Personal Wealth Management /

Why the ECB’s Hiking Path Doesn’t Seem That Rocky to Us

We find ECB rate hikes could very well carry unappreciated benefits for markets.

Normally, we don’t think monetary officials’ actions to move short-term interest rates to 0% would constitute tightening monetary policy. Yet that is what commentators we follow seem to think since last Thursday, when the ECB announced its intention to hike policy rates by 25 basis points (0.25 percentage point) at its July meeting and beyond.[i] With its deposit facility rate currently at -0.5%, markets are expecting that to hit 0% by September.[ii] Many of those commentators blamed the ECB’s announcement for European stocks’ sharp selloff late last week.[iii] In our view, whilst 0% is higher than -0.5%, that doesn’t mean monetary policy is necessarily becoming more restrictive. Rather, we see it as a move back to normal after years of negative rates, which could very well bring some benefits.

The ECB has three benchmark rates it uses to conduct monetary policy: its main refinancing operations (MRO), marginal lending facility and deposit facility.[iv] The MRO rate is what banks pay to borrow from the ECB for a week. This borrowing is collateralised, meaning banks must provide the ECB with eligible assets to guarantee the loan. The MRO rate is currently set at 0%. The marginal lending facility rate is banks’ overnight borrowing cost, which is also collateralised, but typically costs more, now 0.25%.

The deposit facility rate determines what banks receive for keeping funds at the ECB overnight.[v] Notably, this rate has been negative since June 2014—which means banks have had to pay the ECB to store their money.[vi] Imagine paying your bank a 0.5% annual rate to hold your deposits—we think many would find this a bit unusual and perverse. The ECB has set this rate progressively further below zero—starting at -0.1% eight years ago and bottoming at -0.5% from September 2019 onward—in an attempt to spur lending.[vii] This may sound promising: Penalise banks for storing cash as a prod for them to lend instead. But the experiment hasn’t worked out that way, in our view. Our research finds it has backfired, weighing on lending—not prompting it—which is why we think the ECB’s aim to remove negative rates is a blessing in disguise, putting an end to a long-misguided policy.

Why haven’t negative rates stimulated eurozone economies? We find they act more as a (small) tax on banks’ balance sheets than a lending incentive. As we explained earlier when the Bank of England (BoE) was contemplating the practice, many banks have tried to pass the costs on to depositors rather than lend. We don’t think it is huge—mostly a minor hindrance to large, institutional depositors—but it shows negative rates are far from having their intended effect.

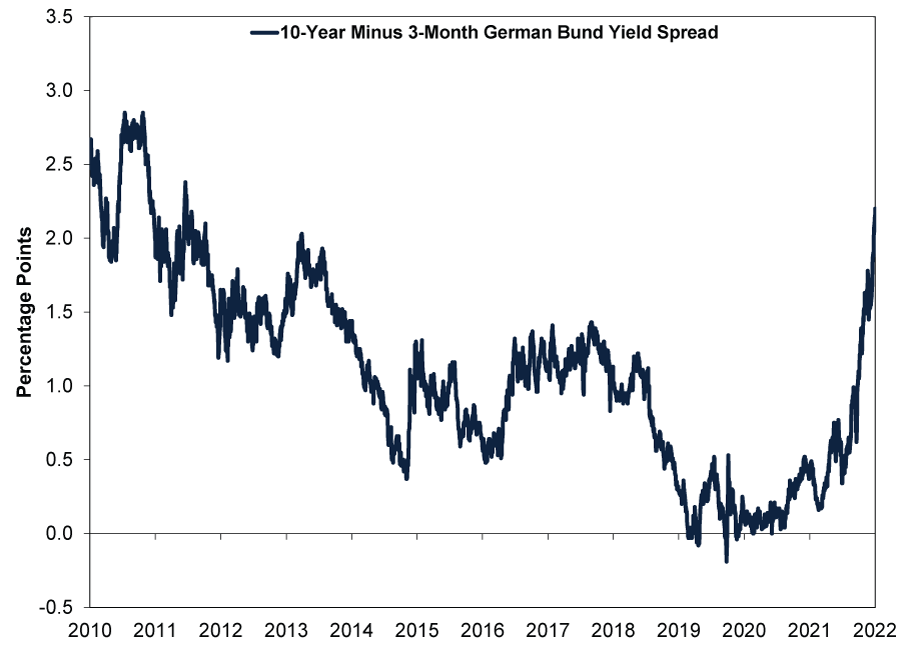

In our view, monetary policymakers who presume slightly penalising banks for parking reserves will push them to greater loan growth disregard their core business model—borrowing at short-term rates to lend at longer-term rates and earn the difference. We think this is a curious oversight. We have long thought it odd and glaring that monetary policy institutions, which supervise and regulate the banking system, don’t always appear to acknowledge how it works. The most tried and true way to induce loan growth—and stimulate the economy—is a steeper yield curve (a debt issuer’s interest rates across their maturity range), as a century of monetary theory and evidence has borne out.[viii] Our research shows a wider spread between short and long-term rates fattens banks’ potential loan profit margins, increasing their incentive to lend. These have steepened lately in the eurozone, with Germany’s yield curve representative.[ix] (Exhibit 1)

Exhibit 1: Germany’s Yield Curve Has Steepened Recently

Source: FactSet, as of 16/6/2022. 10-year minus 3-month German bund yields, 16/6/2010 – 16/6/2022.

But we have found that when negative short-term rates linger over time and are expected into the future, long-term rates also drift lower—flattening the yield curve. At one point, Germany’s yield curve was negative out to 30 years.[x] Now, amongst commentators we follow, higher long rates are also fanning debt fears in southern European nations like Italy—an issue we have explored before and a topic for another day—but we mostly think this is a sign of sentiment. When markets are falling fast, we observe it isn’t unusual for people to couch good news as bad. This is part and parcel of a phenomenon we call the pessimism of disbelief, and we have found it to be a hallmark of late-stage declines.

But back to lending. Granted, banks don’t charge government rates, in our experience. Outside just a few headlines we saw, mortgage rates never went negative.[xi] But eurozone investment grade corporate yields, which are a decent proxy for banks’ business loan rates, bottomed out at 0.4%, which isn’t a great absolute return.[xii] It likely incentivises lending to only the most creditworthy borrowers, in our view. We don’t think this is exactly unknown. The San Francisco Federal Reserve Bank, for instance, published a study showing negative rates’ negative effect.[xiii] Rather than increase lending, it showed banks park their cash in higher-yielding assets, which is generally less beneficial to the economy. We think this is why some monetary policy institutions, like Sweden’s Riksbank, have exited their negative rate regimes, whilst many others—such as the US Federal Reserve and BoE—abstained from going below zero.

To us, the ECB’s return to 0% and positive rates would be a return to normal. Its planned gradual reduction of its balance sheet—letting assets acquired under quantitative easing (QE) mature without replacement—would be, too, in our view. For markets, we think that would likely be a relief and, judging by commentators’ recent rhetoric (e.g., their fears over Italian debt), an unappreciated and perhaps even subconscious one. Headlines we read universally pronounced the ECB’s announcement as tightening monetary policy. Coupled with Europe’s energy woes, economic slowdown and associated headwinds from Ukraine, many of them appear to think the ECB is charting a highly uncertain course, risking recession (prolonged and widespread economic contraction) and/or stagflation (economic weakness accompanied by high and rising consumer prices), not to mention a fresh debt crisis. To that end, we have seen lots of commentators compare last week’s ECB announcement with its decision to raise rates in 2011, as the eurozone debt crisis was escalating.

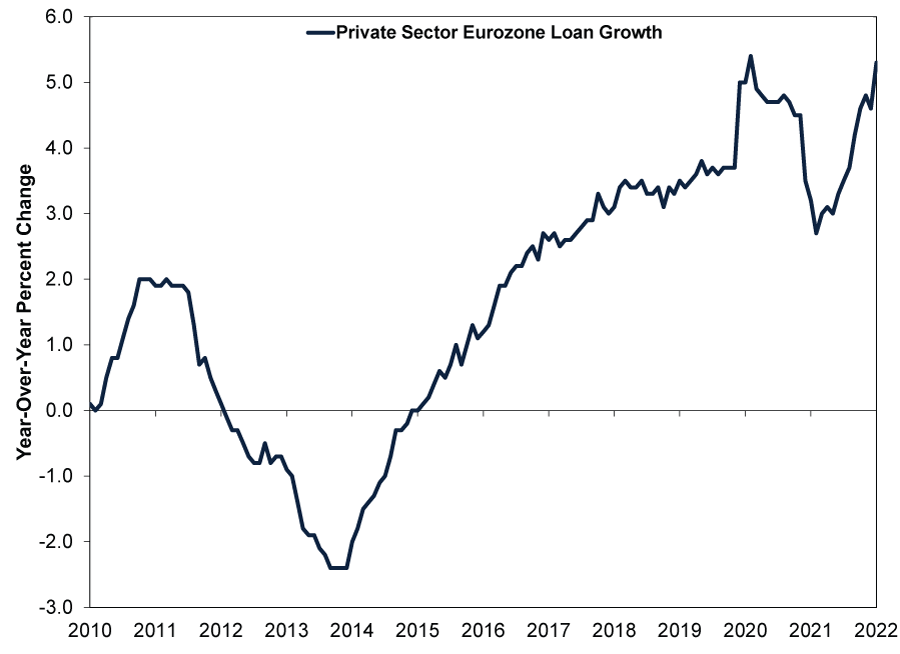

What few commentators we follow highlight, though: The eurozone’s yield curves have steepened this year—a counterpoint to chatter about a deep regional recession being a foregone conclusion.[xiv] As Exhibit 1 showed in Europe’s biggest economy, the spread between Germany’s 10-year and 3-month bund yields has widened to 2.2 percentage points from half a percentage point at the year’s start.[xv] We think steepening yield curves across the developed world suggest stronger growth is likelier against the background chorus of doom. In the eurozone, lending has apparently responded—accelerating, even as emergency loan programmes wound down. (Exhibit 2)

Exhibit 2: Eurozone Loan Growth Is Accelerating

Source: ECB, as of 27/5/2022. Private sector loans adjusted for loan sales, securitisation and notional cash pooling, April 2010 – April 2022.

Meanwhile, whatever policymakers may think, hiking rates is unlikely to affect inflation, in our view. When price jumps stem from supply-driven disruptions, we don’t think there is much monetary policymakers—who have no control over supply—can do. Despite their reputation for omnipotence, they have no power to reverse material shortages, expand shipping capacity or stop wars that we can see. All they have are a few monetary levers, and they don’t seem to us to have demonstrated much skill at pulling them over the years. Besides, we find monetary policymakers don’t drive the economy. It is a complex beast, in our observation, and their influence on it is marginal at best.

We think it is possible the ECB and other monetary policy institutions, taking aggressive action, invert global yield curves mistakenly—that is worth watching out for. But none are close, in our view, and whether intentional or not, their balance sheet runoffs help preserve positive yield curve spreads as they remove some of the downward pressure on yields.

[i] “Monetary Policy Decisions,” Staff, ECB, 9/6/2022.

[ii] “European Central Bank Confirms July Rate Hike Plans, Raises Inflation Projections Significantly,” Elliot Smith, CNBC, 9/6/2022.

[iii] Source: FactSet, as of 16/6/2022. Statement based on MSCI Europe Index returns with net dividends, 9/6/2022 – 16/6/2022.

[iv] “Monetary Policy,” Staff, ECB, 16/6/2022.

[v] Ibid.

[vi] “Monetary Policy Decisions,” Staff, ECB, 11/6/2014.

[vii] “Monetary Policy Decisions,” Staff, ECB, 18/9/2019.

[viii] A Monetary History of the United States, 1867 – 1960, Milton Friedman and Anna Jacobson Schwartz, Princeton University Press, 1963.

[ix] “Euro Area Yield Curves,” Staff, ECB, 16/6/2022.

[x] Source: FactSet, as of 16/6/2022. 30-year German bund yield, 5/8/2019.

[xi] Ibid. Statement based on long-term mortgage rates in Denmark, 31/12/2018 – 31/12/2021. “Danish Bank Launches World’s First Negative Interest Rate Mortgage,” Patrick Collinson, The Guardian, 13/8/2019.

[xii] Ibid. 7 – 10-year ICE BofA Euro Corporate Index yield to maturity, 11/12/2020.

[xiii] “Commercial Banks Under Persistent Negative Rates,” Remy Beauregard and Mark M. Spiegel, Federal Reserve Bank of San Francisco Economic Letter, 28/9/2020.

[xiv] See note ix.

[xv] Source: FactSet, as of 16/6/2022. 10-year minus 3-month German bund yields, 31/12/2021 – 16/6/2022.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.