Personal Wealth Management / Market Analysis

How ‘Sell the Losers’ Can Be Very Counterproductive

Whether to sell should always be a forward-looking decision.

With stocks tumbling again, we have seen a notable shift in financial commentary: an abundance of chatter about winners and losers, both in this current bear market and in recessions historically. The implication? Shifting into what has done well—and what usually holds up better during recessions—will help limit portfolio downside from here. This prospect, coupled with the emotional relief some investors feel when “selling the losers,” seems enticing to many. Yet we think it is one of the least beneficial things anyone seeking long-term growth could do right now.

Selling stocks that have suffered this year may seem appealing from a stop the bleeding standpoint.[i] But in investing, emotional appeal and wisdom rarely intersect. So it is with selling stocks that are down right now, in our view. For one, it amounts to selling a company because of what it has done, not what it will do. Two, overall and on average, the categories that get pounded the hardest during a bear market (generally a prolonged decline of -20% or worse with a fundamental cause) typically have the biggest, fastest bounce off the bottom. So if the bounce is close by, you likely limit your potential to capitalize on it if you sell the stocks most likely to drive it.

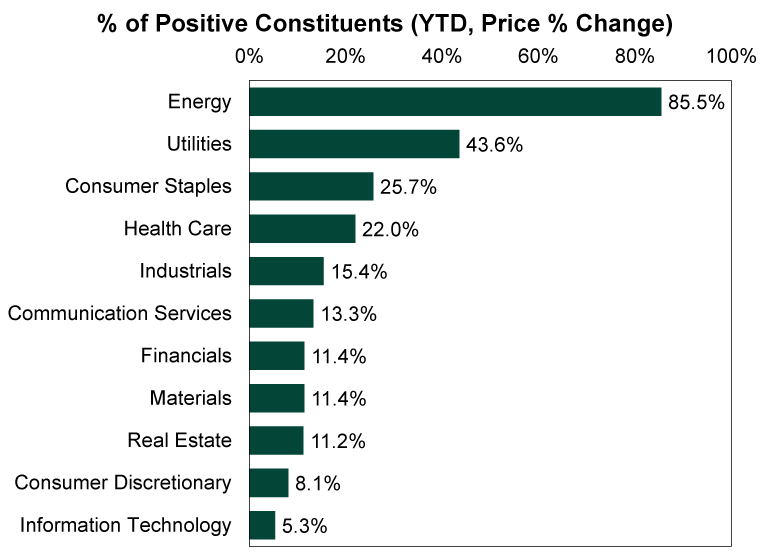

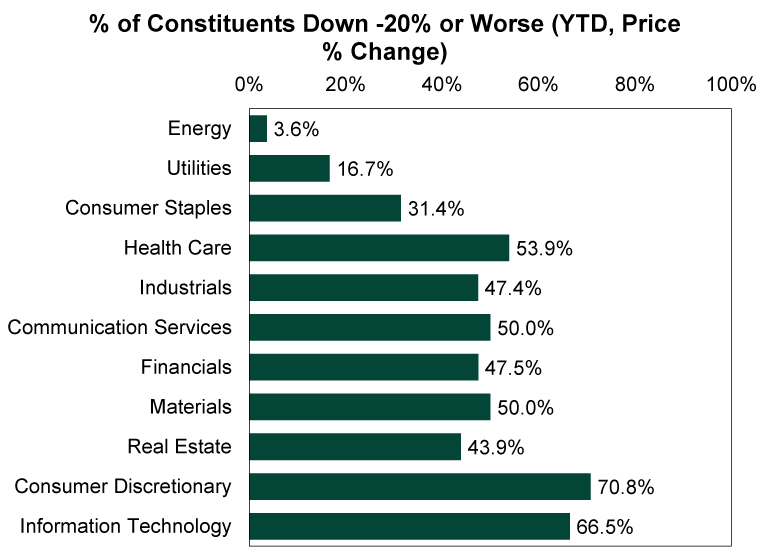

Then too, selling losers risks impeding diversification. The popular view of this bear market holds that Tech and Tech-like stocks in Consumer Discretionary and Interactive Media & Services (within the Communication Services sector) are primarily responsible for stocks’ trip below -20%. And to an extent, that is true, considering these categories have been hit the hardest. Yet the vast majority of stocks are down this year (Exhibit 1), and nearly half of MSCI World Index constituents are currently in bear market territory (Exhibit 2). If you were to sell all the down stocks, you would be selling over 80% of the global market’s constituents. Selling only those that are down big would take 749 of 1,510 MSCI World Constituents off the table. Ditching all of those and piling into what has held up well basically means taking concentrated positions in Energy, Utilities and Consumer Staples.

Exhibit 1: This Year’s Declines Are Broad-Based

Source: FactSet, as of 9/2/2022. MSCI World Index constituent price returns, 12/31/2021 – 9/1/2022.

Exhibit 2: So Are This Year’s Deep Declines

Source: FactSet, as of 9/2/2022. MSCI World Index constituent price returns, 12/31/2021 – 9/1/2022.

Another problem: The sectors that have held up ok are holding up ok for some pretty clear and specific reasons. Energy stocks benefit from high oil prices, as oil jumped when Russia invaded Ukraine and supply shortage fears reigned supreme. Those fears have eased some as it becomes ever-more apparent that sanctions aren’t keeping Russian oil off the market and other nations are ramping up output. We would expect that easing to irregularly continue. That limits the likelihood that oil prices soar from here, which means the eye-popping earnings growth rates that Energy stocks enjoyed earlier this year are unlikely to repeat perpetually, likely teeing up some disappointment for the sector. Meanwhile, Utilities, Consumer Staples and parts of the Health Care sector are traditionally defensive, so they are benefiting from all this year’s recession dread. Their relative resilience is part of stocks’ pricing in recession talk this year, making the core thesis to own them largely priced in at this juncture.

Stocks look forward, not backward. Companies that investors have punished for global growth fears will logically stand to bounce disproportionately as those fears prove false. That same phenomenon will probably work against those that have held up well—the reason to own them will likely vanish. In short, selling the biggest losers and piling into this year’s winners basically means crystalizing big losses and loading up on things with the least bounce potential in a recovery, potentially robbing you of returns that would otherwise compound throughout the next bull market. In our view, that is likely to work against the vast majority of stock investors’ long-term goals.

Of course, all of this is predicated on the bear market’s end being close by. We think it is, as we have shown in other recent commentaries. All of today’s negatives are widely known. Pundits have extrapolated them into increasingly dour forecasts for months. At this point, it would take something much worse than what stocks have already priced in to make the market drop another -20%, -30% or more from here. That is possible, but it doesn’t seem probable to us. Meanwhile, sentiment has morphed into what we call the “pessimism of disbelief,” where bad news gets top billing and good news goes ignored or gets buried in “yah, but” objections. This is the typical backdrop for a recovery.

We know this year, like most bear markets, has been frustrating and difficult. But taking rash action this far into it seems likely to be a decision many would go on to regret.

[i] Note: This is vastly different from tax-loss harvesting, which isn’t about market conditions at all, and is a generally temporary move designed to limit capital gains tax exposure.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.