continental Europe, potentially making Europe’s energy supply one of the main casualties of a Russian attack, either because of European sanctions or Russian flexing. This, some commentators argue, would cause an energy price spike dwarfing what the world endured in October, causing a global energy and financial crisis. We think it is fair to place this scenario in the realm of the possible, but we don’t think it is automatic or even likely.

For one, consider incentives. Our research shows Russian government revenues depend on strong oil and gas royalties. If Russia stopped selling oil and gas to international clients, it would likely drain state coffers and bring economic instability, which could very well put Putin’s time in office at risk. So whilst it could be disruptive in the near term if Russia cut gas supplies to Europe, we think there is a pretty large short-term incentive not to do so.

In the medium to longer term, if Russia stopped selling to Europe, global supply lines would likely adjust. Europe would probably find new suppliers. How long this would take isn’t totally clear, but in time, we think high prices would encourage even more production in the US, Canada, Brazil and North Africa. Russia would likely have to find new buyers if interruptions persisted for long enough.

So keep an eye on Russia and Ukraine, and mentally prepare yourself in case there is volatility, should conflict materialise. Even if it never arrives, we think it is always better to be ready than caught off guard. But we don’t think it is beneficial for long-term investors to let regional war and rumours of war deter them from a long-term investment strategy tailored to their goals, needs and risk tolerance. History shows investors are overwhelmingly more likely to miss a a continued rise in equity markets than avoid a decline if they do so.[xv]

[i] “Gas Prices Soar as Germany Suspends Approval for Nord Stream 2 Pipeline,” Mark Thompson and Walé Azeez,” CNN, 16/11/2021.

[ii] Source: FactSet, as of 16/11/2021. Statement based on S&P 500 price returns in USD and MSCI World Index price returns in GBP. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.

[iii] Ibid.

[iv] Source: FactSet, as of 16/11/2021. Statement based on S&P 500 price returns in USD. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.

[v] Ibid.

[vi] Ibid.

[vii] Ibid.

[viii] Ibid.

[ix] Ibid.

[x] Ibid.

[xi] Ibid.

[xii] Source: World Bank, as of 15/11/2021.

[xiii] Ibid.

[xiv] See Note ii.

[xv] Ibid.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.