Personal Wealth Management / Politics

A Post-Election Economic Palate Cleanser

In case you missed it, there was some economics news, too.

Political news continues hogging investors' attention, keeping recent economic data under the radar. We think that's a shame, because data are fun and-most importantly-economic drivers probably matter more for stocks globally than the political leadership of a country that contributes just 25% of world GDP. So here is a rundown of the latest and greatest economic haps. Overall, stocks' economic backing remains solid.

China Grows Again

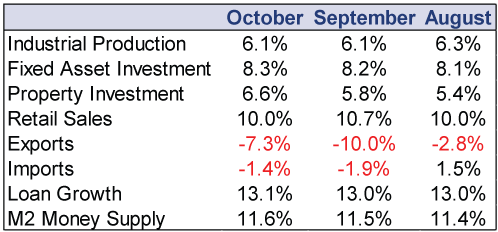

China's economy got off to a fine start in Q4, extending the major trends from summer and last month-robust government infrastructure and investment spending and an ongoing housing recovery helped shore up activity. Private investment remains weak, but high public fixed investment shows the government remains committed to supporting growth as needed. Lending and broad money supply also continue expanding apace.

Other data showed the long-running shift from heavy industry and trade to domestic consumption continues. Retail sales once again grew double digits, while industrial production was relatively cooler at 6.1% y/y. Trade stayed weak, but China has grown just fine alongside falling trade in recent quarters. All in all, the numbers are consistent with China's long-running, gradual slowdown-and another round of evidence the long-feared hard-landing isn't happening.

Exhibit 1: China's October Datafest

Source: FactSet and National Bureau of Statistics of China, as of 11/14/2016. All figures y/y except Fixed Asset Investment and Property Investment, which are ytd y/y.

Silver Linings in UK Data

UK trade and industrial output for September came out last week, and both were a bit mixed at first blush-but a deeper look shows economic activity is just fine.

Industrial production fell -0.4% m/m, but heavy industry was far from weak overall. North Sea oil rig maintenance shoulders most of the blame for the headline decline. Manufacturing production, the purest measure of UK factories, rose 0.6% m/m, the second straight month. Factory output still fell in Q3, but we now have confirmation that negativity came early, when everyone was panicked over the Brexit vote. After firms digested the results and saw life carrying on as normal, they unfroze, and output rose.[i] In other words, the initial weakness stemmed from sentiment, not deteriorating fundamentals.

Trade also shows the UK economy's resilience. Exports fell -0.4% m/m, but the real story is imports, which rose 2.5% m/m. Conventional wisdom about currency swings says this rise should be due entirely to the weak pound, which pushes up import prices and whacks demand. Yet the opposite happened. Imports of physical goods rose 3.6% m/m in value terms, but volumes rose even faster, 4.7% m/m. Import prices fell -0.5% m/m (-0.8% excluding oil), even though the pound weakened in September and importers' currency hedges started expiring. Sterling just isn't all that meaningful of an economic driver, and UK demand is a lot stronger than most give it credit for.

Japanese GDP Accelerated, but ...

On the surface, Q3's 2.2% annualized GDP growth might seem great for Japan. It trounced expectations for 1.0% annualized growth, and it was the fastest rise since Q1 2015. But, there is a catch: Exports' 8.1% annualized rise drove the acceleration, while everything else crawled. Domestic demand grew only 0.4% annualized, with government consumption doing the heavy lifting. Consumer spending grew just 0.2%, private capex grew a measly 0.1%, and imports-an overlooked indicator of domestic demand-fell -2.4%.

We've long been unenthusiastic about Japan's prospects, and this report underscores our views. Weak demand, anemic inflation, ineffective monetary policy and uncertainty over fiscal policy remain headwinds to business investment. Consumer spending growth remains feeble, largely due to a lack of wage growth. Residential real estate investment's 9.6% rise looks lovely, but it's a big slowdown from Q2, when homebuyers were trying to get ahead of a potential 2017 consumption tax hike (which the government ultimately delayed in June). While strong export growth does benefit Japanese firms, three-plus years of soaring export values from early 2013 on didn't spur domestic production. With domestic growth drivers unchanged, there is no reason to expect anything different this time-and no reason, in our view, to expect Japanese stocks to outperform in the foreseeable future.

Some Emerging Markets Reported GDP

And they all beat expectations-and matched the long-running trend, as commodity-reliant Russia contracted again, while the others grew. Even Greece got back in the "win" column. Emerging Markets remain a strong contributor to global growth-and developed world firms' revenues.

Exhibit 2: Recent Emerging Markets Q3 GDP Reports

Source: FactSet, as of 11/14/2016. All figures are y/y.

[i] So we made a rhyme, in time.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.