Personal Wealth Management / Behavioral Finance

Four Timely Timeless Lessons for 401(k) Day

Reviewing some well-known keys to successful long-term investing.

Last Friday was 401(k) Day in the US, a day dedicated to retirement planning. We think 401(k) plans are great—a useful tool for those traveling along the most reliable road to riches: saving and investing well over the longer term. The occasion is also an opportunity to revisit some timeless lessons we think are particularly useful during a challenging year for investors.

Lesson One: Fathom the Power of Compounding

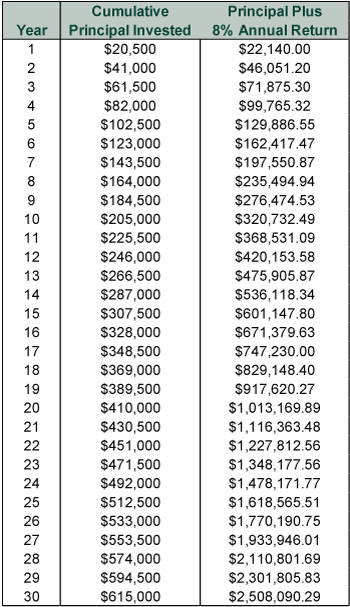

The max contribution to a 401(k) plan in 2022 is $20,500 (plus a catch-up contribution of $6,500 for those 50 and over), which doesn’t include any employer-matching funds. Of course, one contribution of $20,500 won’t provide for retirement. Moreover, not everyone can necessarily save that sum year in, year out. However, to the extent you are able, the combination of time and saving is critical to unleashing the power of compounding. Consider what a yearly contribution of $20,500 invested the instant the market opens on the first trading day of every year combined with an 8% annual return—a little below stocks’ historical average—can turn into over 30 years. (Exhibit 1)

Exhibit 1: A Hypothetical Illustration of Compounding’s Power

Source: Math and Microsoft Excel. Note, actual investment returns are highly unlikely to be this consistent and smooth, and we realize most people make regular contributions throughout the year rather than investing a lump sum contribution at the precise beginning of every year. We share this table strictly for illustrative purposes.

Lesson Two: Long-Term Returns Include Bear Markets

The S&P 500, which we use here for its long history, has an average annualized return of 10.3%.[i] That figure includes all the negativity over the past 96 years, from bear markets (typically prolonged and fundamentally driven declines exceeding -20%) and corrections (short, sharp, sentiment-driven declines of -10% to -20%) to pullbacks and daily dips—2022 isn’t an anomaly in that regard. Now, no individual investor likely invests with the next 100 years in mind. Most think in much shorter timeframes, so we understand concerns that one or two bad years can permanently set back a retirement portfolio.

But consider 20-year periods, which better resemble many current retirees’ timeframes. Since 1926, the S&P 500 has averaged about 5 negative years per rolling 20-year stretches. Yet no rolling 20-year period has been negative. The worst run (1929 – 1949) included the market crash of 1929, the ensuing Great Depression and World War II. Despite 10 negative years, that stretch’s average total return was 6.2%.[ii]

As we always say, the past isn’t predictive of the future, and it is always possible stocks deliver weaker—or even negative—returns over next 20 years. But making portfolio decisions based on historically unprecedented, possible outcomes isn’t wise, in our view.

Lesson Three: Most Investing Harm Is Self-Inflicted

In our experience, one of the most damaging moves investors can make is changing their asset allocation in reaction to negative volatility. If you are able to identify a bear market early enough, it can make sense to shift. But taking action for the sake of “doing something”—the comforting feeling of taking control in an uncomfortable situation—is often counterproductive. Selling when stocks are down turns paper losses into actual losses and leads to an even bigger risk: not returning to markets for the subsequent recovery. In our view, not participating in bull markets is the biggest risk to investors’ ability to reach their long-term goals.

Washington Post columnist Michelle Singletary recently highlighted the big opportunity cost of missing a recovery.[iii] She described three hypothetical 401(k) investors in September 2008 and the actions they took (or didn’t take) after US stocks had fallen by -20%:

The first investor jumped out of the market, going to all cash, and stopped making contributions. The second one also moved to cash but kept contributing to a workplace plan. The third investor kept the money invested and continued to contribute. The latter two investors each had $15,000 going into their 401(k) annually, including employer matching contributions.

By February 2012, the investor who cashed out and stopped contributing had $353,400. The worker who went to cash at least returned to making 401(k) contributions and had $404,709. The third investor had $524,600 by sticking to the original investment mix

Often in investing, “doing nothing” is the most beneficial long-term move, in our view.

Lesson Four: Nobody Said This Is Easy

That said, nothing about investing is easy. Whether you have been investing for decades or just started to learn about the stock market, nobody is perfectly immune from the market’s challenges. There is a reason why Fisher Investments’ founder and Executive Chairman Ken Fisher calls the market “The Great Humiliator.” Whatever their experience level, people are at risk of making mistakes by acting on emotional impulses. Moreover, there is no silver bullet strategy, and if anyone tells you otherwise, turn around and walk away—quickly.

But as challenging as times are today, bull markets always follow bear markets—and experiencing the latter needn’t prevent you from reaching your investing goals. So don’t get caught up trying to identify market inflection points with precision. Instead think longer term, focusing on what you want your money to provide for you in the future.

Finally, mistakes come with the territory, and every investor makes them. Rather than beat yourself up, view them as learning opportunities that will make you a better investor going forward. During rough market periods, perspective and levelheadedness are your best allies.

[i] Source: Global Financial Data, as of 3/28/2022. S&P 500 Total Return Index, 12/31/1925 – 12/31/2021.

[ii] Ibid. S&P 500 Total Return Index, 12/31/1925 – 12/31/2021. Statement based on average annual return from 1929 – 1949. Common claims that you didn’t earn a positive return over this stretch do not factor in dividends, and dividend yields were higher at that time than today.

[iii] “When the Stock Market Is Crazy, Invest Like a Millionaire,” Michelle Singletary, Washington Post, 8/19/2022.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.