Personal Wealth Management /

What Rising Real Wages Say About the UK Economy

Not a lot, as it turns out. But folks’ reaction says a good deal about prevailing sentiment.

Since the pound’s post-Brexit referendum plunge, folks have fretted inflation would surge, eating into UK consumers’ purchasing power. After wage growth fell below inflation last March, worries escalated. But the most recent inflation and wage reports show the gap is nearly gone—February headline inflation was 2.7% y/y, and January wage growth excluding bonuses (the latest figure available) was 2.6% y/y—2.8% including bonuses. Headlines cheered: Goodbye, pay squeeze! The “most important challenge for the UK economy” could soon be in the past—a big win! But despite shifting narratives about UK consumers’ health, the overall economic picture remains much the same. Negative real wages pinched households, true, but they didn’t crush consumer spending—and contrary to widespread belief, debt doesn’t explain the rise. Rising real wages’ warm reception shows investors still fret the reverse, believing UK growth depends on incomes outpacing inflation. To us, this suggests sentiment towards the UK hasn’t caught up with reality. As it does, stocks should benefit.

For those whose incomes didn’t keep up with faster inflation last year, higher prices did pinch—shrinking purchasing power is no treat. Now, as more employers start factoring higher prices into their pay increases, many households are no doubt feeling some relief. As an economic risk, however, negative real wages were never as dangerous as most observers feared. Falling real wages can squeeze consumers, but that doesn’t mean they automatically prevent consumer spending from growing.

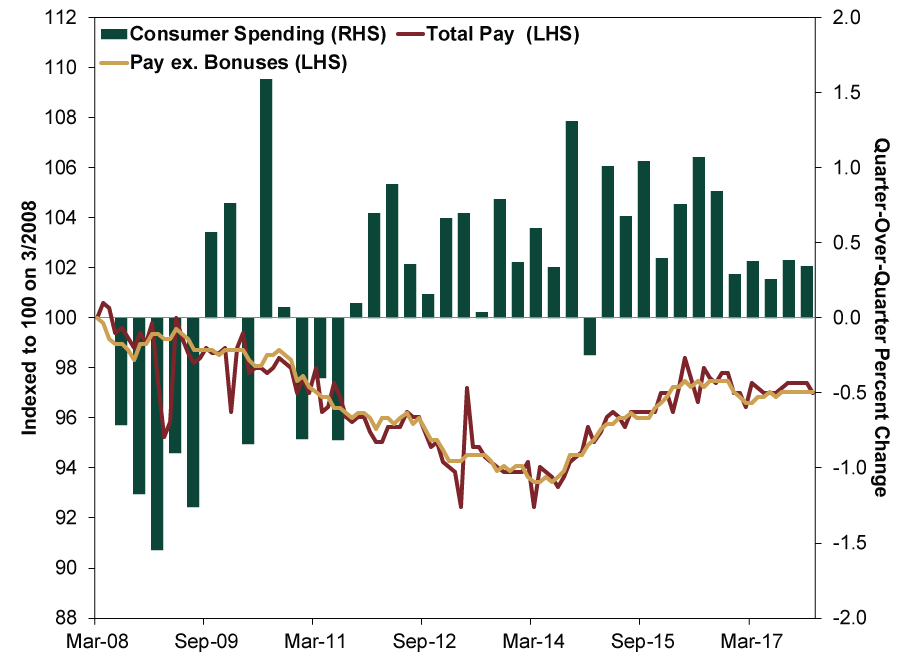

To see this, consider longer-term trends. Average weekly total earnings of UK employees before tax and other deductions, adjusted for inflation—what folks shorthand as “real wages”—remain 6.5% below their March 2008 peak.[i] Yet quarterly consumer spending, also adjusted for inflation, has risen 9.1% over the same period.[ii] Exhibit 1 shows real wages (both including and excluding bonus pay) and consumer spending over this entire stretch. Even as real wages fell for a long spell during this economic expansion’s first five years, consumer spending grew. While it bounced around a good deal the first couple years, consumer spending growth turned consistently positive in late 2011—over two years before real wages started their recovery.

Exhibit 1: Real Wages Fall, Brits Spend Anyway

Source: Office for National Statistics, as of 3/23/2018. Household final consumption expenditures, Q2 2008 – Q4 2017; real average weekly earnings including bonuses and real average weekly earnings ex. bonuses, March 2008 – January 2018.

Some argue negative real wages forced UK consumers to resort to borrowing to finance spending, implying a house of cards soon to tumble. But this claim doesn’t totally wash, either. Excluding student loans, UK consumer debt is a touch below its September 2008 peak.[iii] Yes, it is up about £50 billion over the last five-ish years, but UK consumers buy over £300 billion pounds worth of goods and services each quarter. Debt alone can’t explain this—seems to us like UK households were a lot more resilient than they got credit for, perhaps because average wage figures aren’t the most accurate look at how individuals are faring since they ignore changes in the workforce.

We aren’t saying inflation had no impact. Household spending growth did slow while inflation was higher, averaging 0.35% q/q last year compared to 0.75% and 0.78% in 2016 and 2015, respectively.[iv] Retail sales got choppier, too: Although monthly retail sales held up well when measured in pounds, in volume terms, they struggled. Consumers weren’t getting as much bang for their buck, and retailers felt the pressure as well. However, given slowing lending and money supply growth and a relatively flat yield curve, inflation likely moderates further this year, easing this pressure.

One lesson investors can draw from the media’s fixation on inflation and wage levels: Narratives change fast, even if fundamentals don’t. Just last month you may recall hearing December’s wage uptick was going to lift inflation past the BoE’s target. (This is bunk, in our view. Faster wage growth is a symptom of inflation, not its cause.) But the report showing higher wages in January coincided with February data showing lower inflation—so this talk faded away.[v] Rather than getting caught up in short-term noise, we see a better way for investors to look at shifting perceptions of real wage growth. People had a false fear and now believe it is fading. Although this brought a touch of cheer, it shows folks generally still see UK growth as precarious. As people gradually realize UK consumers were a lot better off than thought—and likely remain so—the gap between reality and sentiment probably narrows, supporting stocks’ rise.

[i] Source: Office for National Statistics, as of 3/23/2018.

[ii] Ibid.

[iii] Source: Bank of England, as of 3/23/2018. Monthly amounts outstanding of total sterling consumer credit lending to individuals, ex. loans issued by the Student Loans Company.

[iv] Source: Office for National Statistics, as of 3/23/2018. Quarter-over-quarter growth in household final consumption expenditures, Q1 2016 – Q4 2017.

[v] The about-face is even more curious given wage data comes out about a month behind inflation. January inflation—a better comparison—was still 3.0%.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.