Personal Wealth Management / Market Analysis

The Bank of Japan Bends, Causing a Stir Amongst Commentators We Follow

In our view, observers are overreacting to a monetary tweak.

Steadfast. Iron-willed. Throughout the autumn, as Japan’s yen plunged to generational lows versus the dollar, officials at the Bank of Japan (BoJ) clung to a policy called yield curve control, whereby they set an official ceiling of 0.25% for 10-year Japanese government bond (JGB) yield.[i] As long-term interest rates globally rose this summer and autumn, the BoJ announced it would continue making “unlimited” bond purchases if necessary to prevent the 10-year yield from punching through the ceiling.[ii] When higher long rates outside Japan seemingly pulled investment from Japanese assets to their Western counterparts—weakening the yen—officials maintained the ceiling and used foreign exchange reserves to support the exchange rate.[iii] But that changed Tuesday, when the BoJ suddenly reversed course and loosened its capped rates, known also as an interest rate peg. 10-year JGB yields jumped, the yen strengthened and commentators we follow globally called it a game changer with global implications—the rate rise being just the tip of the iceberg.[iv] But we think a more sober, less-theatrical analysis reveals this wasn’t so huge a shift.

For one, we have long observed that pegs are seemingly made to be broken, so we think it shouldn’t be too surprising that BoJ Governor Haruhiko Kuroda and his colleagues took advantage of a recent global fall in long rates to make some tweaks and avoid the perception that it was surrendering to market forces (meaning, that speculators had forced its hand by trying to force rates higher).[v] At Tuesday’s meeting, policymakers raised the 10-year JGB yield’s allowed bandwidth to 0% plus or minus half a percentage point, effectively setting the ceiling at 0.50%.[vi] But lest you think this is some big pivot, they also upped their monthly JGB purchases from $55 billion (£45.4 billion) to $67 billion (£55.3 billion) per month.[vii]

Upon announcing the move, the BoJ cited concerns about market function—not a shift in its inflation outlook.[viii] Reading between the lines, we would guess policymakers are arguing they successfully beat the JGB market into submission when defending their peg earlier this year and that continuing to do so would now bring more risks than benefits, including difficulty pricing corporate bonds and other assets that use JGBs as a baseline rate. Increasing its JGB purchases—and leaving the policy rate at -0.10%—seemingly underscores its belief that even with the recent uptick, inflation remains too slow, with feeble monetary drivers masked by energy prices lately.[ix] Hence it remains committed to what it views as loose policy—negative rates and quantitative easing (QE) bond buying—which we would crudely summarise as indicating the monetary beatings will continue until morale improves. Banks will likely still struggle to lend amidst slim net interest margins (meaning, the small gap between their funding costs and the potential interest rate they can charge on new loans).[x] JGBs appear likely to remain in short supply for investors as the BoJ keeps adding to its huge holdings. And we think international investors will probably still see little to no reason to plop some money in the yen—not when all other comparable assets globally have much higher yields.[xi]

As a result, all the articles from publications we follow portraying the move as a threat to global stocks’ latest rally seem a tad overblown, in our view.[xii] For one, the yield move that spurred so many headlines is … not big. The BoJ’s announcement sent 10-year JGB yields up to 0.41% on Tuesday, and Western yields rose in sympathy.[xiii] Commentators we follow argue Japanese investors now have ample incentive to repatriate yen, which will allegedly send Western yields even higher—hitting stocks in the process. But hold on. Wednesday, Japanese yields rose again—to 0.47%.[xiv] Yet most Western yields didn’t follow suit.[xv] Furthermore, we think this theory misses the fact yield curve control mostly created oddities, like 9-year JGBs yielding more than 10, and 15-year yielding still more than that.[xvi] If those relatively higher yields didn’t drive repatriation, please explain why a 16 – 20 basis point move up in one bond maturity would be such a huge development.

All else equal, our research shows money flows to the highest yielding asset. Amongst major currencies, that remains the dollar, with 10-year US Treasurys yielding over three full percentage points more than 10-year JGBs.[xvii] The BoJ is still adding to its JGB portfolio at breakneck speed. The US Federal Reserve, Bank of England and now even the European Central Bank are shrinking theirs. The BoJ now owns over half the outstanding supply of JGBs, which many observers we follow warn has created liquidity issues.[xviii] Government bonds in the US, UK and eurozone are much more abundant based on those institutions’ holdings relative to total supply.[xix]

Perhaps most importantly, despite the BoJ’s protestations, Tuesday’s move didn’t appear to come as much surprise to anyone. Markets have seemingly expected the BoJ to do something like this for months. This is likely why 9-year maturities paid more than 10-year.[xx] It is also likely why market-set, non-pegged 15- and 30-year yields barely budged.[xxi] We think they incorporated the move into prices pre-emptively. We suspect investors know better than to take monetary policy institutions at their word, and, in our view, it was only a matter of time before the BoJ found a plausible path to loosen its peg.

We suspect investors have long known keeping it at 0.25% was unrealistic, based on the wealth of global commentary on this topic. They may not have known the timing, but, in our view, it looks like investors have positioned accordingly. Note: JGB yields’ jump didn’t trigger a wave of forced selling from banks or non-bank financial institutions (meaning, there wasn’t a Japanese version of when UK pension funds sold gilts en masse when 10-year UK Gilt yields spiked in late September and early October this year due to sudden collateral calls). We also think the fact yields settled well below the new ceiling shows there wasn’t much pressure. In our view, if anything, markets probably expect too much from the BoJ over the next year, with market-based indicators implying rather significant rate hikes and 10-year JGB yield increases from here.[xxii] We don’t think that seems terribly realistic given energy prices and the weak yen are basically Japan’s only inflation drivers at this point … and energy costs are now falling.[xxiii] (Japan imports much of its energy, which is priced globally in US dollars, so Japan’s energy costs rise even more when the yen is weak.) If the BoJ didn’t react to those forces earlier this year, when they were more acute, we think it is hard to imagine it doing so as energy price spikes retreat further into the rearview—even with a change of BoJ leadership looming next April.[xxiv]

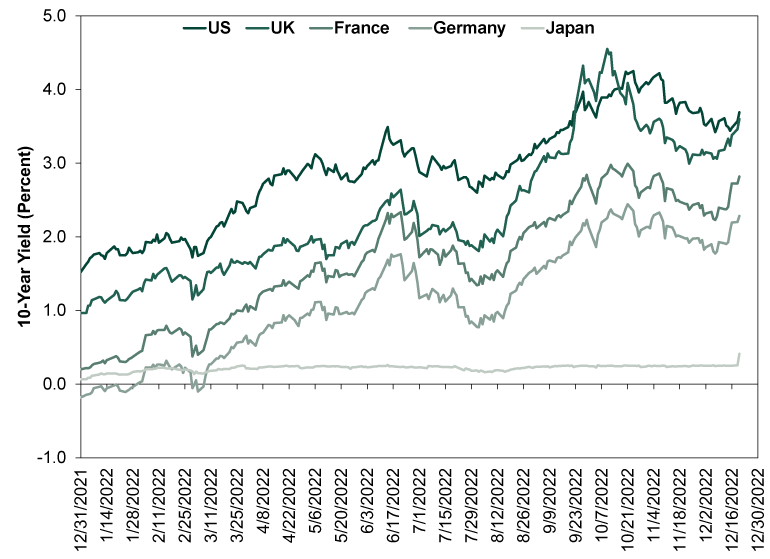

So no, we don’t see this as some monumental shift for Japan or the world. Based on how commentators we follow portrayed the market’s reaction, we suspect it is easy to get fooled by the direction of a move like this, especially when 10-year JGBs yields’ rise looks huge on a chart. But that is because the chart zooms in on a very low level. Next to US, UK, German and French yields, the 10-year JGB looks very small indeed—in our view, too small to drive some big shift in international capital flows.

Exhibit 1: Japanese Yields Are Still Low

Source: FactSet, as of 21/12/2022. 10-year US Treasury, UK Gilt, German Bund, French Treasury and JGB yields, 31/12/2021 – 20/12/2022.

[i] “BOJ Policymaker Takata Rules Out Ending Yield Cap – Nikkei,” Staff, Reuters, 9/12/2022. Accessed via Internet Archive. A yield curve is a graphical representation of a single issuer’s interest rates across the spectrum of maturities. FactSet is the source for the statement about the yen’s exchange rate, which is based on the spot exchange rate of yen per US dollars.

[ii] “BOJ Maintains Stimulus, Vows to Continue Unlimited Bond Buying,” Leika Kihara, Tetsushi Kajimoto, Daniel Leussink and Kantaro Komiya, Reuters, 27/4/2022.

[iii] “Japan Authorities May Have Intervened Again to Shore Up Yen,” Staff, The Yomiuri Shimbun, 24/10/2022.

[iv] Source: FactSet, as of 21/12/2022. Statement based on 10-year Japan Government Bond yield and Japanese yen per US dollar on 20/12/2022.

[v] Source: FactSet, as of 21/12/2022. Statement based on 10-year government bond yields in the US, UK, France and Germany.

[vi] “Statement on Monetary Policy,” Bank of Japan, 20/12/2022.

[vii] Ibid.

[viii] Ibid.

[ix] Ibid.

[x] Source: Bank of Japan, as of 12/12/2022. Statement based on the BoJ’s official policy rate and the Average Contract Interest Rates on Loans and Discounts.

[xi] Source: FactSet, as of 21/12/2022. Statement based on 10-year US Treasury, UK Gilt, German Bund, French Treasury and JGB yields, 31/12/2021 – 20/12/2022.

[xii] Source: FactSet, as of 21/12/2022. Statement based on MSCI World Index return with net dividends in GBP, 12/10/2022 – 20/12/2022.

[xiii] Source: FactSet, as of 21/12/2022.

[xiv] Ibid.

[xv] Ibid.

[xvi] Ibid.

[xvii] Ibid.

[xviii] “BOJ Owns Over 50% of Outstanding JGBs for 1st Time,” Staff, Jiji Press, 19/12/2022.

[xix] Source: Federal Reserve, Bank of England and European Central Bank, as of 20/12/2022.

[xx] Source: FactSet, as of 21/12/2022.

[xxi] Ibid.

[xxii] Source: Bloomberg, as of 20/12/2022.

[xxiii] Source: FactSet, as of 21/12/2022. Statement based on Brent crude oil spot prices, 31/12/2021 – 20/12/2022.

[xxiv] Ibid.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.