Personal Wealth Management / Politics

Italy's Election: Let the Games Begin!

While Italy probably won’t have a government for a while, the likeliest outcome—gridlock—should be fine for Italian and eurozone stocks.

Italy voted on Sunday, and as of Monday morning, here is what we know: The anti-establishment populists won the most votes, the second-place finisher is considered a failure, the third-place finisher thinks it should govern the country, and the man who would be kingmaker is suddenly an afterthought. We don’t know—and probably won’t know for a while—which parties will end up in charge. Officials are still figuring out how many seats each party gets, and it will likely be a few weeks before President Sergio Mattarella decides which party leader should get the first shot at forming a government. So uncertainty hasn’t vanished from Italian politics. However, now that investors know the basic results, markets can start weighing potential outcomes—including the very high likelihood that whoever forms Italy’s next government, they will likely form a diverse coalition. These are usually a recipe for gridlock, reducing the chances of major change. Considering investors broadly fear major change in Italy, gridlock throwing sand in the gears should bring relief—and be bullish for Italy and the eurozone.

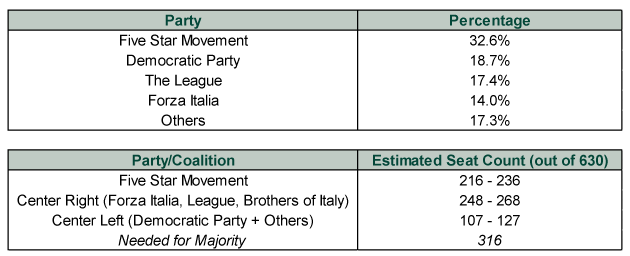

Exhibit 1 shows the latest vote tally.

Exhibit 1: The Latest Vote Tally

Source: BBC News, as of 3/5/2018 at 9:00 AM PST.

While the center-right coalition—symbolically headed (at least until yesterday) by Silvio Berlusconi’s Forza Italia—won the most seats, few expect Berlusconi to be kingmaker. That honor rested on Forza Italia being top banana of the group. Instead, voters flocked to The League, a euroskeptic party formerly known as The Northern League.[i] Its leader, Matteo Salvini, is now the coalition’s poster boy, and many suspect he will abandon Forza Italia and instead seek an alliance with the anti-establishment Five Star Movement (M5S) and its equally telegenic leader, Luigi Di Maio. Early tallies have them combining for around 50% of the vote. Before the vote, Di Maio said M5S wasn’t interested in joining a formal coalition, preferring instead to form a minority government and partner with various parties on individual laws. Now, however, he has changed his tune, and M5S is open for business.

Aside from Berlusconi, the other big “loser” was the Democratic Party and its leader, former Prime Minister Matteo Renzi. While it came in second, it lost a big chunk of the vote and failed to win over even one-fifth of voters. With The League and M5S collectively trouncing the two mainstream parties, the traditional center-left and center-right will probably have to do some soul searching and figure out how to regain relevance—much as Greece’s center-right opposition, the New Democracy Party, has done during the last three years. Left in disarray after the radical leftist Syriza party won Greece’s election in early 2015, New Democracy now tops polls.

We bring this up because what everyone fears today—M5S and The League forming a radical populist government that pulls Italy from the eurozone and EU—is a near-perfect repeat of what investors feared when Syriza won in Greece. And to Syriza and Greek Prime Minister Alexis Tsipras’s credit, they tried. But after a chaotic first six months in power, which included Syriza ripping up the bailout agreement and “winning” a referendum against austerity imposed by eurozone leadership, things settled down. Syriza didn’t pass much in the way of populist legislation, complied with the EU, passed some tough austerity measures (ignoring the referendum they called) and kept Greece in the eurozone. Tsipras and company talked a big game, but with only a tiny majority in parliament, they couldn’t make good on most campaign pledges.

If The League and M5S were to join forces, we expect it would go similarly. They would talk a lot but pass little, hamstrung by the divided parliament and their own internal divisions. After all, while both parties are populist, ideologically, they are different. The League has a fairly hard right bent. M5S is much more of a hodgepodge, united solely by their hatred of the proverbial Man, but it has a strong leftist faction. The League is also more euroskeptic than M5S’s leadership, which has softened considerably toward Brussels in recent months. Not only have they backtracked on Italexit talk, but they now claim they never wanted to leave—they only wanted to use it as some leverage to reform the eurozone from the inside. So while both parties seem to want to thumb their nose at the establishment in Europe and their own country, it is difficult to see much common ground on matters of policy. The same logic would likely apply to any broader coalition of Forza Italia, The League and M5S—another mooted possibility.

That said, there are a lot of permutations for potential coalition negotiations, and we think it is premature and fruitless to examine these in detail for now. Markets move on probabilities, not possibilities. In the coming weeks, as party leaders haggle and consult with Mattarella, the outcome should become more clear, and it will make sense then to assess specific policy pledges and their potential economic and market impact. For now, though, we think the biggest takeaway is that, whoever forms the next government, gridlock likely makes governing difficult—not much different from the status quo in Italy. A do-little government hasn’t kept Italy’s economy from growing or Italian stocks from rising, and we expect stocks should be a-ok with having more of the same.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.