Personal Wealth Management / Market Analysis

On Consumer Spending, Look Past Sentiment Surveys

Consumer confidence is at best a coincident indicator.

The Conference Board’s US Consumer Confidence Index slipped again this month, hitting its lowest level since July. With pessimism mounting just in time for the holiday shopping season, pundits warn sales—and the largest chunk of GDP—will disappoint. While that may yet come true, we don’t think weak consumer sentiment is sound evidence of it. Surveys like this aren’t great at predicting actual consumption, which we think investors would do well to keep in mind.

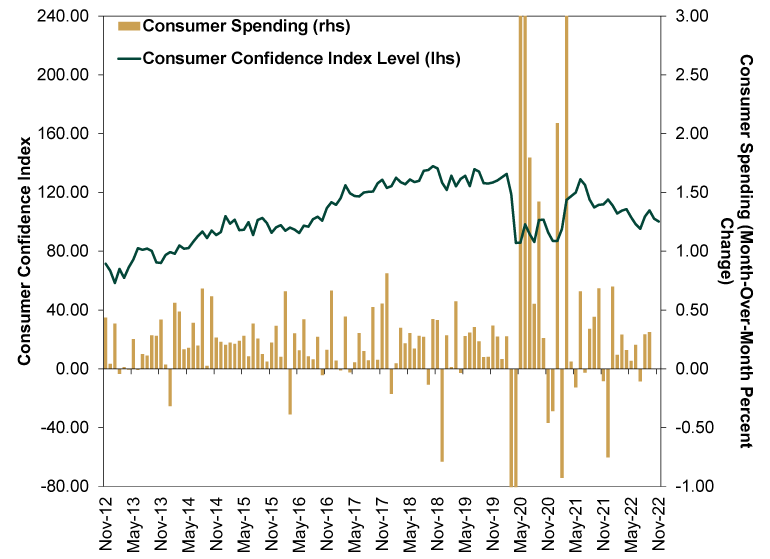

While it seems logical consumer confidence would lead spending, it doesn’t usually work that way in the real world. Confidence is a coincident indicator of people’s feelings, typically influenced by what they read, hear, see and experience in the period immediately before they are surveyed. So it isn’t surprising that confidence tumbled this month as headlines continued beating the dour drumbeat of inflation, midterms, rate hikes, layoffs and more. Yet none of this means the same consumers aren’t simultaneously spending. Consider Exhibit 1, which shows the past 10 years of consumer confidence and inflation-adjusted consumer spending. As you will see, spending has risen in times of waxing and waning confidence alike. Even this year, with confidence on a downswing, spending has risen much more often than not.

Exhibit 1: Consumer Confidence Doesn’t Predict Spending

Source: FactSet, as of 11/29/2022. The Conference Board Consumer Confidence Index, November 2012 – November 2022, and month-over-month percent change in real Personal Consumption Expenditure, November 2012 – September 2022 (latest available data). Consumer spending Y-axis truncated at 3.00% and -1.00% due to lockdown-related extremes that would make the chart unintelligible.

Now, we aren’t saying people outright say one thing and do another. Rather, folks have a well-documented tendency to compartmentalize, separating their feelings about the broader economy from their feelings about their personal situation. It is a general sense of darn, things look really bad in the newspaper and on television, but I’m doing ok, still employed, no pay cut and at least my mortgage payment is fixed and I can afford to keep going as normal. People feel bad for those falling on hard times, but they take solace in things holding up for them personally.

A Washington Post piece published Tuesday morning highlights this phenomenon well, featuring anecdotes from people who see one economy in the headlines and another in their everyday life. A children’s furniture business owner from New York summed it up well: “He’s encouraged that global supply chains are clearing up and borders are gradually loosening. From his New York City headquarters, he has no plans to cut staff and would hire more people if the right candidates come along. ‘People and businesses create their own self-fulfilling prophecy: you expect the worst, you end up creating the worst,’ [he] said. ‘I laugh because sometimes I sit with some of my friends, talking about how bad it is. And I say, “We’re at a gorgeous restaurant, spending tons of money.” I look left and right, and say, “Ah, things don’t look so bad. And yet, you’re complaining.”’ That same divide pervades the whole economy, as people brace for a looming downturn — but aren’t yet feeling one in their daily lives.”[i]

Anecdotal evidence is generally pretty weak, but we think it illustrates what US Chamber of Commerce Chief Economist Curtis Dubay calls, “secondhand pessimism,” as the article goes on to explain. They regurgitate the sour sentiment they glean from headlines but don’t reflect it in their own behavior. They express worries but keep shopping. Businesses do the same yet keep investing and hiring because activity is still humming and they need to keep up. Everyone figures they must be an outlier of good, not realizing that their overall good situation is largely the norm, not the exception. San Francisco Fed President Mary Daly admitted she sees this phenomenon throughout her district, saying “‘people’s own situations feel different than the situations they fear are out there, or that they even see out there.’” That snippet came amid an overall pessimistic economic forecast, which probably goes a long way to explaining the disconnect.

When in doubt, we suggest watching what people do—not what they say. The economy moves on spending and investment, not feelings. So if feelings don’t typically predict either, then we reckon it is wisest to not lean on sentiment surveys for economic clues. They can be a useful signpost of investor sentiment, but if you want to tally economic drivers, we think sticking with the actual results is wisest. October consumer spending data are out later this week, but the narrower, more volatile, not-inflation-adjusted retail sales gauge jumped in October.[ii] Durable goods orders, which hint at future manufacturing and business investment in equipment, rose in October. Industrial production fell a smidge in October, but manufacturing rose. Manufacturing and services purchasing managers’ indexes will be out shortly. None of this guarantees a recession won’t happen, but it also argues against one being underway this autumn. Even if one does materialize, stocks could very well already reflect it, considering this year’s shallow bear market is consistent with how stocks normally behave ahead of a shallow recession.

That really is the heart of the matter. Stocks typically move first, making it beside the point to try to read the confidence tea leaves. Whatever confidence surveys show in the heat of the moment usually isn’t news to stocks. They will likely have already dealt with it and moved on. Hence, we don’t think dreary sentiment readings are cause for pessimism—and sunny readings wouldn’t be a sound reason for bullishness. Mostly, we think these surveys sum up the tenor of economic headlines, which we think basically amount to old news for markets.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.