Personal Wealth Management / Market Analysis

Quick Hit: China’s Economy Stutters, Doesn’t Stop in July

Chinese data releases lagged expectations last month, but we don’t believe they signal rough times ahead.

Chinese economic data broadly disappointed in July, spurring fears the government’s stimulus efforts are failing to halt this year’s slowdown. In our view, however, they more likely reflect the predictable after-effects of an early-2018 crackdown on shadow banking and don’t mean the Chinese economy is losing steam.

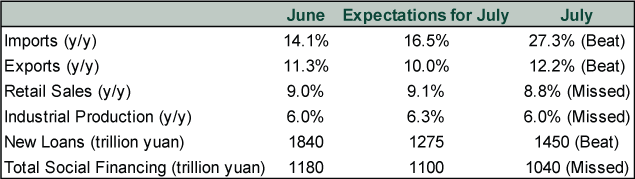

For your viewing convenience, here are the most noteworthy economic statistics released in July.

Exhibit 1: Chinese July Economic Data

Source: National Bureau of Statistics of China, as of 8/16/2018.

Among these, retail sales, industrial production and total social financing—a measure of available credit—lagged expectations. Headlines wondered: Given recently announced fiscal stimulus measures, why is the economy still seemingly slowing? Is it US tariffs’ fault? Sagging domestic demand? And regardless of the cause, what is China to do if stimulus proves feckless?

We believe these worries are overblown for a variety of reasons. For starters, as we have written, tariffs’ scope remains small—and we believe there is a very strong likelihood it stays that way. Second, it takes a little while for new government spending and lending to ripple through the economy—and Chinese officials just announced much of this stimulus in late July![i] Expecting a resulting jolt to show up in July data—which cover the whole month, not just the tail end—strikes us as a tad premature.

Moreover, we are talking about one month—and monthly data tend to wobble. July may prove a blip or part of a more significant slowdown—only time will tell. It wouldn’t shock if a couple more blips await, either, particularly as measures implemented earlier this year cracking down on risky lending practices continue having their intended effect.

But this doesn’t mean the Chinese government is powerless. Regulators have already softened some financial rules and probably do so again if data disappoint further. Also, Goldman Sachs recently reported comments from the country’s central bank suggest additional stimulus is likely forthcoming. To us, this is further evidence Chinese regulators possess the tools needed to cushion their shadow banking crackdown. They have been balancing twin goals of social stability and addressing financial sector excesses for a while now, and while the road ahead may hold some more bumps, thus far it doesn’t appear a “hard landing” is materially more likely today than at any point in the last several years when folks have fretted it.

[i] “China stimulus signals trade war first, debt worry later,” Issaku Harada, Nikkei Asian Review, 7/25/2018. https://asia.nikkei.com/Economy/Trade-War/China-stimulus-signals-trade-war-first-debt-worry-later

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.